20 1

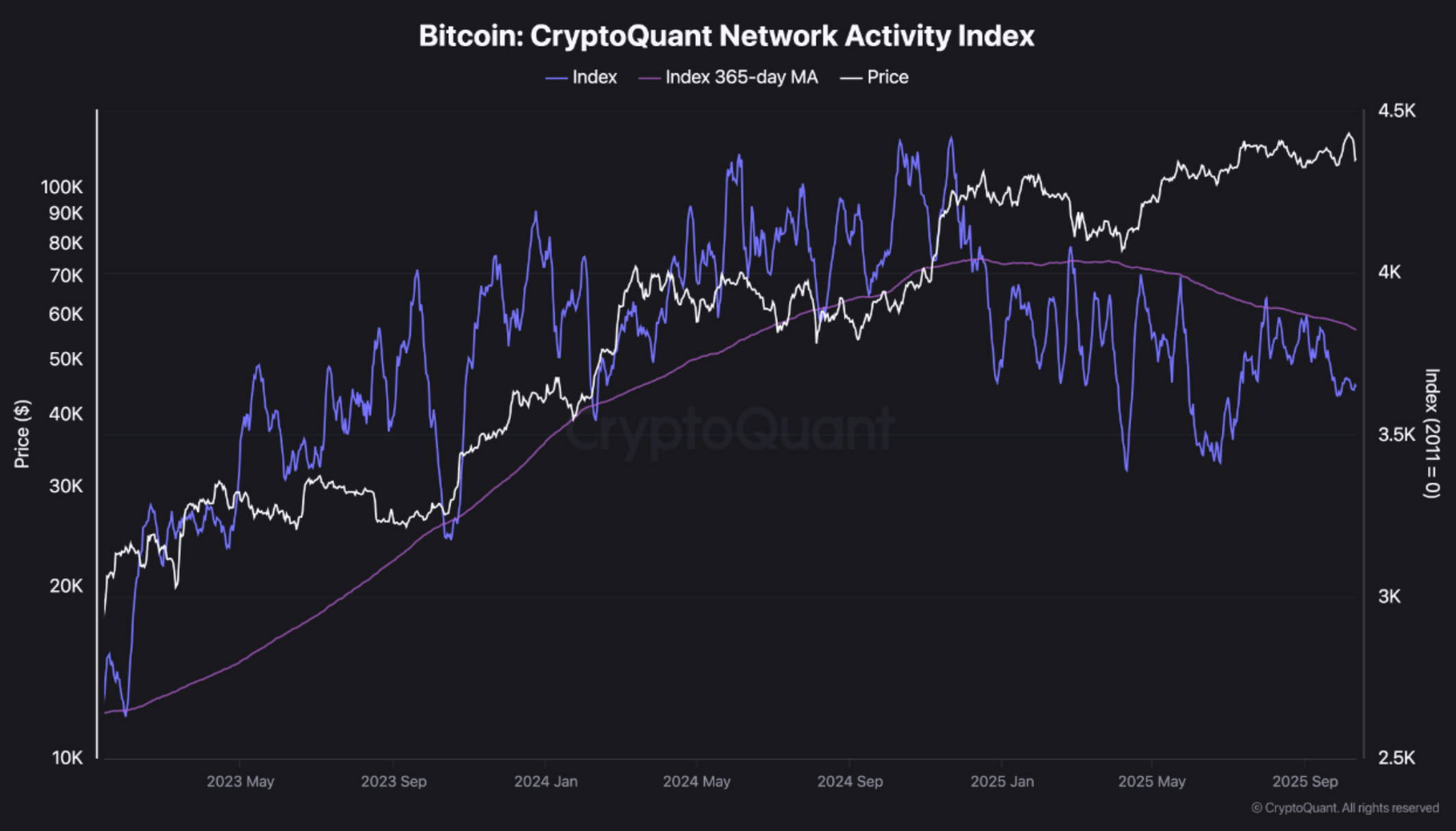

Bitcoin Network Usage Declines Below 365-Day Average in 2025

Bitcoin (BTC) experienced a flash crash to $102,000 on October 9, recovering most losses. However, on-chain signals show a decline in Bitcoin network usage throughout 2025.

Key Insights:

- The Bitcoin Network Activity Index has been below its 365-day moving average, indicating reduced on-chain engagement.

- Previously, during 2023-24, increased network activity correlated with price growth driven by genuine on-chain usage.

- In 2025, liquidity moved off-chain through ETFs and custodians, reducing on-chain traffic and causing the Network Activity Index to drop.

- BTC price remains between $100,000 to $120,000, with valuations increasingly disconnected from network fundamentals.

- The current capital rotation does not reflect network strength but suggests momentum without substantial backing.

Despite concerns, some analysts believe the bull market is ongoing. According to Titan of Crypto, a bear market will start if BTC loses the 50-day Simple Moving Average (SMA) on the weekly chart.

Q4 2025 Predictions:

- Industry experts predict BTC may reach new record highs in Q4 2025.

- Crypto analyst Ash Crypto forecasts BTC hitting $180,000.

- Binance data suggests a potential target zone of $130,000 for BTC.

- Analyst Egrag predicts a surge to $175,000 with a minor catalyst.

- Currently, BTC trades at $114,076, up 0.8% over the past 24 hours.