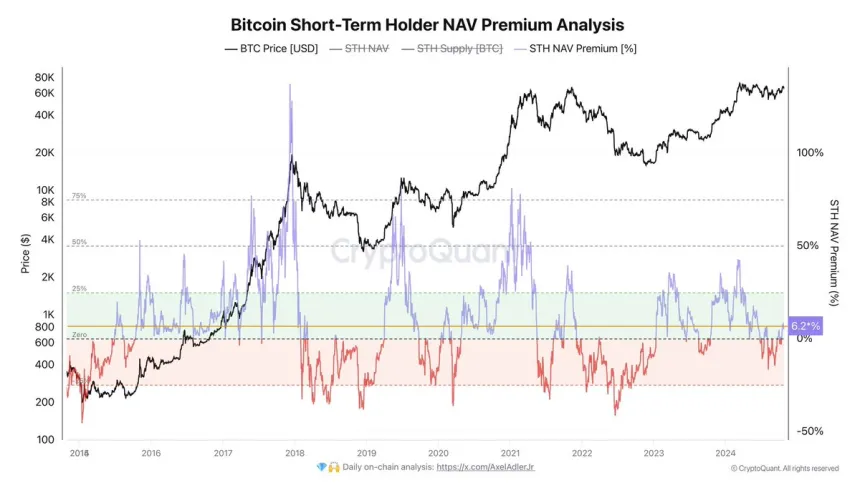

Bitcoin Price Consolidates Below $70,000 with 6.2% NAV Premium

Bitcoin's price has fluctuated between a high of $69,500 and a low of $65,000 over the past week. The market is consolidating below the significant $70,000 level, which could trigger increased buying pressure if breached.

Data from CryptoQuant indicates potential for further growth, with short-term holder (STH) coins trading at a 6.2% net asset value (NAV) premium. This premium reflects positive market sentiment, suggesting that short-term holders expect continued price appreciation.

As Bitcoin stabilizes, the focus remains on the $70,000 mark as a breakout point. Positive sentiment and supportive data contribute to an encouraging outlook for Bitcoin in the coming weeks.

Retail Buying Bitcoin (Again)

Demand for Bitcoin is increasing among short-term holders, evidenced by a 6.2% NAV premium, indicating optimism for further gains. Analyst Axler Adler noted this metric as a bullish signal, suggesting room for continued price growth.

This NAV premium reflects healthy demand, aligning with an accumulation phase rather than a peak. As Bitcoin consolidates under resistance levels, rising demand could lead to a price increase.

The balance between premium demand and NAV levels may indicate sustained upward momentum. Strengthened buying pressure could signal a rally ahead.

Technical Level To Watch

Currently trading at $66,900, Bitcoin shows resilience with support around $65,000. Holding above this level signals strength and optimism among investors. A push above $70,000 is necessary to maintain bullish momentum.

If Bitcoin falls below $65,000, analysts predict a retracement toward the 200-day moving average (MA) at $63,274, a critical long-term support zone. A pullback to this area could attract new buyers, reinforcing it as major support.

The 200-day MA serves as an important anchor for Bitcoin’s bullish structure. Sustaining prices above $65,000 and breaking $70,000 would indicate ongoing bullish conditions. Conversely, a dip below these supports would shift focus to the 200-day MA, where holding above is essential to avoid a bearish reversal.

Featured image from Dall-E, chart from TradingView