7 2

Bitcoin Price Drops to $105,485 as Altcoin Liquidations Rise

Bitcoin reached an all-time high of over $111,000 last week but has retraced approximately 4%, currently trading at $105,485. This decline includes a daily drop of 1.8%, indicating cautious market sentiment and profit-taking.

Liquidation Disparity Between Bitcoin and Altcoins

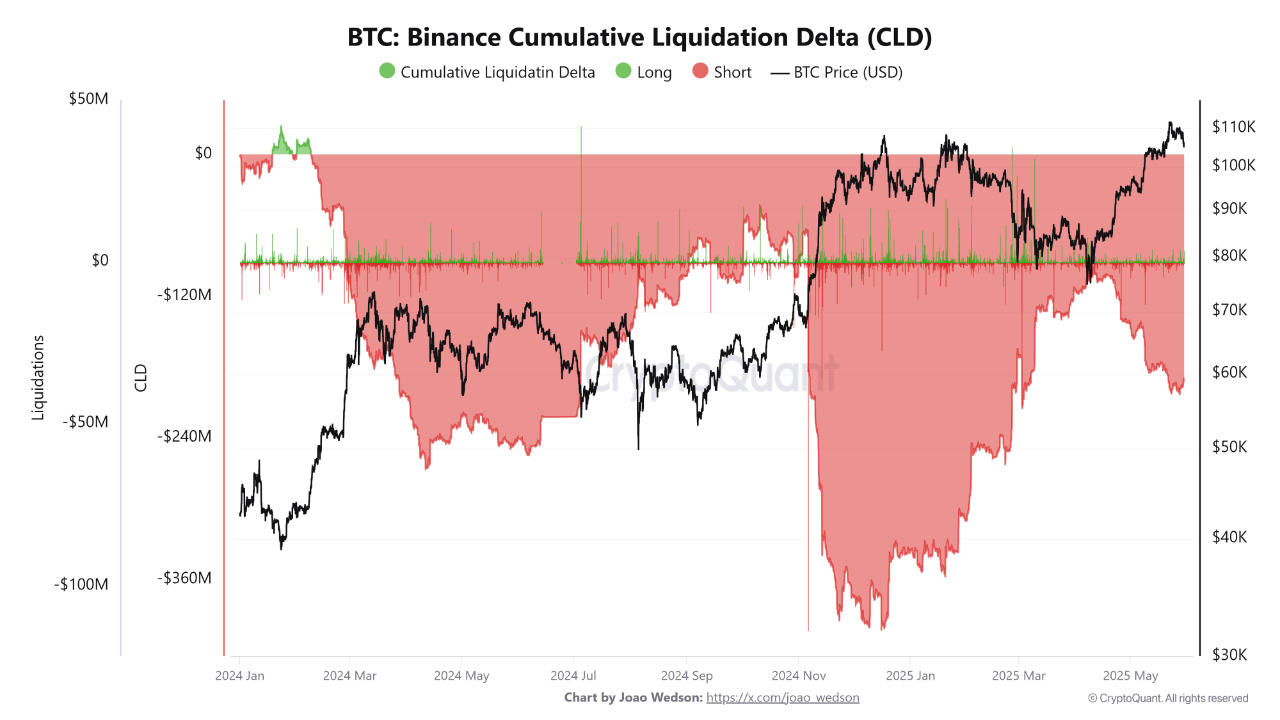

- Since the Bitcoin ETF launch, liquidations show divergence between Bitcoin and altcoins.

- Bitcoin short liquidations on Binance outnumbered longs by around $190 million, reflecting forced exits of bearish traders during price increases.

- In contrast, altcoins faced nearly $1 billion more in long liquidations compared to shorts.

- This discrepancy indicates substantial losses for traders betting on altcoin recovery.

Implications of Market Asymmetry

- The liquidation patterns suggest shifts in investor sentiment, favoring Bitcoin as a safer asset amid market uncertainty.

- Altcoins continue to experience declines due to heightened leverage and speculative trading.

- Post-ETF approval, traders are increasingly confident in Bitcoin's stability over altcoins' volatility.

- Current market conditions may lead investors to adopt a cautious stance towards altcoins while maintaining optimism about Bitcoin.