Bitcoin Price Breaks Free From 7-Month Descending Broadening Wedge

Recent market inflows have led to Bitcoin breaking free from a 7-month descending broadening wedge pattern. Analyst Gert van Lagen suggests this breakout may indicate the start of a significant price continuation phase, with bulls targeting above the $70,000 mark. Van Lagen emphasizes that Bitcoin's successful retest of the upper trendline supports the current bullish structure.

The descending broadening wedge is a reversal pattern in technical analysis, often indicating strong trends upon breakout. Bitcoin breaching the upper trend line enhances the possibility of bullish momentum, potentially leading to a new all-time high soon.

Bullish Retest Validates Strong Support For Next Rally

During van Lagen's analysis, Bitcoin was retesting a bottom-sloping trend line that had previously capped its rallies since the all-time high of $73,737 in March. By this point, Bitcoin had already surged beyond the trend line in the descending broadening wedge and was on its third candle.

As Bitcoin rebounded from the upper trend line, van Lagen termed this a “successful bullish retest.” He noted that upward breakout directions occur 79% of the time for this pattern.

With Bitcoin now above the wedge, it may extend gains and surpass $70,000. Reaching a new all-time high is crucial for validating the wave continuation pattern.

Key Bitcoin Price Levels To Watch

Despite promising technical signs, van Lagen cautions traders to watch a critical downside level at $58,700. A weekly close below this price would invalidate the bullish structure, disrupting the anticipated wave five continuation and reversing the bullish setup towards a new all-time high.

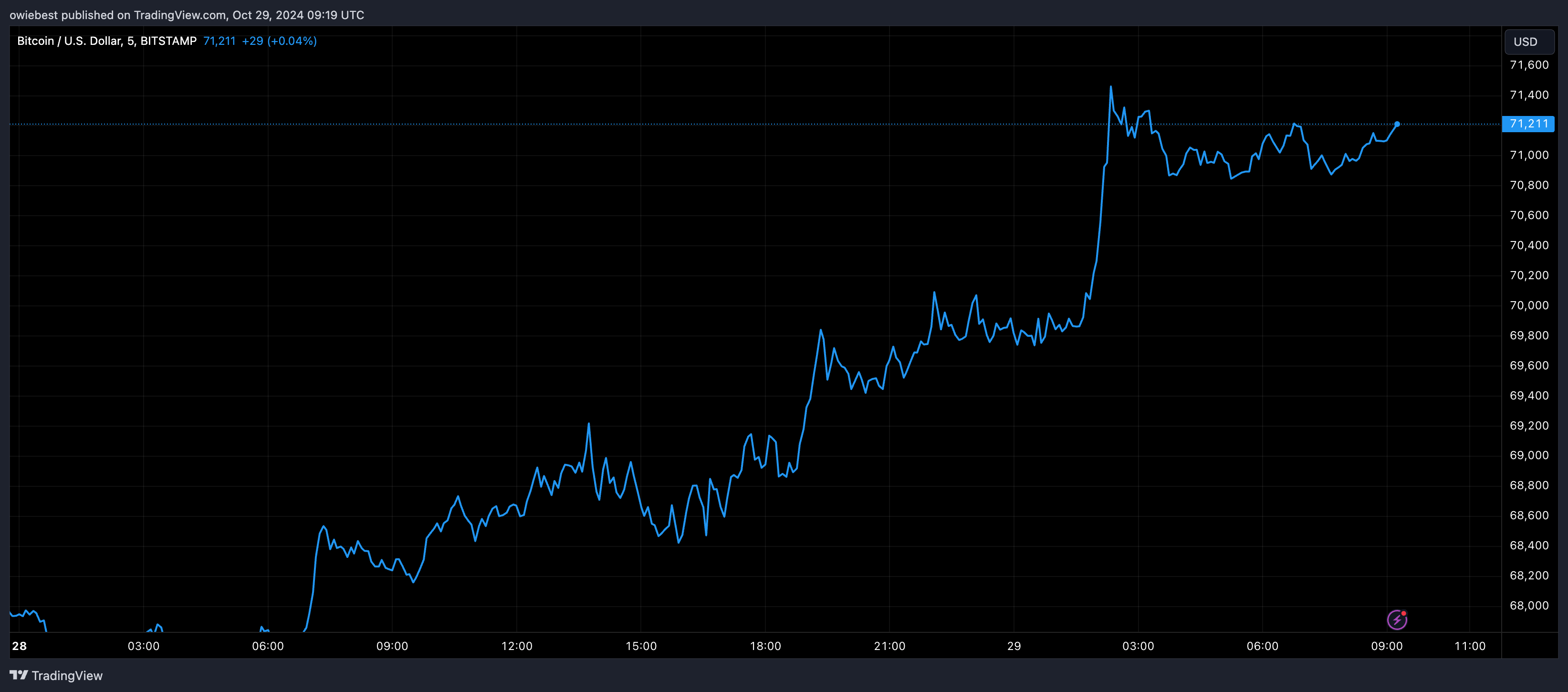

Following the breakout, Bitcoin has increased significantly, trading above $71,000 for the first time since June. Currently, Bitcoin is priced at $71,150, with an intraday high of $71,450 within the past 24 hours, just 3.6% away from previous price records. The only key resistance level remaining is the current all-time high.

Various Bitcoin metrics suggest continued bullish momentum in the short term. Open interest in Bitcoin has reached $42.6 billion, indicating heightened trading activity among Bitcoin traders.