Bitcoin Reaches New All-Time High of $93,477 with Low Profit-Taking

Bitcoin (BTC) has reached a new all-time high (ATH) of $93,477, nearing the $100,000 target. The price rally has seen low profit-taking, suggesting potential for further increases.

Low Profit-Taking For Bitcoin In Current Cycle

A report by Glassnode indicates that BTC's current momentum is driven by strong spot demand and rising institutional interest, with optimism bolstered by Donald Trump's presidential candidacy. Over 95% of Bitcoin’s supply is in profit, yet profit-taking remains subdued, with about $20.4 billion realized compared to historical ranges of $30 to $50 billion during previous ATH cycles. This low level of profit-taking suggests that BTC may rise further, potentially reaching the $100,000 mark before demand decreases.

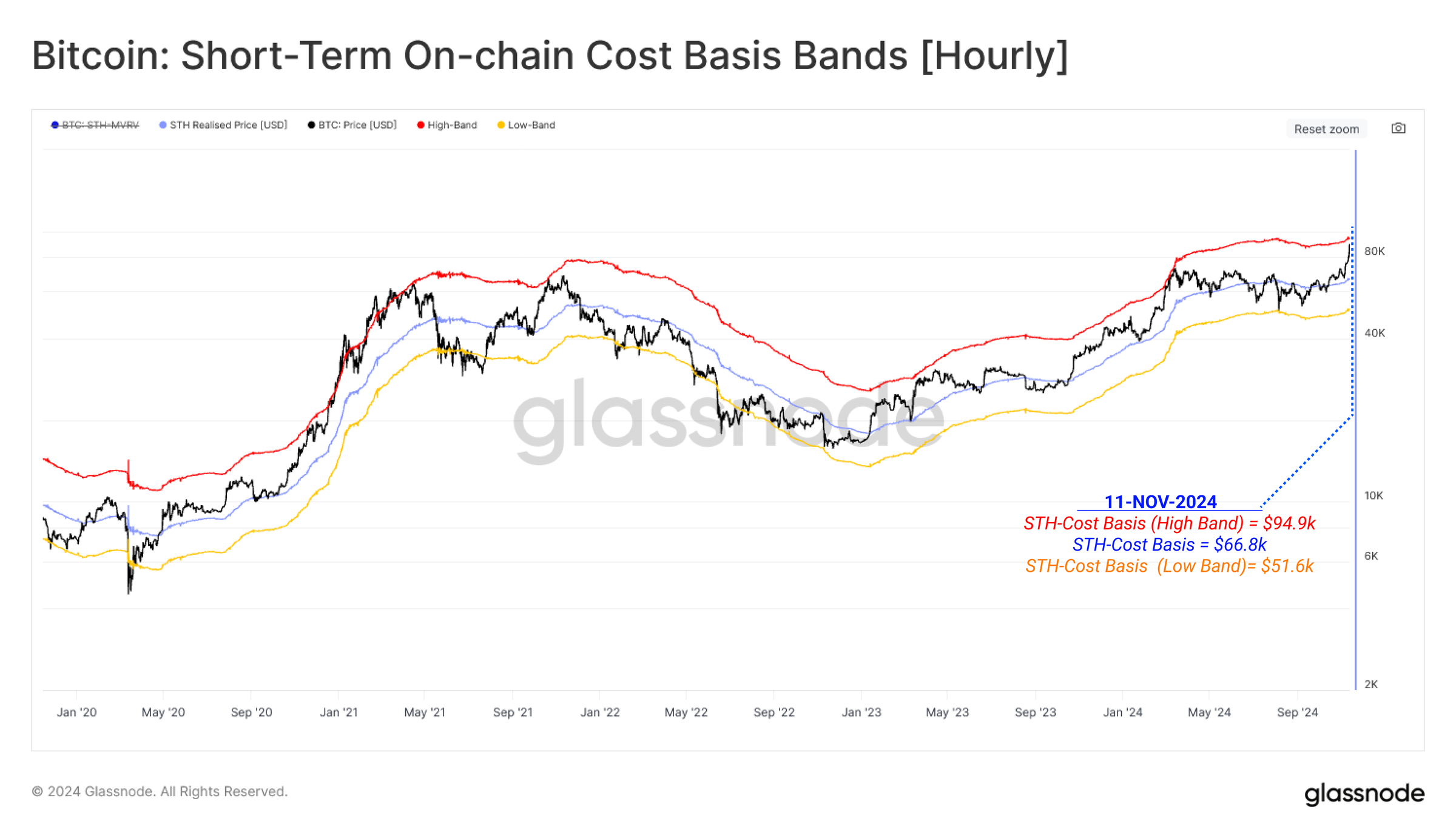

The chart below illustrates the cost basis of new BTC investors alongside upper and lower statistical bands. During an ATH phase, BTC’s price tends to test the upper bands as new investors enter at higher prices.

Currently, BTC's spot price at $91,199 is just below its upper band of $94,900. Monitoring movements between these bands can indicate when holders might be inclined to sell.

Excess Leverage Must Be Flushed Before $100,000 BTC

As BTC trades less than 10% from the $100,000 level, experts suggest that excess leverage must be cleared before reaching this milestone. Data from Coinglass shows over $718 million in crypto contracts were liquidated recently, affecting 202,074 traders. The liquidations were nearly evenly split between longs and shorts, indicating no clear trading advantage despite bullish sentiment.

Some industry leaders express optimism regarding BTC’s trajectory. CleanSpark's CEO noted that BTC may peak at $200,000 within 18 months. BitMEX co-founder Arthur Hayes predicted a potential rise to $1 million under Trump’s administration. Currently, BTC is priced at $91,199, reflecting a 3.9% increase in the past 24 hours.