9 0

Bitcoin Price Declines 2.3% to $107,205 Following Recent Gains

Bitcoin's price has decreased by 2.3% in the last 24 hours, currently trading around $107,205, which is 4.1% below its all-time high of over $111,000 reached last month.

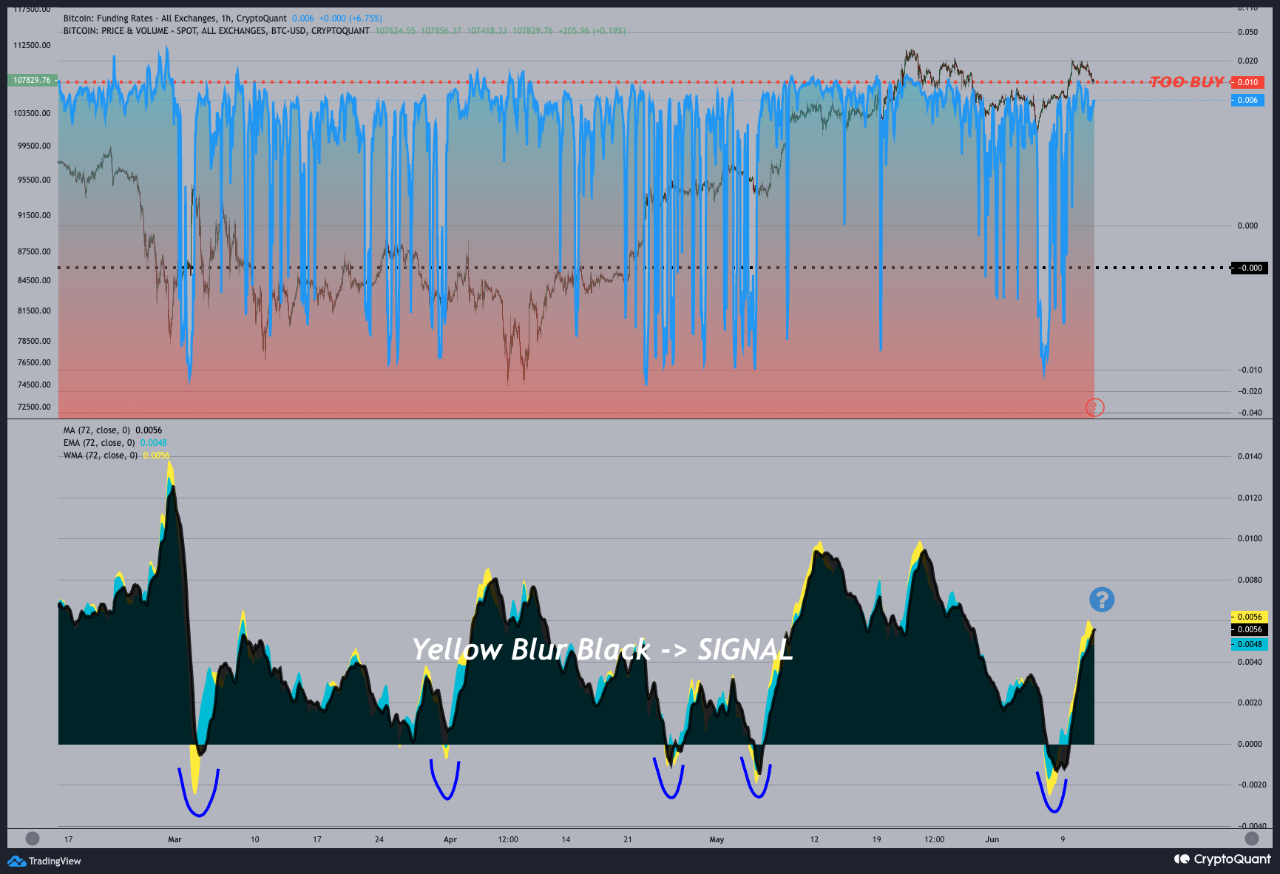

Funding Rate Rebounds Signal Potential Upside for Bitcoin

- Analyst "nino" suggests Bitcoin is repeating a funding rate pattern historically linked to price rebounds.

- The funding rate dipped into negative territory before reversing, aligning with previous price recoveries.

- Nino indicates that the 72-hour moving averages exiting the oversold zone could lead to short position liquidations.

- The current funding rate remains below levels of excessive bullish sentiment, indicating potential for upside without overheating in derivatives markets.

- Negative funding rates followed by increases often reflect unwinding of bearish bets, creating buy pressure as traders close positions.

- This setup has occurred multiple times earlier in 2025, suggesting a cyclical trend may be repeating.

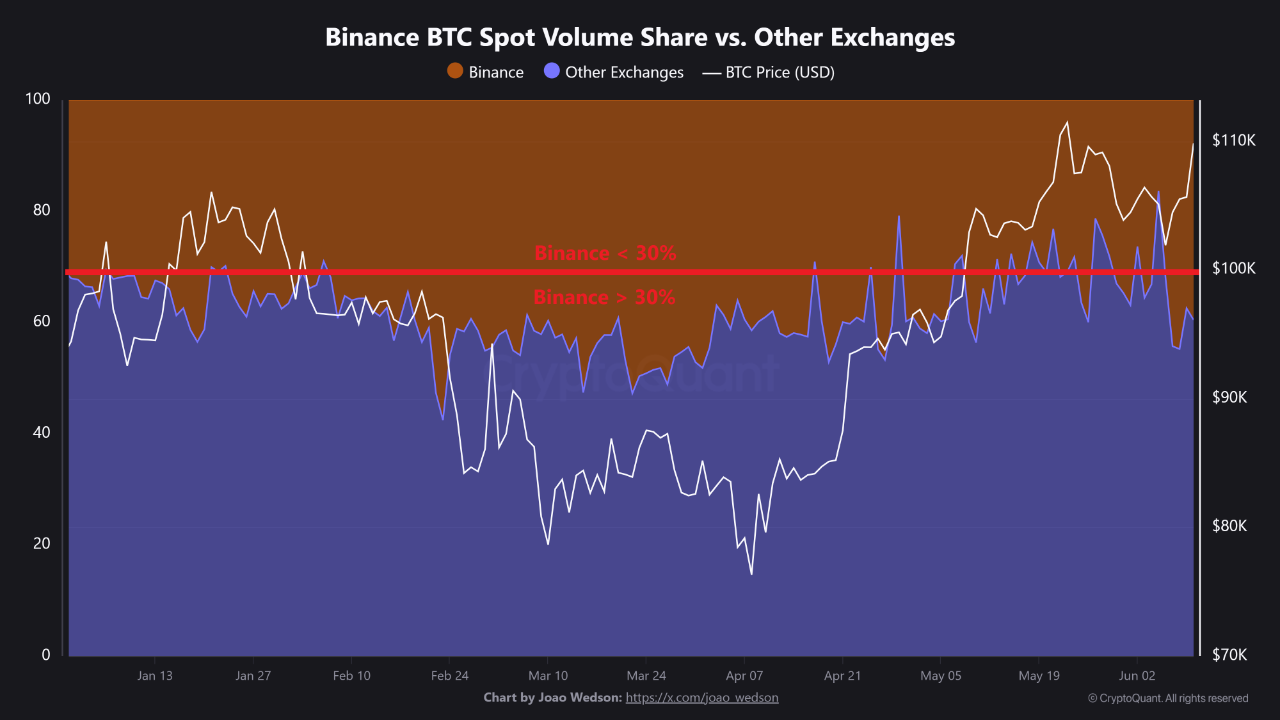

Binance Volume Share Signals Key Trends in Market Liquidity

- Analyst Burak Kesmeci highlights Binance’s share of global trading volume as an indicator of institutional participation and market health.

- Increased Binance spot volume share correlates with higher liquidity and smoother price discovery.

- A drop below 30% in Binance’s volume could signal fragmented liquidity across other exchanges, leading to increased volatility.

- Currently, Binance's volume share shows signs of recovery, indicating ongoing capital flow and a stable trading environment.