9 3

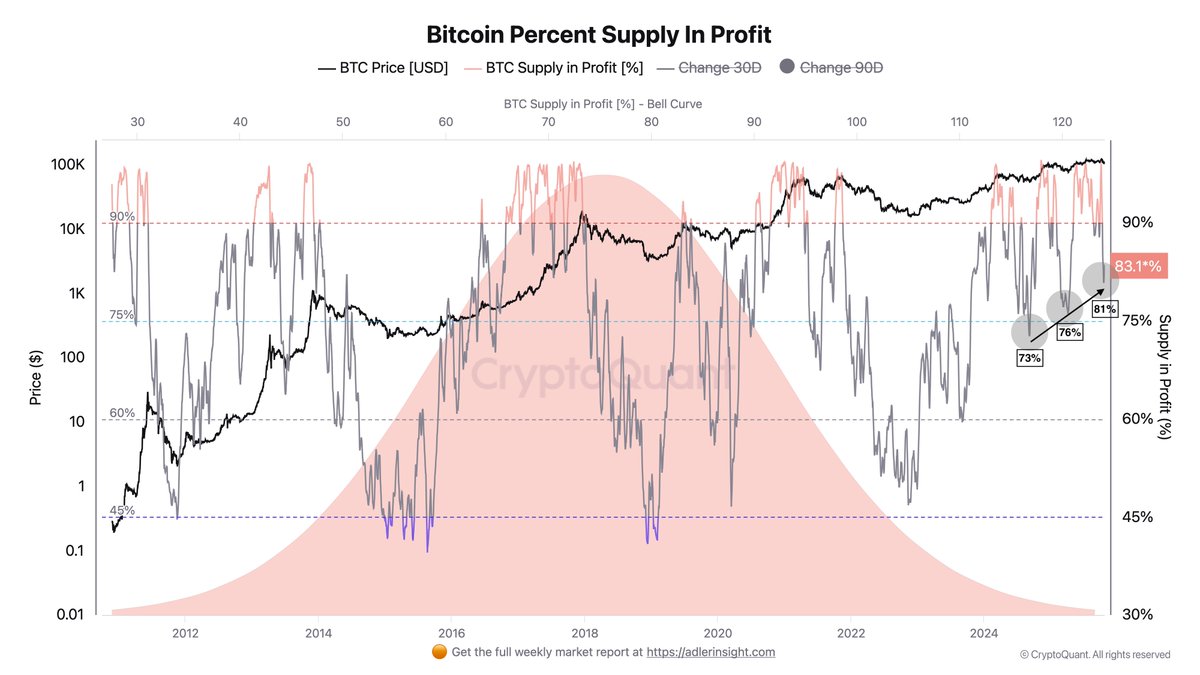

Bitcoin Nears $115K as Supply in Profit Hits 83.6%

Bitcoin (BTC) Market Update:

- Bitcoin has reclaimed the $115,000 level after a period of volatility.

- Bulls aim to confirm a bullish structure post-consolidation, with potential for further gains.

On-Chain Data Insights:

- Market enters an overheated phase when over 95% of BTC supply is in profit, often leading to corrections.

- Corrections typically bottom around the 75% profit supply threshold, where long-term holders start reaccumulating.

- Recent data shows BTC supply in profit has risen to 83.6%, indicating improved market sentiment.

Analyst Perspective:

- Darkfost notes that rising profit levels suggest investors anticipate further upside, characteristic of mid-cycle recovery phases.

- A profit supply surpassing 95% could indicate overheated conditions, leading to increased volatility and potential corrections.

BTC Retests $115K Resistance: Bulls Regain Momentum

- BTC trades around $115,443, breaking above key moving averages, signaling a shift in short-term sentiment.

- The next resistance lies at $117,500, a breakout above which could lead to targets between $120K–$125K.

- Momentum indicators show strong buying pressure, with support from the 200-day MA near $107K.

- A rejection at $117.5K might result in consolidation towards $111K–$112K.

If Bitcoin sustains above $115K and breaks past $117.5K, it could initiate a new bullish phase supported by positive investor sentiment and on-chain metrics.