Bitcoin Price Drops 10.5% as Short-Term Holders Face Losses

Bitcoin is currently trading at approximately $111,090, down 10.5% from its recent high of over $124,000 and 4.2% lower this past week. This decline indicates weakening buying pressure among traders.

Key points include:

- The Binance Buying Power Ratio has increased, indicating more stablecoins are entering the exchange while Bitcoin is being withdrawn.

- This trend suggests a potential accumulation phase as liquidity builds and Bitcoin supply on exchanges decreases.

- A historical correlation exists where rising stablecoin inflows often precede increased trading activity.

Market Signals

Analyst Crazzyblockk noted that the combination of stablecoin accumulation and Bitcoin withdrawals may indicate a market preparing for upward movement.

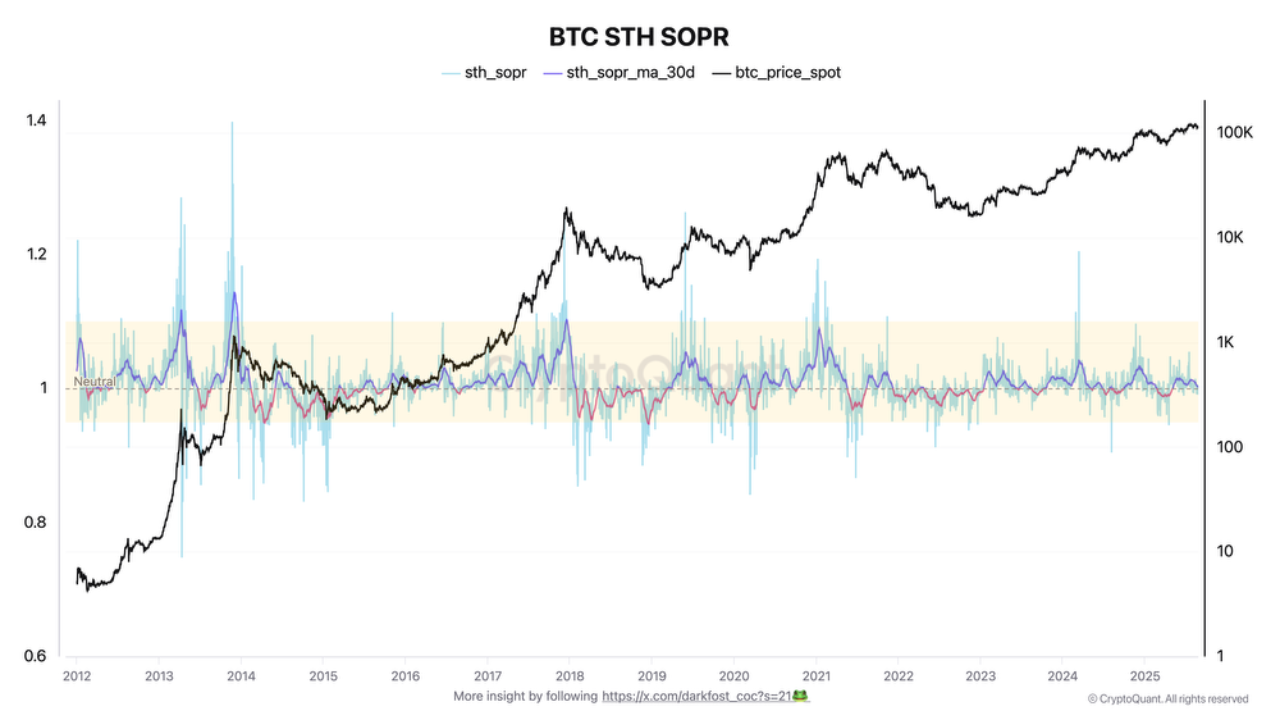

However, another analyst, Darkfost, highlighted concerns with the Spent Output Profit Ratio (SOPR) for short-term holders, which has fallen below 1. This indicates many recent buyers are facing losses.

Darkfost stated:

When SOPR reaches this level, the market usually either rebounds quickly or short-term holders panic, leading to further losses.

The current situation resembles patterns observed in late 2021 when Bitcoin peaked before experiencing a prolonged correction. A continued decline in SOPR may signal increasing pressure on traders to sell, despite stronger conviction from long-term holders.