Bitcoin Price Could Reach $1 Million Amid Growing Demand

Bitcoin's price outlook remains optimistic, as Michael Saylor from Strategy asserts that a market freeze is unlikely. He cites increasing demand and limited supply as key factors driving the price towards $1 million.

Supply And Demand Pressure

- Miners release approximately 450 BTC daily, valued around $50 million at current prices of about $109,859.

- Once this supply is absorbed by buyers, prices are expected to rise, given that demand matches or exceeds miner output.

High Price Targets

- ARK Invest raised its Bitcoin bull case from $1.5 million to $2.4 million by 2030.

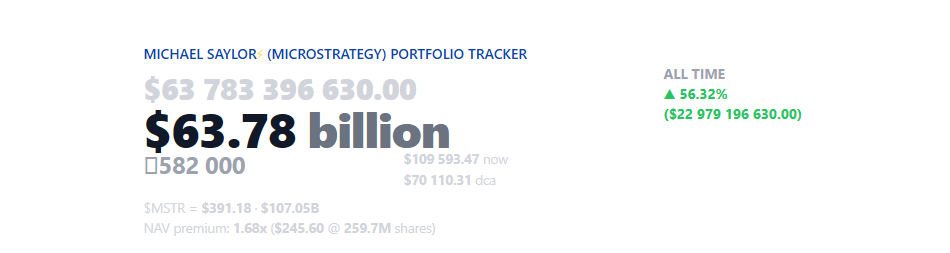

- Saylor predicts Bitcoin will reach $1 million, supported by his firm's acquisition of 582,000 BTC worth nearly $64 billion.

Institutional And Political Support

- Saylor highlighted endorsements from notable figures including US President Donald Trump and SEC chair Paul Atkins.

- Banks are increasingly offering custody services for Bitcoin, while ETFs from firms like BlackRock contribute to daily purchases.

Volatility Warning

- Saylor warns that if Bitcoin reaches $500,000 or $1 million, a potential drop to $200,000 could occur—representing a nearly 60% decline.

- Price fluctuations are intrinsic to Bitcoin’s history and anticipated future.

The broader market dynamics also play a crucial role as spot and futures trading often exceed $10 billion daily, meaning $50 million in fresh buys may have limited impact. Regulatory changes and competition from other cryptocurrencies may pose additional challenges.

What Comes Next

The critical factor will be whether new buyers can outpace miner supply and selling by profit-taking holders. While Saylor's analysis supports continued upside, investors should prepare for significant price volatility. Ultimately, daily demand, political influences, and reactions from the financial sector will determine if these high targets materialize.