7 0

Analyst Warns Bitcoin Price Action Indicates Potential Liquidity Traps

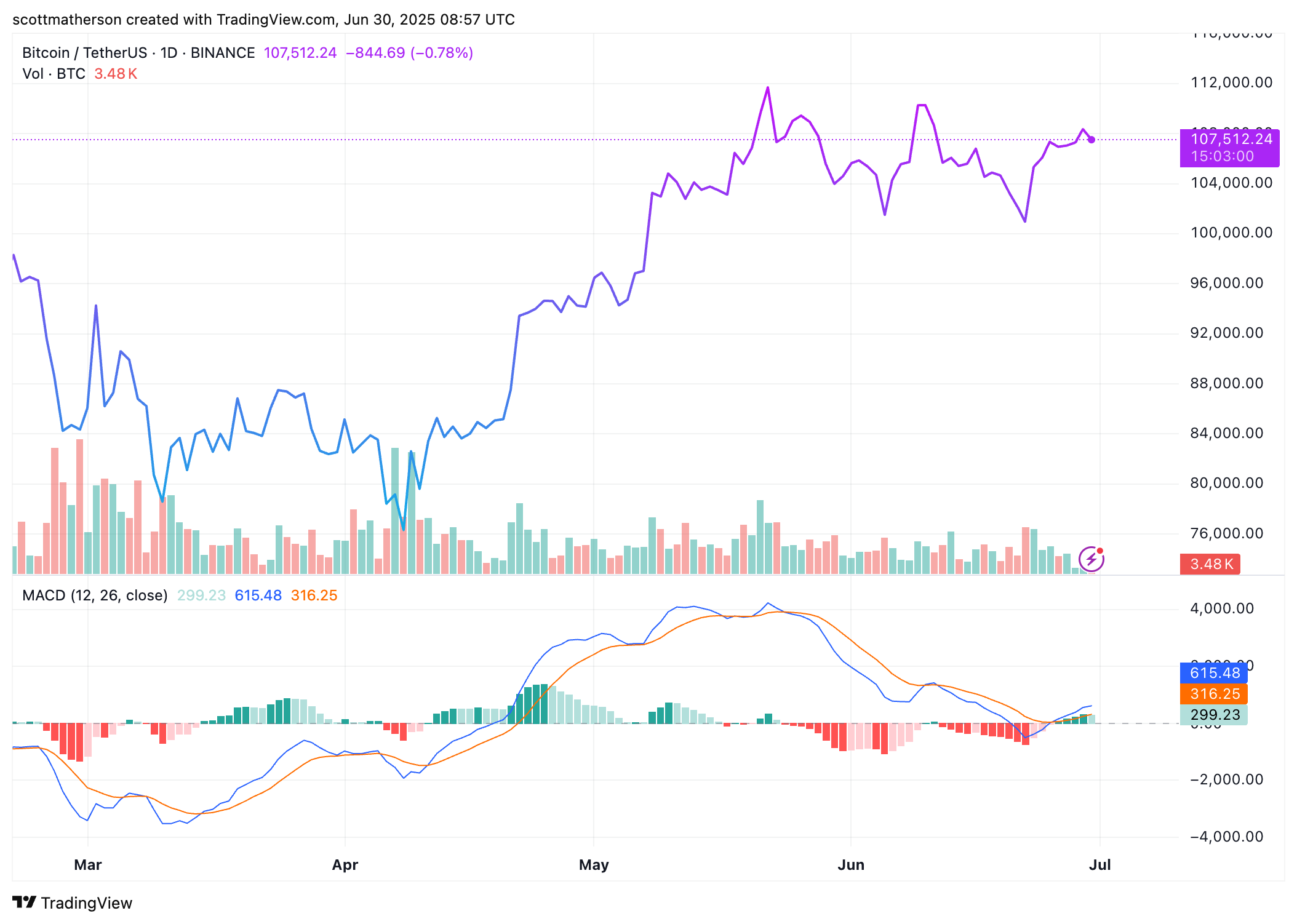

A crypto analyst has indicated that the recent price movements of Bitcoin may lead to significant liquidity traps, reminiscent of previous market cycles. As Bitcoin aims for new all-time highs, market makers could be creating conditions for bear traps before a potential breakout.

Key Highlights

- Analyst Luca observes a liquidity trap phase in Bitcoin's current price behavior.

- Market makers may be manipulating conditions to encourage bearish positions while maintaining stability.

- Multiple resistance levels are identified between $109,000 and $112,000, with Bitcoin consolidating just below these levels.

- Luca suggests this subdued action reflects a strategic effort by market makers to foster bearish complacency.

- The avoidance of liquidity above resistance lines might indicate deeper bear traps are being set.

- A possible short squeeze could trigger a sharp upward move towards a new all-time high.

Luca draws parallels to a prolonged consolidation phase observed in 2024, where similar patterns preceded a breakout in November 2024. Historical trends suggest that current suppressed prices and unswept highs may herald a bullish shift for Bitcoin.