Bitcoin Price Correction Triggers $296 Million in Liquidations

Bitcoin (BTC) experienced volatility over the past 24 hours, dropping to $68,830 on the Binance exchange before recovering some losses.

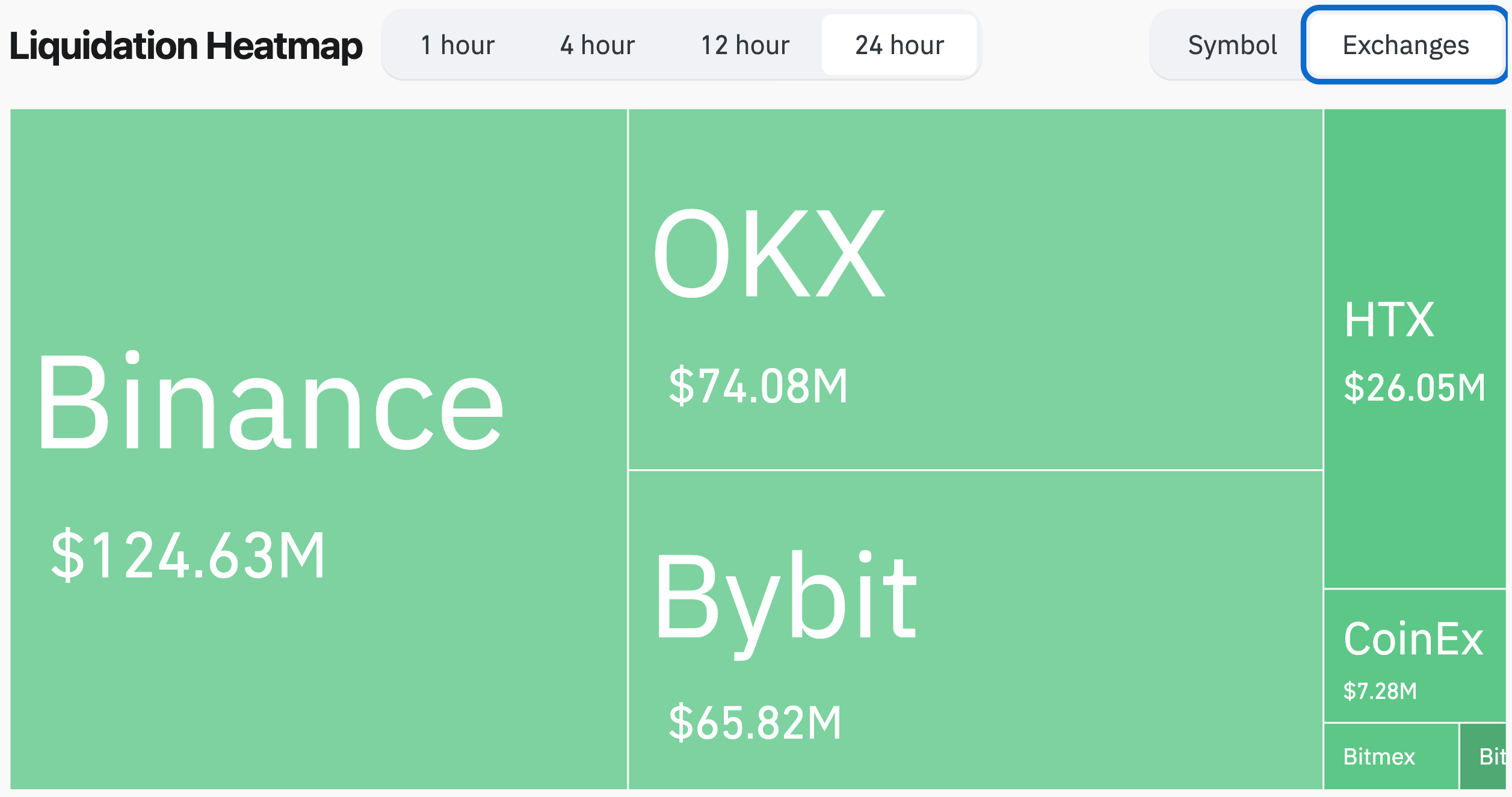

Liquidation Data At A Glance

Currently trading near its all-time high (ATH) of $73,737, BTC's recent price drop raises questions about its ability to set a new ATH. According to CoinGlass data, over $296 million in active positions were liquidated within the last day, with nearly 77% being long positions, indicating a strong bullish sentiment among traders.

Binance led in liquidations at $124 million, followed by OKX at $74 million and Bybit at $65 million. In terms of digital assets, Bitcoin accounted for over $97 million in liquidated positions, while Ethereum (ETH) saw $47 million and Solana nearly $17 million.

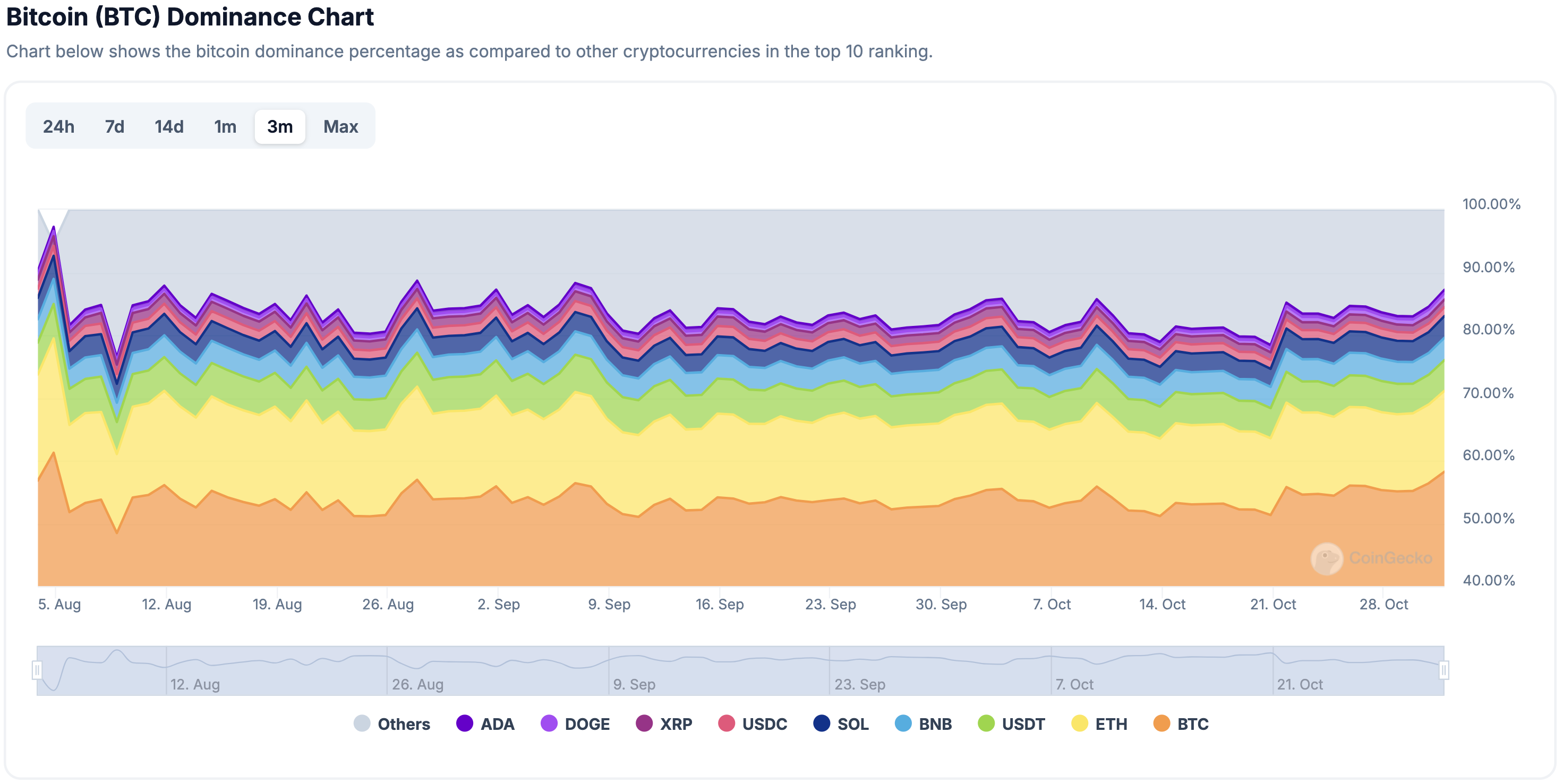

The total crypto market capitalization has decreased by approximately 3.5%, now valued at $2.48 trillion. Although BTC is nearing its ATH, the overall market cap remains significantly lower than its ATH of $2.98 trillion from November 2021. This disparity indicates that altcoins have not matched BTC’s gains, which may reflect cautious investor sentiment favoring BTC during uncertain times.

This scenario presents potential growth opportunities for altcoins, attracting risk-seeking investors hoping for substantial returns compared to BTC. Meanwhile, Bitcoin dominance is approaching 60%. Higher dominance could negatively impact altcoins already lagging behind BTC in price performance.

Can Bitcoin Still Hit ATH?

The possibility of BTC achieving a new ATH during this rally remains uncertain. Supporting factors include:

- Increased likelihood of pro-crypto US presidential candidate Donald Trump winning the election

- Effects of Bitcoin halving

- Increased inflows into BTC exchange-traded funds (ETFs)

- Low interest rate environment

Conversely, sentiment indicators like the Fear and Greed Index show the market is currently in a 'greed' phase, suggesting potential challenges ahead. The crypto market is expected to remain volatile, but long-term BTC holders appear undeterred, as profit-taking has been relatively subdued even when BTC surpassed $71,000.

As of the latest update, BTC trades at $71,524, reflecting a modest increase of 0.6% in the last 24 hours, with a market cap of $1.41 trillion.