Bitcoin Price Remains Above Short-Term Holders Cost Basis at $88,135

The Bitcoin price has struggled to maintain its six-figure valuation after reaching an all-time high of $108,135. Recently, it dropped below $92,000 after briefly holding above $100,000.

Discussions about the end of the bull market have arisen. However, on-chain data from Glassnode indicates that the market may still have potential for upward movement. Key points include:

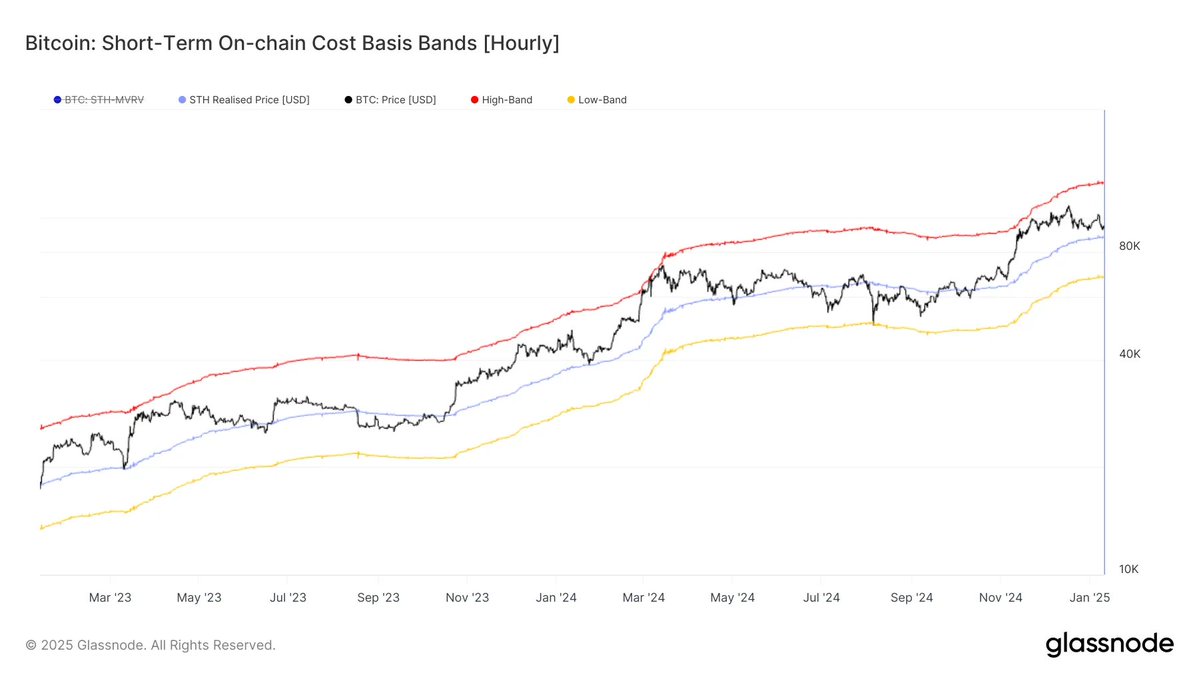

- The STH (short-term holders) cost basis is a metric tracking the average purchase price for investors who held Bitcoin for less than 155 days.

- Currently, Bitcoin’s price is approximately 7% above the STH cost basis of around $88,135.

- Maintaining a price above the STH cost basis could signal the continuation of the bull market.

- A drop below $88,000 could indicate a trend reversal from bull to bear market.

As of now, Bitcoin is priced just above $94,000, reflecting a slight increase of 1% in the last 24 hours but down over 3% in the past week.

The broader crypto market has seen large-cap assets decline significantly, prompting traders to consider selling. Nevertheless, this shift could lead to a market rebound, as historical patterns suggest that prices often rise when bearish sentiment is high, as noted by Santiment.