13 0

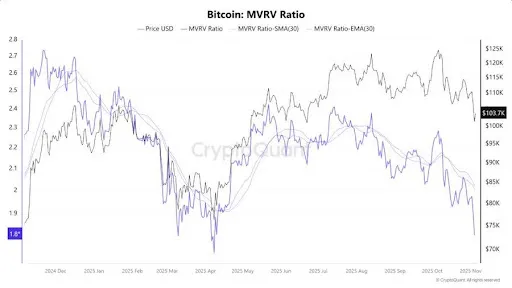

Bitcoin MVRV Ratio Enters Critical Zone Signaling Potential Recovery

Bitcoin's recent market pullback has pushed its Market Value to Realized Value (MVRV) ratio into the critical 1.8 to 2.0 range, historically linked with macro correction lows and early recovery setups. This suggests a valuation reset similar to past major rebound phases.

Key Insights

- The MVRV ratio compares Bitcoin's current market value to its realized value.

- A dip near 2 signals that most holders are around their cost basis, indicating conviction over greed.

- This range has coincided with major market bottoms in June 2021, November 2022, and April 2025.

- The current market sentiment of panic mirrors past scenarios where the market reset quietly.

- Market expert BitBull suggests this phase is one of compression, not capitulation, hinting at long-term opportunities despite short-term pain.

Liquidity's Role in the Crypto Market

- Daan Crypto Trades emphasizes global liquidity as a crucial driver for Bitcoin and the broader crypto market, more so than interest rates.

- Recent observations show global liquidity trending downwards, impacting Bitcoin's upward momentum.

- The expert notes that expanded global liquidity will significantly support the crypto market environment.