Bitcoin Outperforms Gold and Major Indices in 2024

Bitcoin is anticipated to be a leading crypto asset in 2025, having shown significant success as the year begins. Recent performance indicators suggest Bitcoin has outperformed traditional asset classes, including gold.

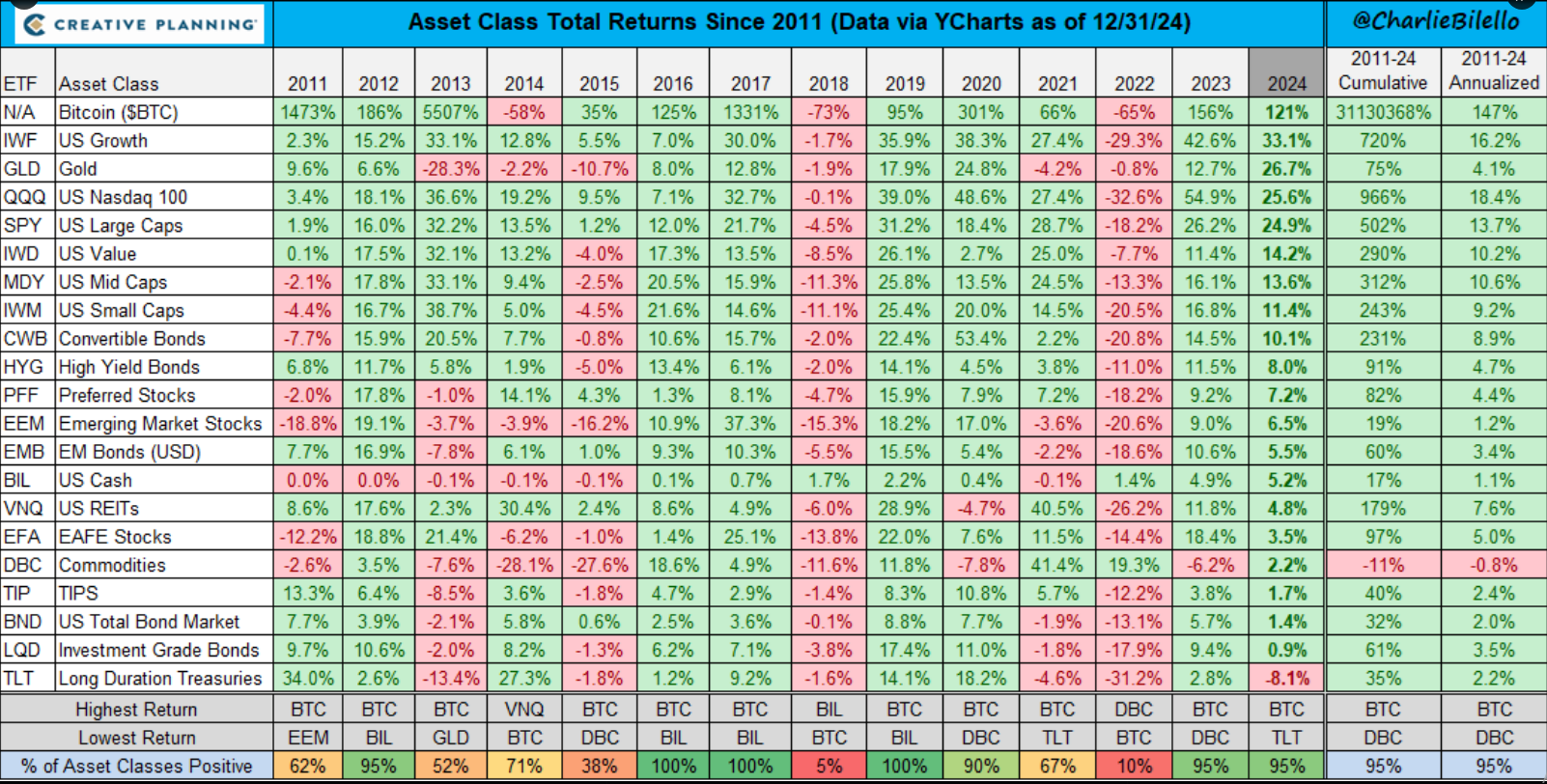

Recent analysis indicates Bitcoin's returns have exceeded those of other assets, with gold yielding only 26%. In contrast, the Nasdaq 100 gained 25%, US large caps 24%, mid-caps 13%, and convertible bonds 10%. Despite its strong performance, Bitcoin remains a volatile asset prone to substantial price fluctuations.

With the exception of Long Duration Treasuries, every major asset finished higher in 2024 with Bitcoin leading the way for the second straight year.https://t.co/l5IYmkf6Ih pic.twitter.com/TyStoT73rp

— Charlie Bilello (@charliebilello) January 1, 2025

Bitcoin Edges Gold And Other US Indexes

Despite facing criticism and regulatory scrutiny, Bitcoin continues to perform well. Since 2011, Bitcoin has generally outperformed other asset classes, with exceptions in years like 2018 when it recorded a -73% yield. Overall, Bitcoin has shown consistent performance, at times exceeding yields of 1,000%, including a notable 1,437% return in 2011.

This year’s yield is lower compared to last year’s 156%, though Bitcoin was again a top performer among major asset classes, surpassing gold.

Bitcoin Shows Strength, But Volatility Remains

Bitcoin has exhibited strong performance relative to other assets over the past 14 years, yet its volatility poses risks. Price swings and policy changes can affect ownership outcomes significantly.

Since the start of 2024, Bitcoin's price has more than doubled, trading between $95k and $97k as of the latest update. On December 5th, Bitcoin reached $100k before dropping below that mark the following day. Ether has also experienced volatility, gaining nearly 50% this year and currently trading around $3,400.

Featured image from Newsbit, chart from TradingView