Bitcoin May Be Entering Phase 2 of Historical Bull Run

On-chain data indicates that Bitcoin may be following a similar pattern to a previous cycle based on current indicators.

Bitcoin Could Now Be Entering Phase 2 Of The Bull Run

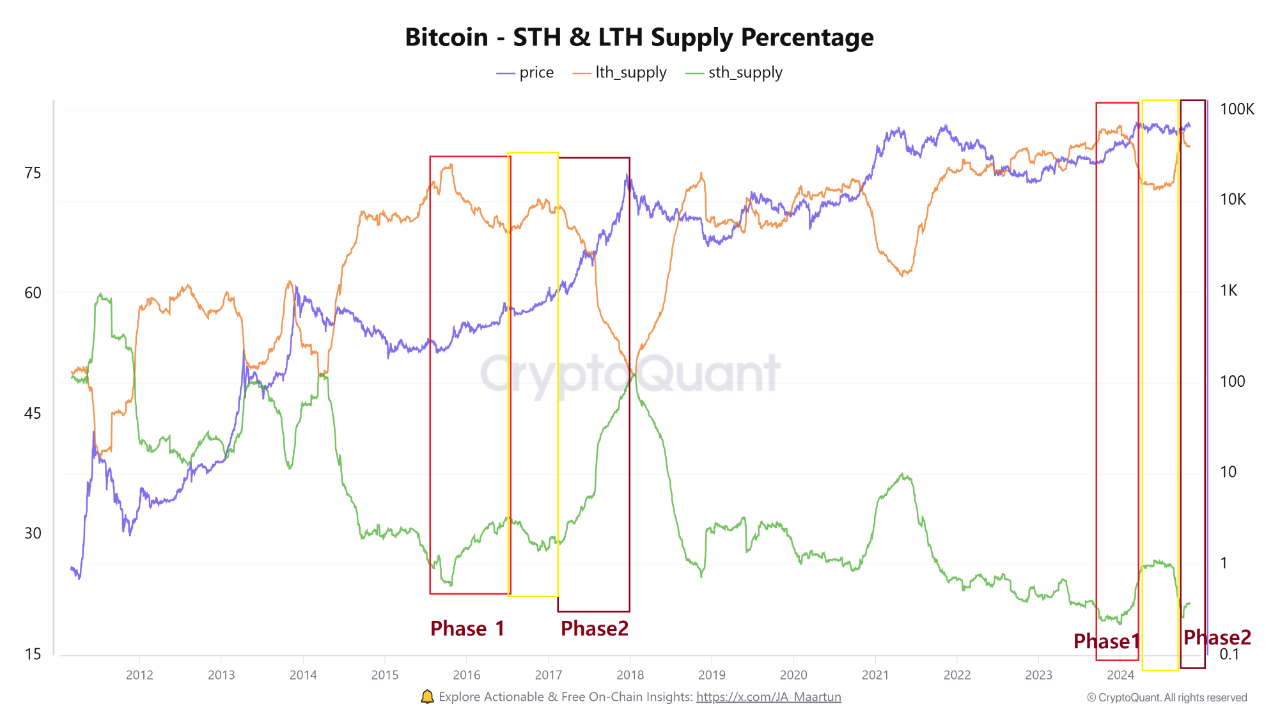

A CryptoQuant Quicktake post highlights a trend in the Bitcoin long-term holder (LTH) supply resembling that of the 2017 cycle. LTHs are one of two main segments of the Bitcoin user base, with the other being short-term holders (STHs). The cutoff between these groups is 155 days: investors holding for over this period are classified as LTHs.

Statistically, longer holding periods reduce the likelihood of selling, indicating that LTHs are more committed market participants.

Below is a chart showing the trend in supply held by both Bitcoin groups:

The graph illustrates a sharp decline in LTH supply during the first quarter rally, suggesting even steadfast holders engaged in profit-taking. This decrease corresponded with an increase in STH supply, as tokens transferred from LTHs become part of the STH group.

Recently, the LTH supply has begun to recover, but with the latest rally reaching a new all-time high (ATH), this metric has shifted again. The analyst notes a pattern similar to the 2017 cycle, where initial distribution from LTHs was followed by accumulation and subsequent distribution.

The recent change in LTH supply may signify the beginning of phase 2 distribution for the current cycle, as new capital flows in to acquire coins from HODLers.

Additionally, the Bitcoin Binary Coin Days Destroyed (CDD) metric shows trends consistent with past cycles. This metric indicates whether HODLers are selling more or less than historical averages. The chart suggests that the 152-day moving average of this metric may be nearing a breakout akin to that preceding the 2021 bull run.

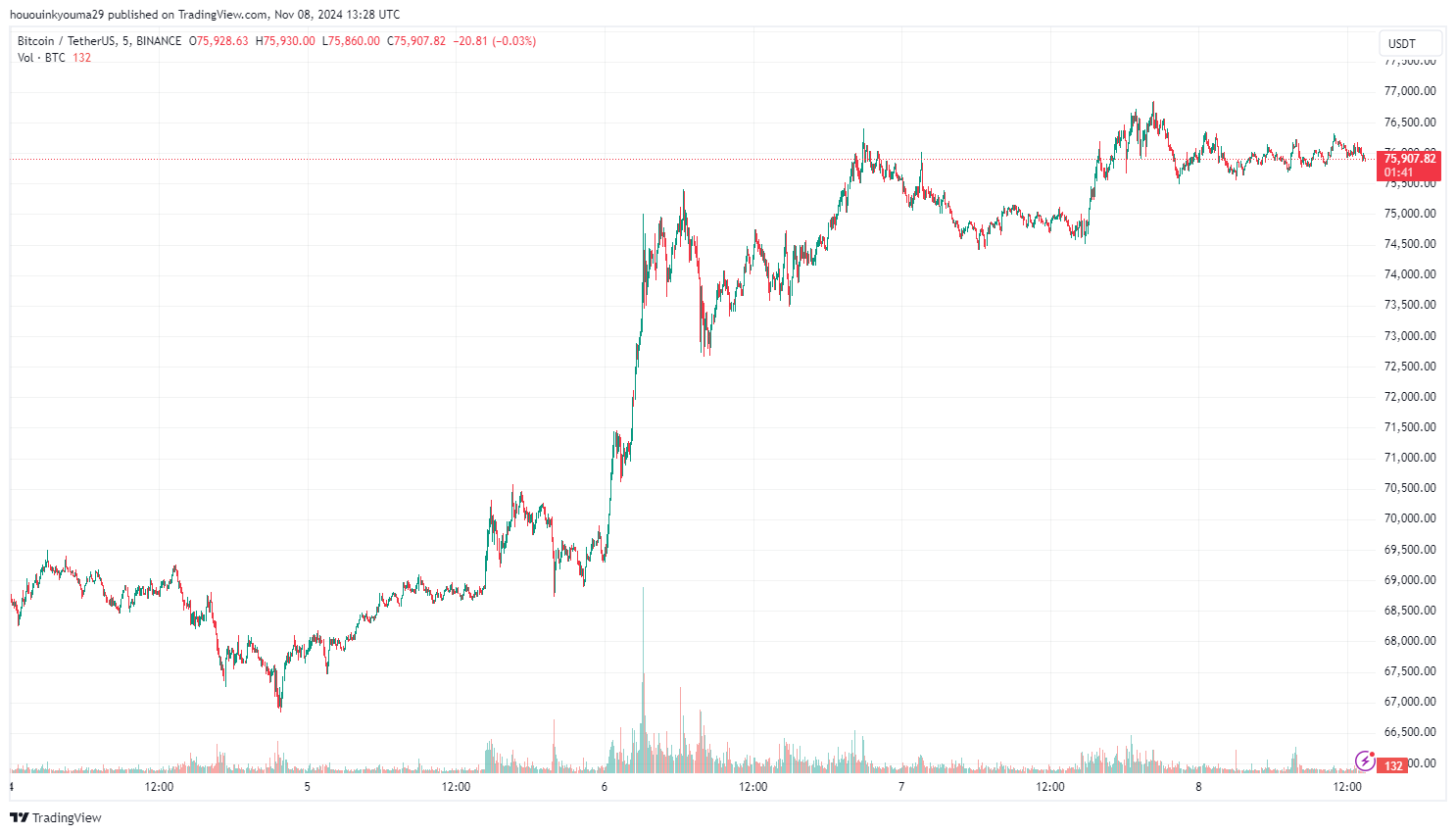

BTC Price

Bitcoin is currently exploring all-time highs, trading around $75,900.