9 0

Bitcoin Price Consolidates Around $108,800 with 6% Monthly Loss

Bitcoin's price settled at $108,800 on August 31, 2025, reflecting a 1% intraday decline and a 6% loss for the month, marking its first negative month since February. This follows a peak of $124,500 on August 14.

Key points include:

- Ethereum (ETH) increased by 25% in August, driven by significant accumulation from companies like Sharplink Gaming and Bitmine.

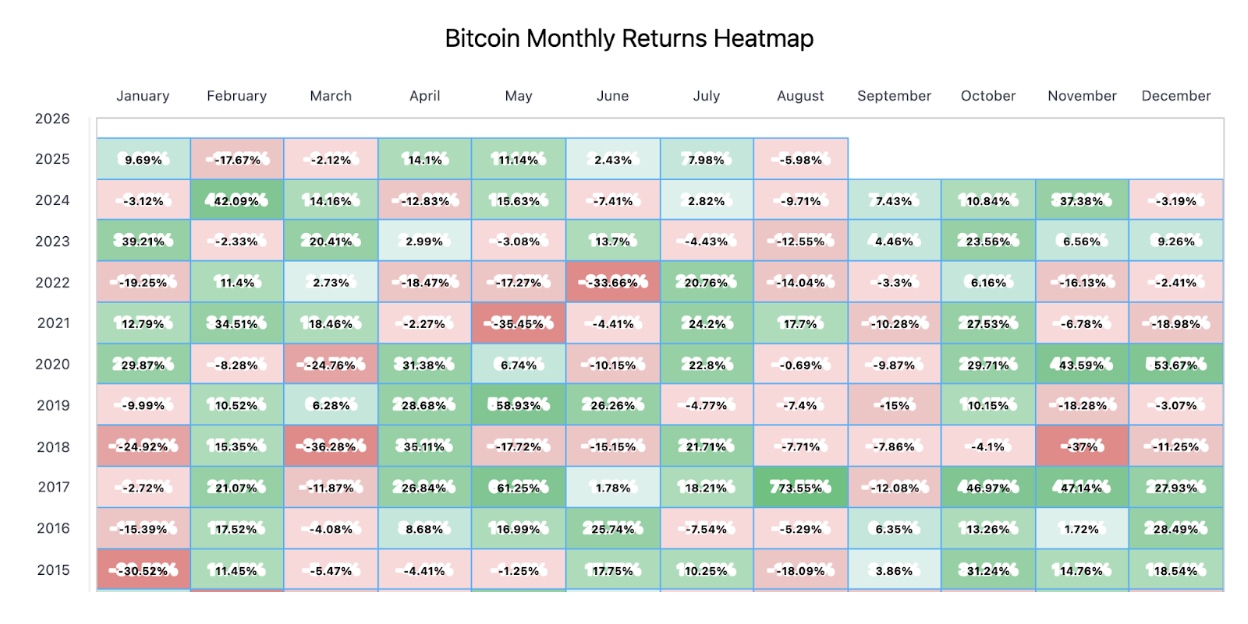

- August has historically been mixed for Bitcoin, with losses recorded in 8 of the last 10 years, yet it has shown gains in September, October, and November over the past two years.

- Analysts are predicting an 86.4% chance of a US Federal Reserve rate cut in the upcoming meeting on September 17, which could positively impact risk assets like Bitcoin.

- Current technical indicators suggest Bitcoin is near critical support at $108,000, with potential resistance at $114,384 and further targets at $118,000 and $122,000.

- Spot trading volumes decreased by 29%, indicating bearish momentum, but institutional buying could drive a rebound.

Additionally, the presale for Maxi Doge (MAXIDOGE), a speculative token project, has raised $1.6 million of its $1.9 million target amid Bitcoin's consolidation.