Updated 14 November

Bitcoin Price May Reach $100,000 Before Year-End, Analysts Predict

Bitcoin reached $90,000, marking a significant market event. Following this milestone, prices briefly dipped after initially hitting the new all-time high.

Current market activity indicates strong enthusiasm among traders, with CME trading volumes reaching record levels post-election. On November 6, CME recorded its highest notional volume day at over $16.4 billion across more than 316,000 contracts.

K33 analysts noted that as futures premiums surged above 15% during Bitcoin's rally, open interest on CME increased by $2.4 billion. Market tops generally do not align with rising CME premiums in an uptrend, suggesting a promising outlook for Bitcoin.

The potential for Bitcoin to reach $100,000 remains strong, possibly occurring before year-end. Analysts Vetle Lunde and David Zimmerman highlighted that while a market correction is expected, there are indicators suggesting upward movement towards this target.

Historical context shows extreme volatility surrounding significant price milestones, as seen during Bitcoin's $10,000 breakout in 2017, which involved considerable price fluctuations.

Galaxy’s Alex Thorn remarked that recent price movements represent one of the largest gains in Bitcoin's history, although early Bitcoin trading was marked by dramatic price changes.

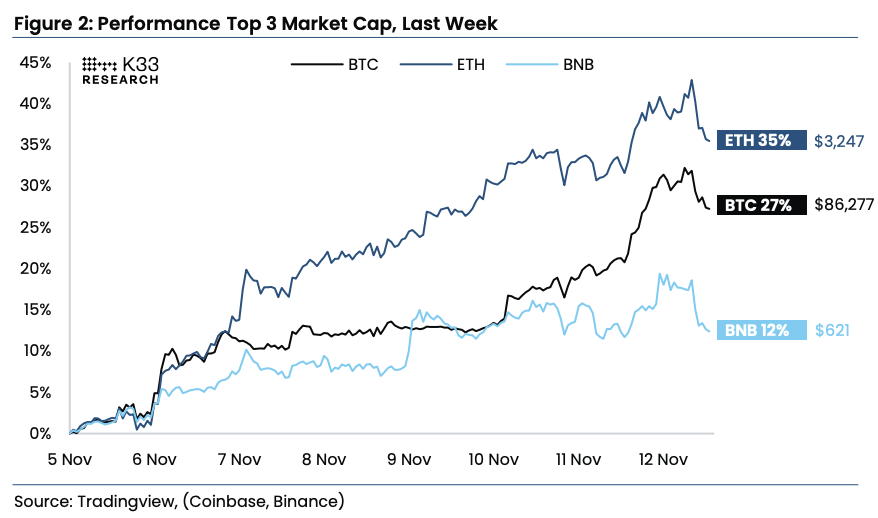

Beyond Bitcoin, the rally influences other cryptocurrency sectors. K33 observed that increased momentum has led to higher funding rates for both Bitcoin and altcoins, reflecting substantial long positioning among traders.

The election outcome combined with lower interest rates creates a favorable environment for DeFi, indicating bullish sentiment in the current market landscape.