1 0

Bitcoin OG Owen Gunden Deposits 2,499 BTC to Kraken Amid Market Speculation

Bitcoin is currently trading below $92,000, with market sentiment turning bearish as selling pressure increases. Key developments include:

- The loss of crucial support levels and increased downside volatility suggest potential entry into a bear market.

- Short-term holders are showing signs of capitulation, adding to the selling pressure.

- Some analysts argue for a possible local bottom, citing past mid-cycle retracements in bull markets and strong macroeconomic conditions.

A Notable BTC Transfer Raises Speculation

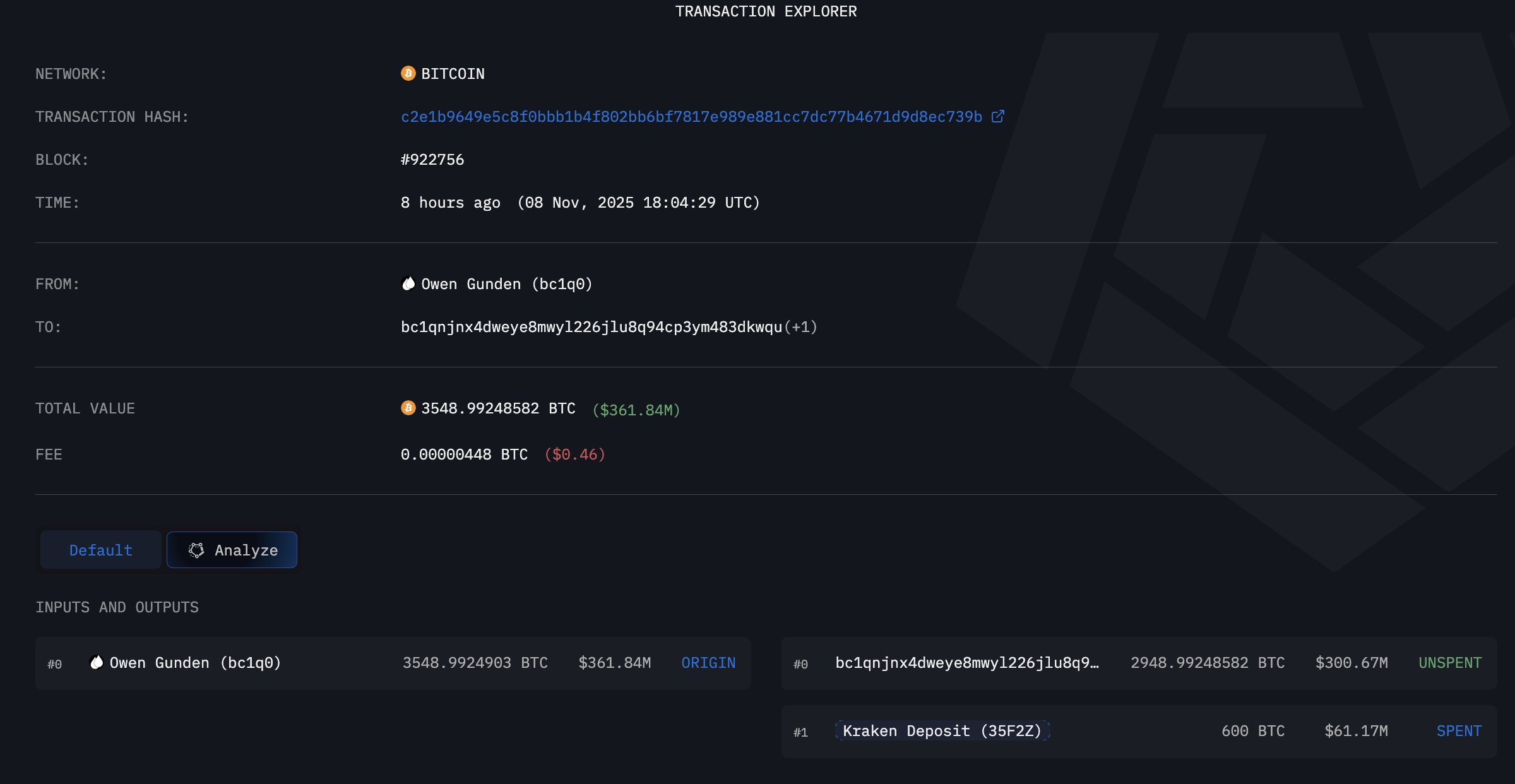

Bitcoin OG Owen Gunden deposited 2,499 BTC (worth $228 million) into Kraken, raising concerns about potential selling pressure. Historically, such moves have coincided with cycle bottoms amidst panic selling.

- This deposit follows reports that Gunden was ready to offload his entire 11,000 BTC stash.

- Such whale behavior can increase short-term volatility and influence market sentiment.

- Historically, long-term holder capitulations have preceded major market turnarounds.

Short-Term Trend Analysis

Bitcoin's 4-hour chart shows ongoing short-term selling pressure:

- BTC struggles to reclaim $92,000, now acting as resistance.

- A persistent downtrend characterized by lower highs and lows since early October.

- All major moving averages (50 SMA, 100 SMA, 200 SMA) are positioned above current prices and indicate a short-term bearish trend.

- Selling volume remains high, indicating conviction-driven sell-offs.

- Buyers show interest around $89,000–$91,000 but lack the momentum for significant reversals.

For a structural shift, BTC needs to break above $95,000 and the 100 SMA. Until then, further downside or consolidation is expected.