5 0

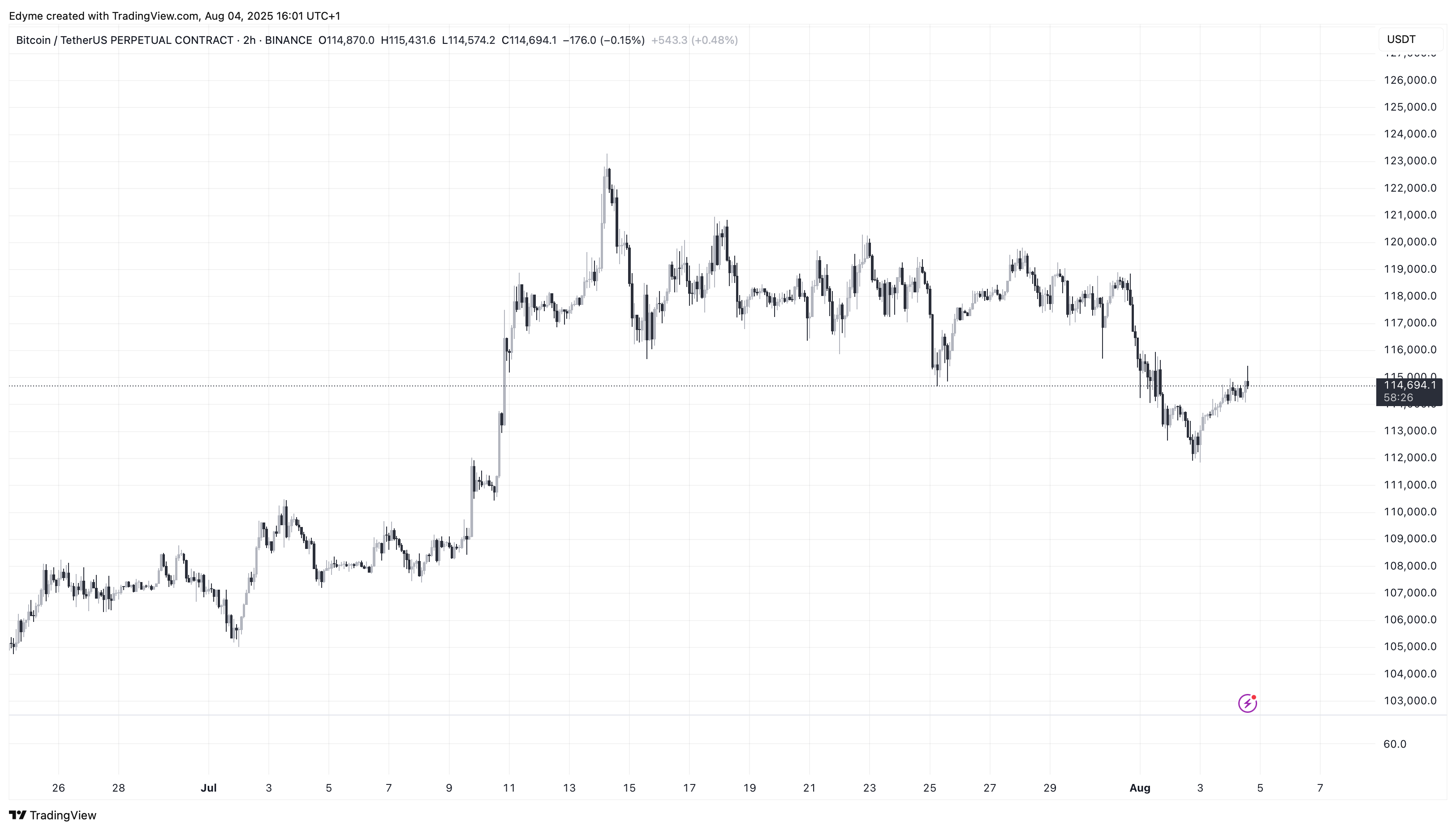

Bitcoin Price Declines 3.7% Amid Weak Liquidity and ETF Demand

Bitcoin (BTC) has seen a price decline of approximately 3.7% over the past week, now valued at $114,420, following a peak above $123,000 last month. This drop is attributed to weakening liquidity and inconsistent institutional demand.

Key Factors Influencing Price Decline

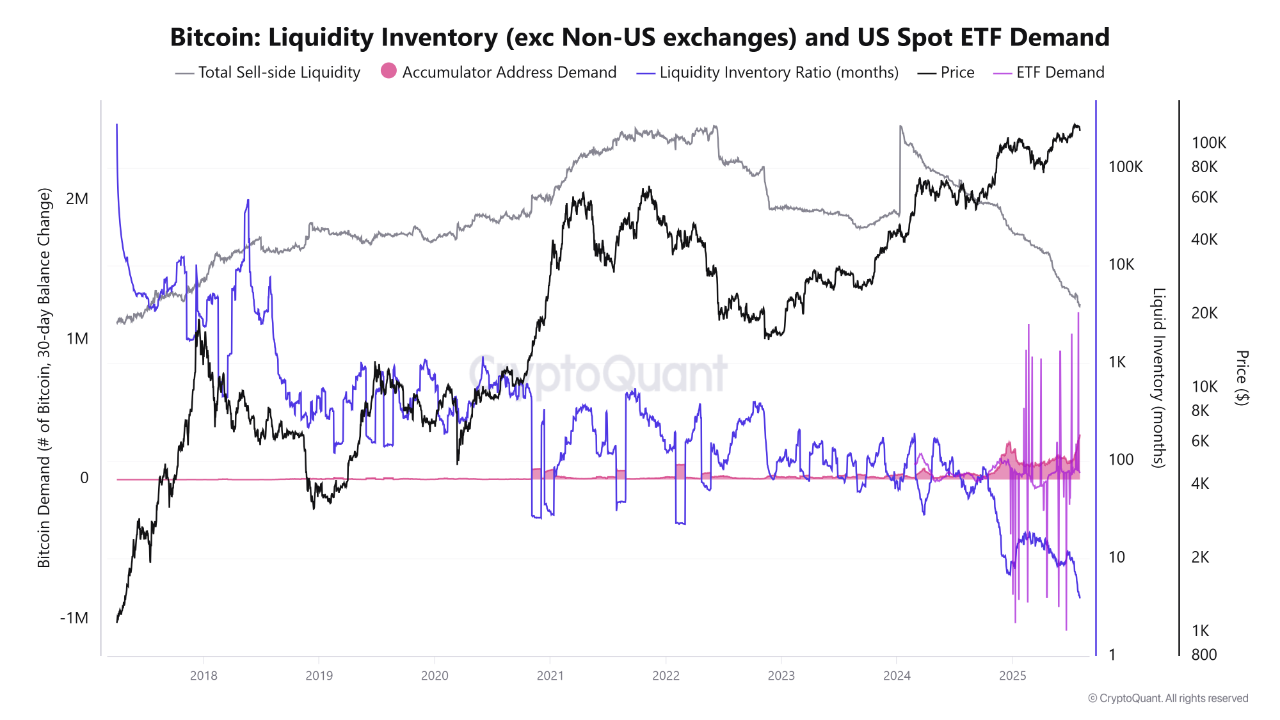

- Liquidity inventory ratio fell sharply since mid-July, indicating limited Bitcoin availability for sale.

- This reduced supply typically leads to upward price pressure; however, insufficient new demand has made prices vulnerable.

- Market conditions resemble a "thin market," where small sell orders can cause significant price drops due to low order book depth.

- Erratic demand for Bitcoin-linked ETFs has led to inconsistent institutional support, exacerbating price volatility.

- Limited activity from high-value addresses during the downturn has failed to stabilize prices despite long-term confidence signals.

- Without an increase in fresh demand or institutional buying, Bitcoin may remain in a vulnerable position.

Investors are closely monitoring liquidity conditions, ETF flows, and accumulation activities to assess potential recovery signals.