Bitcoin MVRV Ratio Indicates Current Bull Run May Not Be Over

The historical trend of the Bitcoin Market Value to Realized Value (MVRV) Ratio provides insights into the current bull run's status.

Bitcoin MVRV Ratio Insights

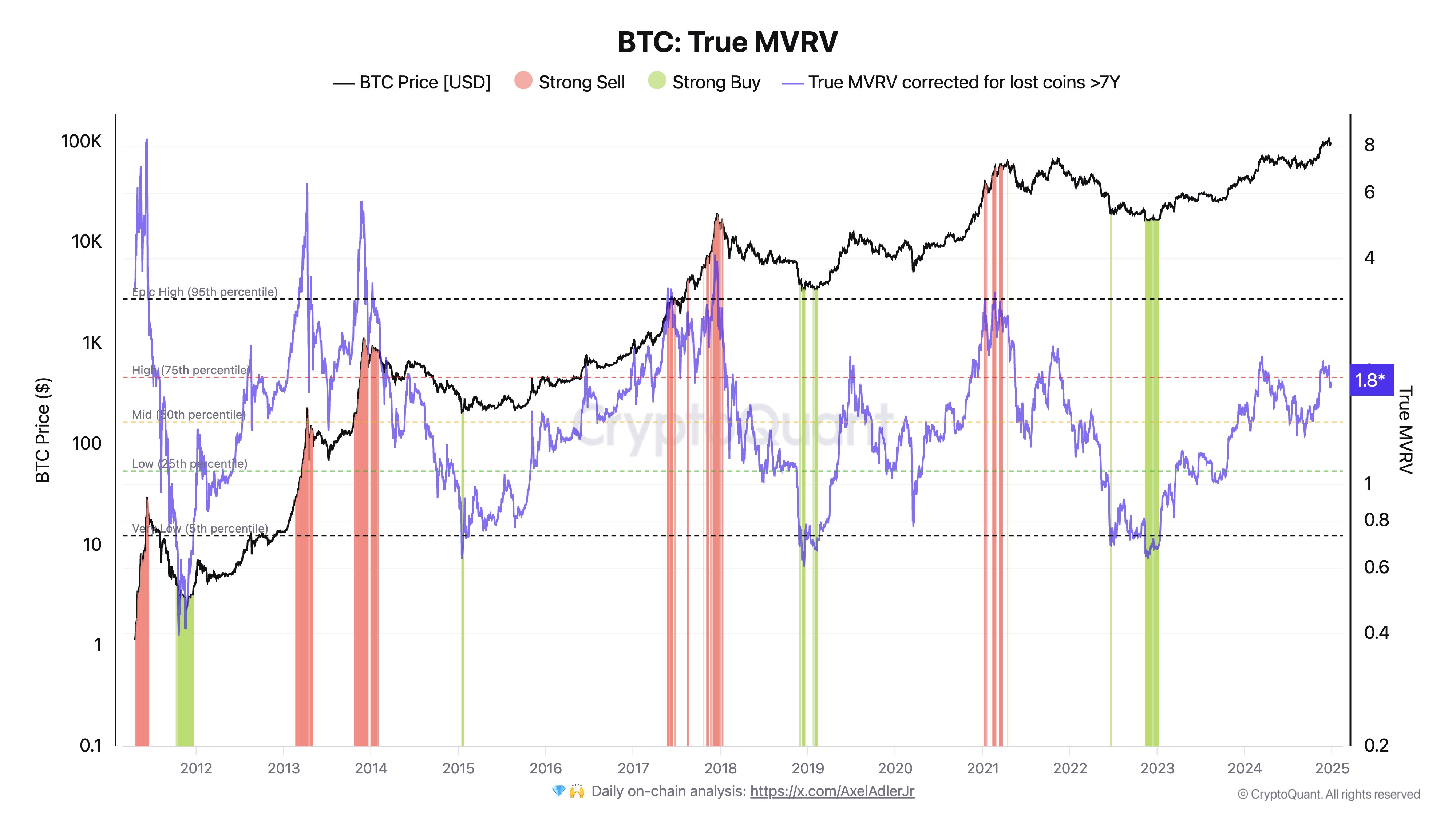

Ki Young Ju, founder and CEO of CryptoQuant, shared a chart illustrating the Bitcoin MVRV Ratio. The MVRV Ratio is an on-chain metric comparing the market cap of BTC held by investors against their initial investment value, known as the realized cap.

An MVRV Ratio above 1 indicates that investors are generally in profit, while a ratio below 1 suggests prevailing losses.

Ju presented a modified version called the “True MVRV,” which considers only coins involved in transactions over the past seven years. Coins older than seven years are likely lost, making this version more accurate for assessing current market conditions.

Here is a chart showing the trend of the Bitcoin True MVRV Ratio:

The chart indicates that the True MVRV has reached high levels during the current bull run, suggesting that average investors are realizing significant profits. Historically, higher profits can lead to mass selloffs as investors take profits, making it probable for BTC to reach a peak when the MVRV Ratio rises significantly.

Previous cycles show that tops occurred when the indicator surpassed a specific threshold, which has not yet been retested in the current cycle.

According to Ju, the lack of overheating in the market cap relative to the realized cap is due to $7 billion in weekly capital inflows into Bitcoin. This suggests that, despite the high True MVRV, there may still be room for BTC in the ongoing bull run.

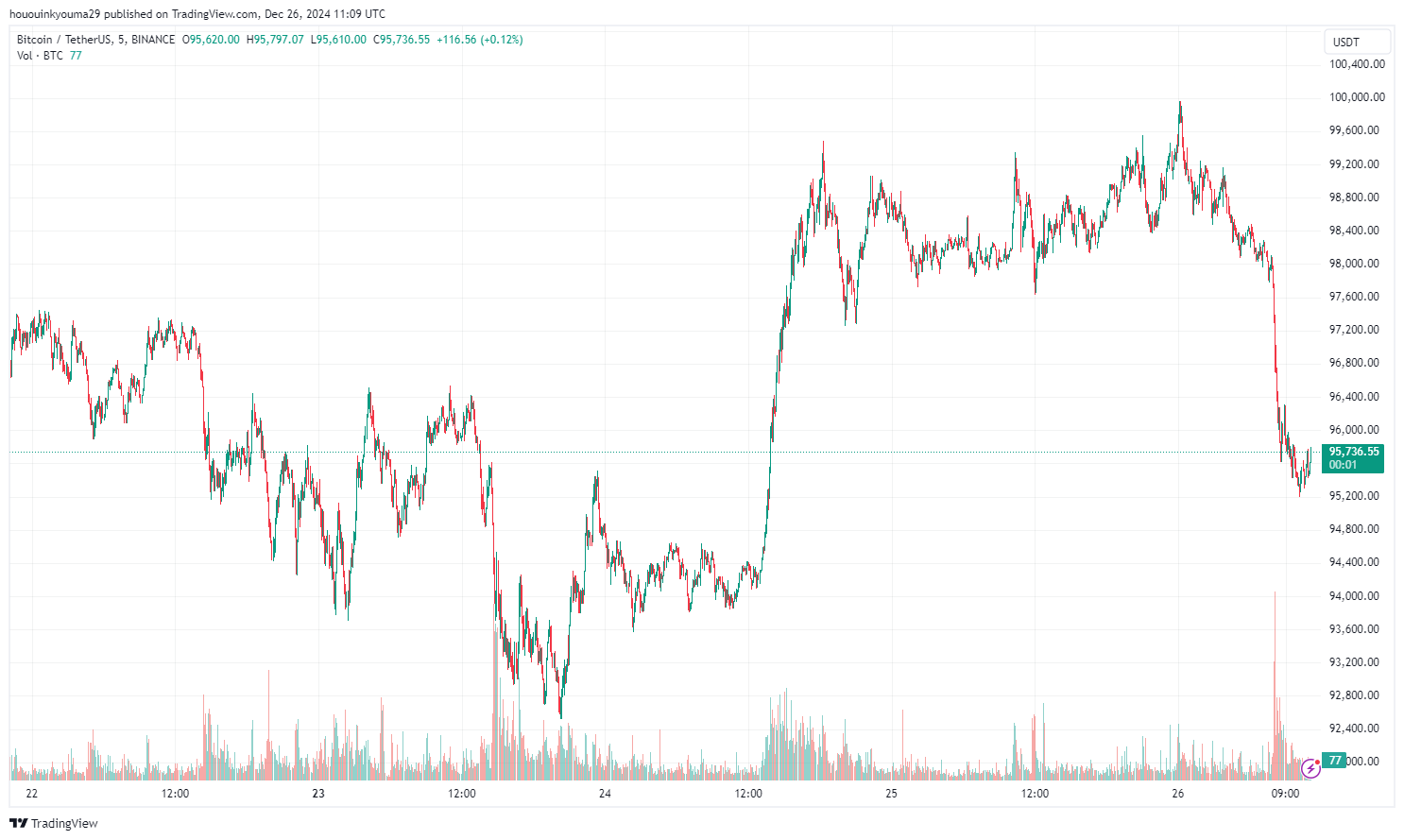

BTC Price

Currently, Bitcoin's price has retraced from its Christmas rally, standing at $95,700.