26 0

Bitcoin Options Expiry of $14 Billion Approaches with Rising Put-Call Ratio

Bitcoin's (https://holder.io/coins/btc/) put-call ratio has increased to 0.72, indicating a rise in interest towards put options, primarily driven by "cash-secured puts" for yield generation and accumulation strategies. This spike contrasts with the traditional bearish interpretation.

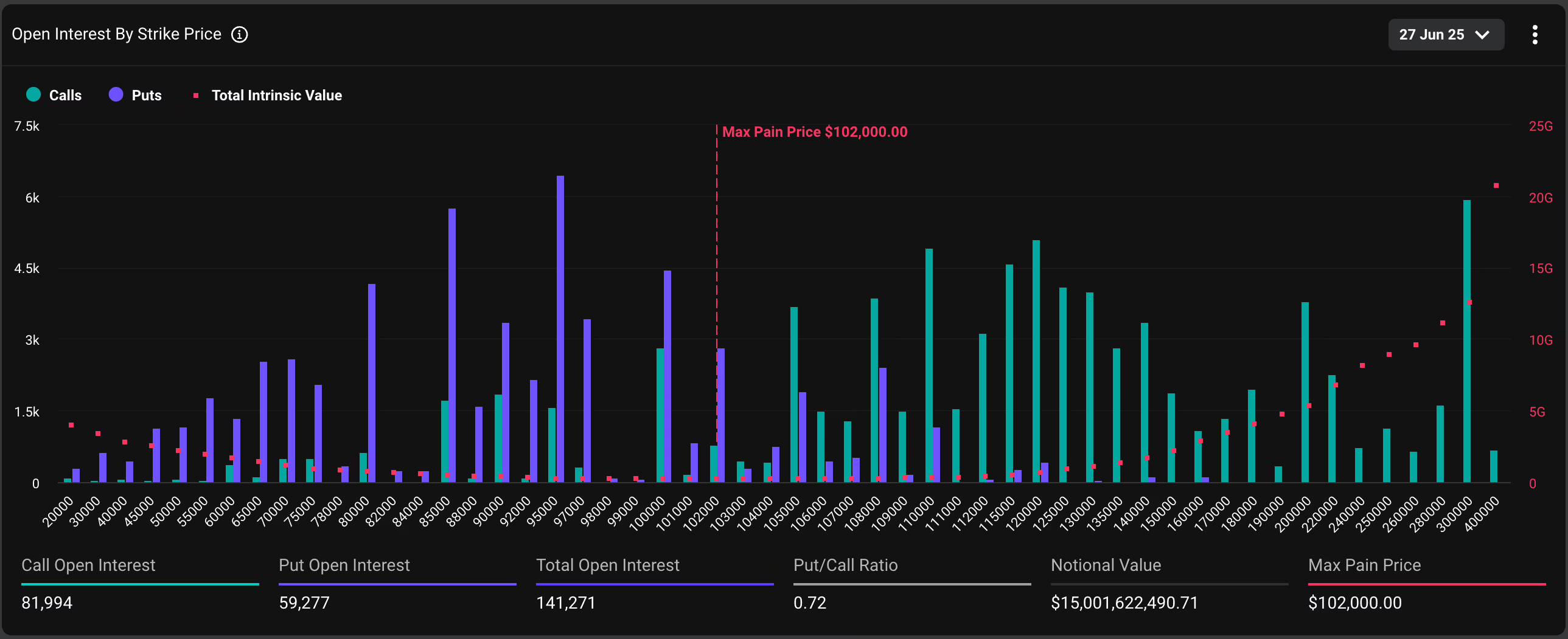

- The upcoming options expiry on Deribit involves 141,271 BTC options contracts worth over $14 billion, set for Friday at 08:00 UTC.

- Of these, 81,994 are calls; nearly 20% of expiring calls are "in-the-money," suggesting profitability for many participants.

- Market volatility is expected as holders may book profits or hedge positions as expiry nears.

- The max pain level for this expiry is $102,000, where option buyers would face the most losses.

- Current market flows suggest a slight bullish bias, with traders engaging in neutral strategies around the $100K-$105K range.

Traders are selling straddles and writing calls at $105,000 while shorting puts at $100,000, anticipating tight price action leading up to the expiry.