Bitcoin MVRV Ratio Indicates Potential for Further Growth Before Overheating

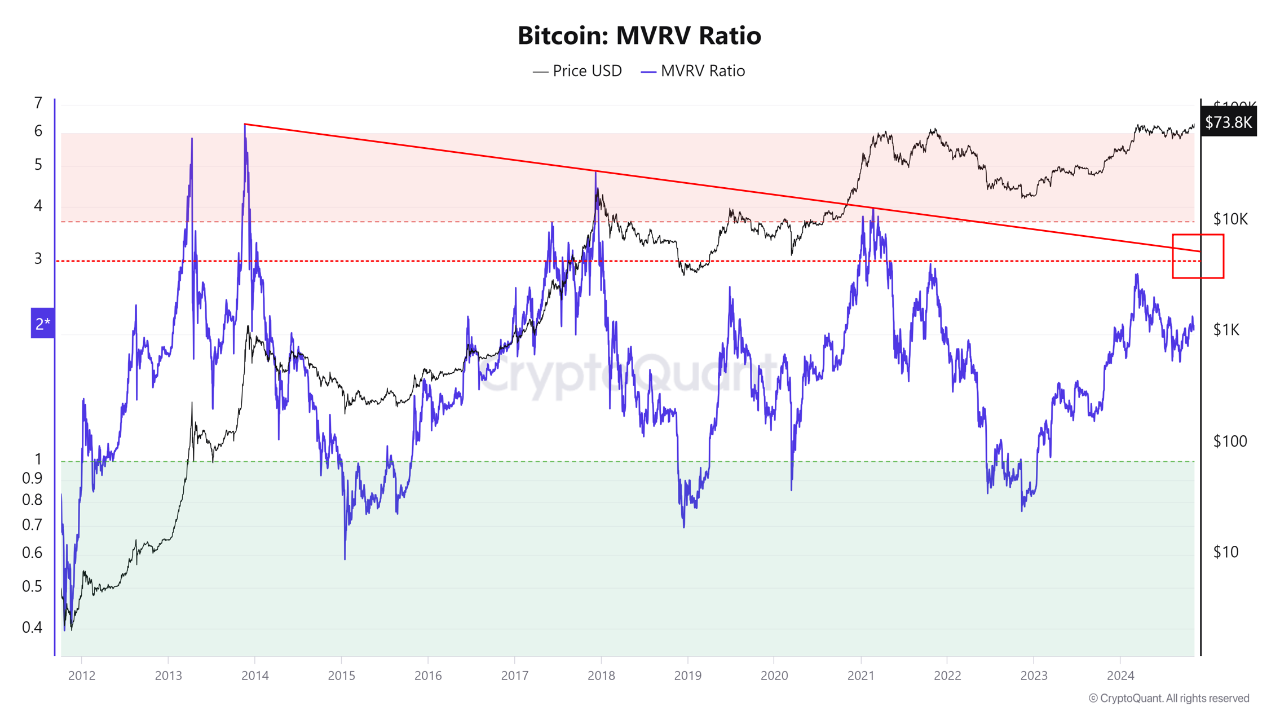

Analysis of the Bitcoin Market Value to Realized Value (MVRV) Ratio indicates whether Bitcoin is currently overheated.

Bitcoin MVRV Ratio Rises with Recent Rally

The MVRV Ratio, an on-chain metric that compares Bitcoin's market cap to its realized cap, has increased alongside Bitcoin's recent price rally. The market cap represents the total valuation of Bitcoin's circulating supply at current prices, while the realized cap reflects the last transaction price of each coin, representing its 'true' value.

The realized cap sums the cost basis of all tokens in circulation, indicating the total capital invested by holders. A MVRV Ratio above 1 suggests that investors are in a net profit state, while a ratio below 1 indicates that average holders are facing losses.

The graph shows the MVRV Ratio surged significantly when Bitcoin surpassed its November 2021 all-time high. While the ratio increased again with the latest ATH break, it has not reached the same level as earlier this year. Historically, Bitcoin tends to peak when the MVRV Ratio rises to high levels, though these peak levels have been declining over cycles.

Current trends suggest that if the analyst's trendline holds, Bitcoin may reach a top near an MVRV Ratio of 3. Currently, the ratio stands at 2, indicating there may be time before Bitcoin becomes overheated.

The tendency for overheating occurs as higher MVRV Ratios prompt investors to realize profits from their gains.

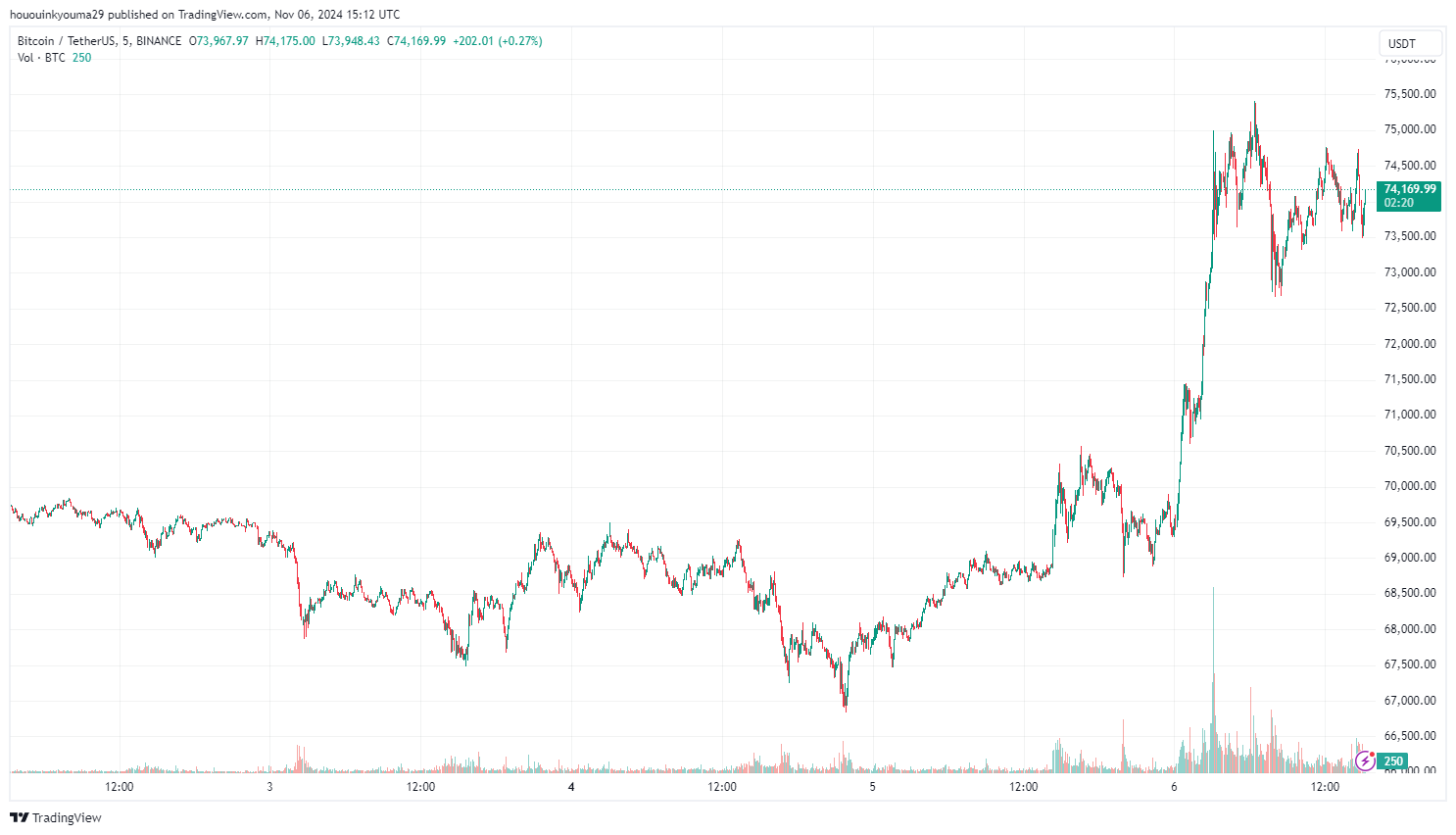

BTC Price

Currently, Bitcoin trades around $74,100, reflecting an increase of nearly 8% in the past 24 hours.