Bitcoin Options Market Aims for $80,000 by Late November

The futures market indicates that the recent Bitcoin rally, influenced by Donald Trump's election victory, may be gaining momentum. Vetle Lunde, head of research at K33 Research, noted a "risk-on rotation" across derivatives, reflecting increased investor confidence.

Bitcoin Options Market Targets $80,000 By Late November

On the Chicago Mercantile Exchange (CME), the basis—the difference between the spot market price and futures contract prices—has risen from 7% to over 15% in one day, indicating heightened interest from institutional investors. Perpetual futures contracts, favored by offshore traders, are trading at their highest premiums to the spot market since March, signaling rising demand for leverage.

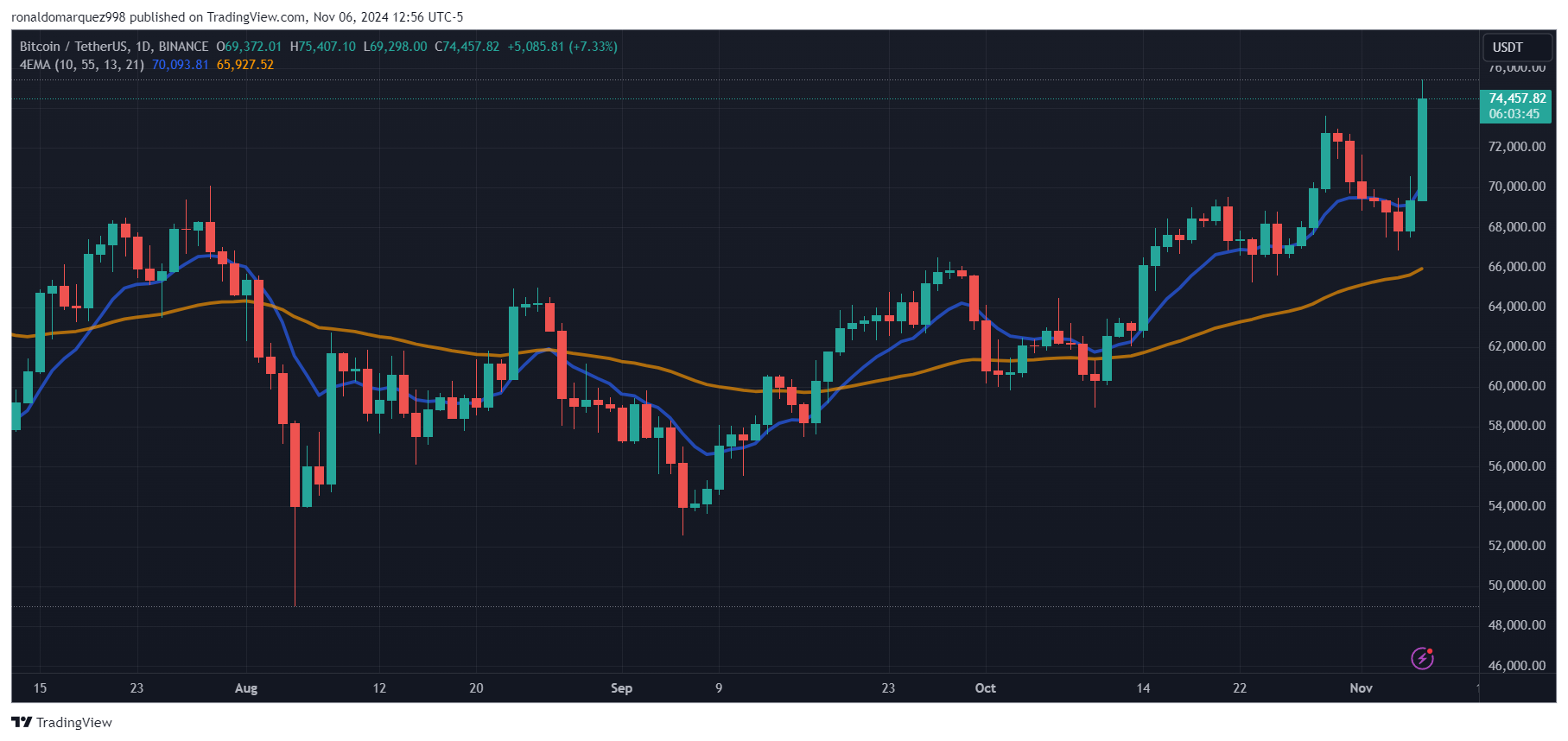

Bitcoin recently surpassed $75,000, supported by expectations that a second Trump presidency will lead to favorable cryptocurrency policies. Prior to the election, reports indicated that the Bitcoin options market targeted $80,000 for expirations set for late November, showcasing optimism about the asset's potential.

Analysts Predict Strong ETF Inflows Post-Election

Michael Safai, founding partner at Dexterity Capital, stated that Trump's administration is expected to reduce regulatory intervention in the US, an outcome many crypto investors have desired during previous scrutiny periods. Although Bitcoin-backed exchange-traded funds (ETFs) experienced significant outflows recently, Safai believes traders remain optimistic about a potential reversal.

Lunde observed that while the European trading session was quiet, Bitcoin is finding support at its previous all-time highs, indicating positive signs for continued growth. He anticipates strong ETF inflows during US trading hours, expecting that rising CME premiums combined with post-election clarity will enhance Bitcoin's performance. However, some traders advise caution regarding possible price corrections.

Historical bullish runs, such as those following the introduction of Bitcoin ETFs, led to notable liquidations, with the cryptocurrency experiencing drops exceeding 20% after reaching record peaks. Nathanaël Cohen, co-founder at INDIGO Fund, warned that profit-taking could trigger corrections but remains optimistic about the overall upward trend in the coming months.

At the time of writing, BTC was trading at $74,430, up 6.2% over the past 24 hours and nearly 4% weekly.

Featured image from DALL-E, chart from TradingView.com.