Bitcoin Price Expected to Reach $80,000 by Year-End According to Bitfinex

Bitfinex reports that Bitcoin (BTC) volatility is expected to increase in the coming week due to geopolitical and macroeconomic factors. Anticipation surrounding the US election and the end of Q4 suggests a potential target price of $80,000 by year-end.

Bitcoin Volatility Expected to Peak

Bitfinex's recent report indicates that Bitcoin could reach $80,000 by year-end influenced by geopolitical uncertainty, macroeconomic conditions, seasonality, and the “Trump Trade.”

Historically, global macroeconomic trends and geopolitical events have impacted BTC’s price. The upcoming US Presidential elections are significantly affecting Bitcoin's performance this year, with both candidates acknowledging the crypto sector. Republican candidate Donald Trump has notably embraced Bitcoin.

Trump’s pro-crypto position has linked his election odds to Bitcoin’s price movements. The narrative around the “Trump Trade” reflects market expectations regarding BTC's performance based on election outcomes.

The report notes that Bitcoin's volatility has increased, characterized by sharp intra-week corrections followed by rebounds. Recently, BTC experienced a 6.2% pullback to around $65,000 before recovering to $68,000.

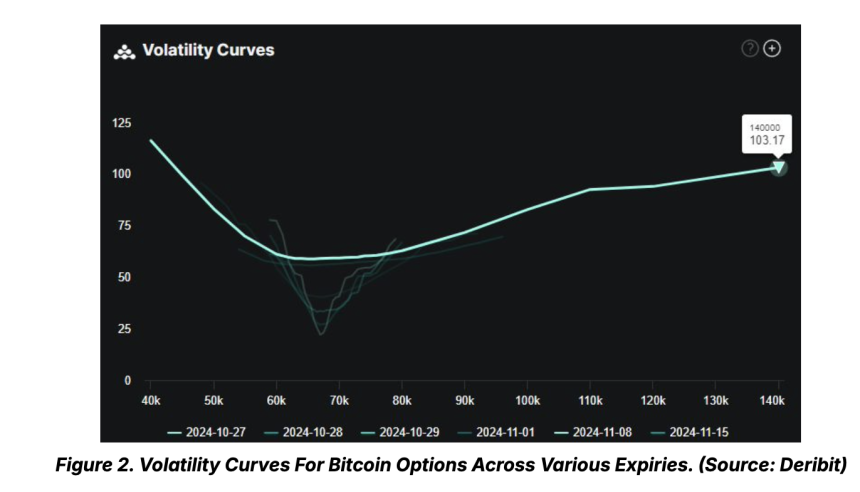

Analysts forecast further “whipsaw price movements” as speculation rises ahead of the elections. Option premiums and estimated daily volatility for both the US stock market and Bitcoin are projected to rise next week, with BTC volatility peaking between November 6 and November 8, coinciding with the expected delivery of election results.

The highest implied volatility is anticipated for the November 8 strike price, exceeding 100 for strike prices above $100,000 for BTC.

BTC Projected to Reach $80,000 by Late December

Despite rising volatility, Bitcoin has shown strength, increasing approximately 30% from September lows. It closed September with a 7.29% increase, marking the highest closing for that month historically. However, October’s close may be less impressive due to volatility.

Bitfinex analysts indicate that Q4's historically bullish seasonality will likely support a positive rally for BTC. There has been a notable rise in call open interest for end-of-year options.

BTC is expected to experience above-average volatility and possible deep corrections in the near term. The market appears positioned for a post-election surge beyond March’s all-time high of $73,666. Call options expiring on December 27 with an $80,000 strike price have seen significant buildup, indicating this target may be reachable by year-end. Currently, BTC is trading at $71,197, reflecting a 3.4% increase over the day.