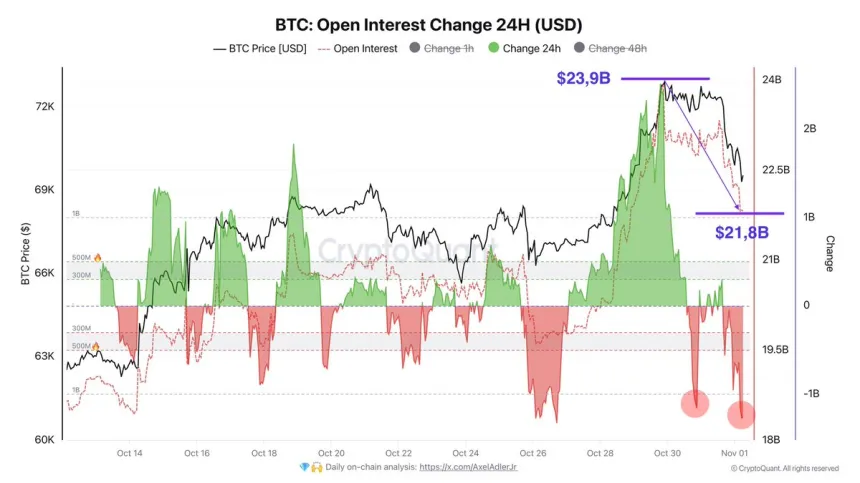

Bitcoin Open Interest Declines by $2.1 Billion in 24 Hours

Bitcoin is trading above $69,000 after a 6% pullback from its peak of $73,600. Open interest surged to $23.9 billion on October 30, indicating high market engagement. However, there has been a $2.1 billion decline in open interest in the past 24 hours, suggesting a shift as BTC retraces to lower levels.

This cooling off prompts analysts to monitor for renewed buying interest from spot investors, which could support another rally for BTC. With Bitcoin near key support levels, increased activity from spot investors may facilitate a rebound. The coming days are critical as traders anticipate fresh inflows that could bolster BTC's resilience and challenge its all-time highs. Market sentiment remains cautiously optimistic while observing spot activity during this retracement phase.

Bitcoin Hype Slowing Down?

Despite nearing its March all-time high, Bitcoin's momentum seems to be waning, as it has not established a new high and open interest is decreasing. Analyst Axel Adler reported a $2.1 billion reduction in open interest, dropping from $23.9 billion to $21.8 billion, suggesting speculative futures trading may not suffice to push Bitcoin higher.

Adler emphasizes the need for spot investors to drive demand for Bitcoin to surpass current barriers. As futures markets retract, fresh buying from these investors could catalyze further gains. The upcoming U.S. election on November 5 may introduce additional volatility, with potential implications for a broader market rally and a Bitcoin bull run.

Currently, Bitcoin hovers below its all-time high. While futures markets pull back, attention shifts to spot buying as a determinant of BTC's upward trajectory. The next few days will be crucial for defining Bitcoin's short-term direction.

BTC Holding Above Key Levels

Bitcoin is trading above the significant $69,000 level, previously a strong resistance since late July. Maintaining this level as support is vital for bullish momentum toward new all-time highs.

If Bitcoin consolidates above $69,000, it may enter a price discovery phase. Conversely, a drop below this mark would indicate a need for more momentum to test prior highs.

In case of a pullback, $66,500 emerges as a critical support level, crucial for maintaining Bitcoin’s bullish structure and providing a base for potential rebounds. Such a dip could attract new buying interest and fuel another rally.

As BTC remains above this support level, traders are attentive to signs of sustained strength or healthy retracement before the next upward movement. Holding above $69,000 is essential, but even a temporary decline to $66,500 would preserve Bitcoin’s overall bullish outlook.

Featured image from Dall-E, chart from TradingView