Crypto Analyst Projects Bitcoin Price to Reach $170,000 After ATH

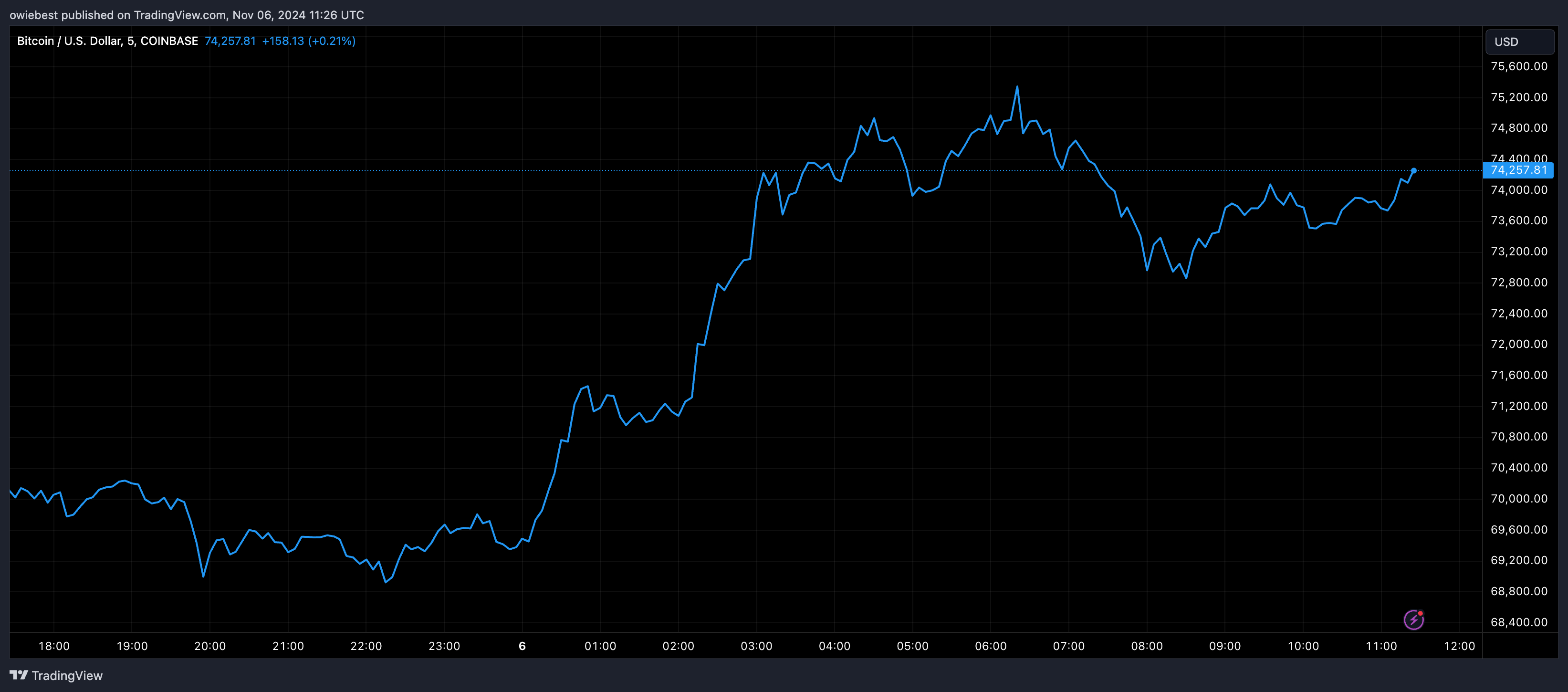

The Bitcoin price has reached a new All-Time High (ATH) above $75,000, marking a significant milestone in the cryptocurrency market. This rally is largely attributed to market sentiment surrounding the US elections. A crypto analyst who previously predicted this rise now anticipates further bullish movement.

Analyst Sets $170,000 Price ATH for Bitcoin

TradingShot, a crypto analyst on TradingView, has published an analysis report predicting a new all-time high of $170,000 for Bitcoin. The report references historical trends and includes a price chart showing movements from 2022 to the present. On August 5, Bitcoin tested the 1-week Moving Average (MA50), a level not reached since March 12, 2003.

In prior market cycles, this level served as a critical support trendline indicating potential bull markets. TradingShot noted that Bitcoin successfully held this trendline twice, contributing to its recent rally that saw the price approach $73,800. The surge occurred shortly before the US Presidential elections, a period historically linked to significant rallies for Bitcoin.

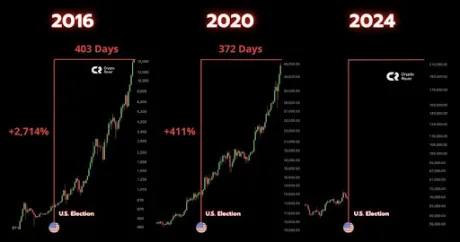

Market expert Crypto Rover on X (formerly Twitter) observed that Bitcoin's average price increase following previous US elections was 1,563%. In 2016, Bitcoin rose 2,714% post-elections, exceeding $15,000, while in 2020, it increased over 400%, surpassing $40,000. Currently, Bitcoin is on an upward trajectory following the recent elections on November 4.

Given the timing of these rallies, TradingShot suggests a similar pattern may be repeating, indicating potential explosive growth for Bitcoin. Based on chart analysis and Fibonacci levels, the analyst projects a target of $170,000, approximately 1.618 Fibonacci extensions from the current ATH.

With Bitcoin trading at $73,715, a rise to $170,000 would represent a 130.55% increase.

BTC Enters Price Discovery Phase

Following Bitcoin's new ATH, crypto analyst Ali Martinez has stated that this rise signifies the cryptocurrency's entry into its price discovery phase.

Price discovery refers to how the market determines value based on supply and demand dynamics. Despite this achievement, Martinez noted that some investors are shorting Bitcoin by liquidating their holdings to take profits. If Bitcoin retraces to the $75,550 price point, approximately $210 million could be liquidated from the market.