16 0

Bitcoin Price Drops 22.3% as Whales Accumulate Amid Short-Term Holder Distress

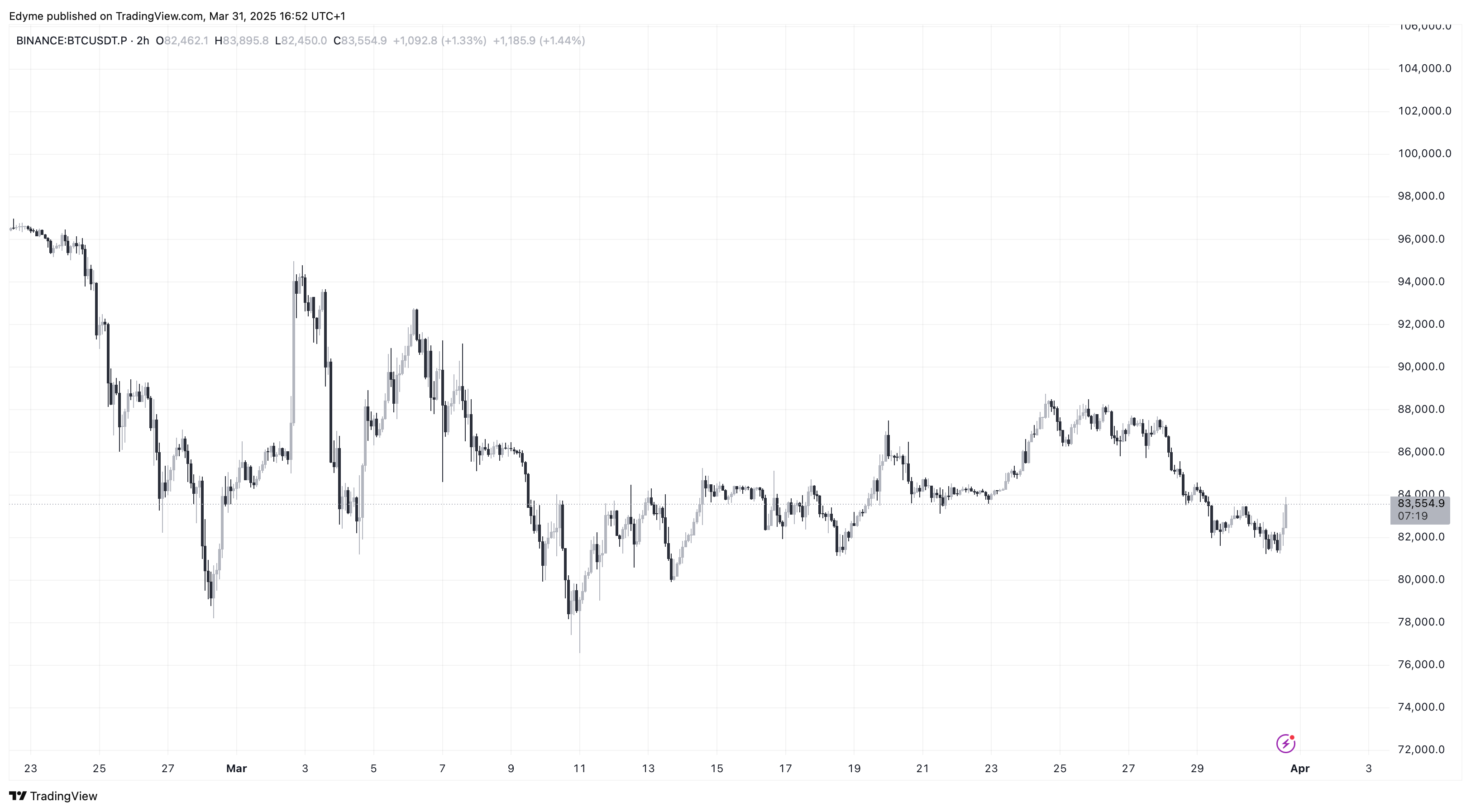

Bitcoin has decreased by 22.3% over the past month, reaching a price of $83,191. This decline reflects reduced risk appetite among investors and a lack of bullish catalysts.

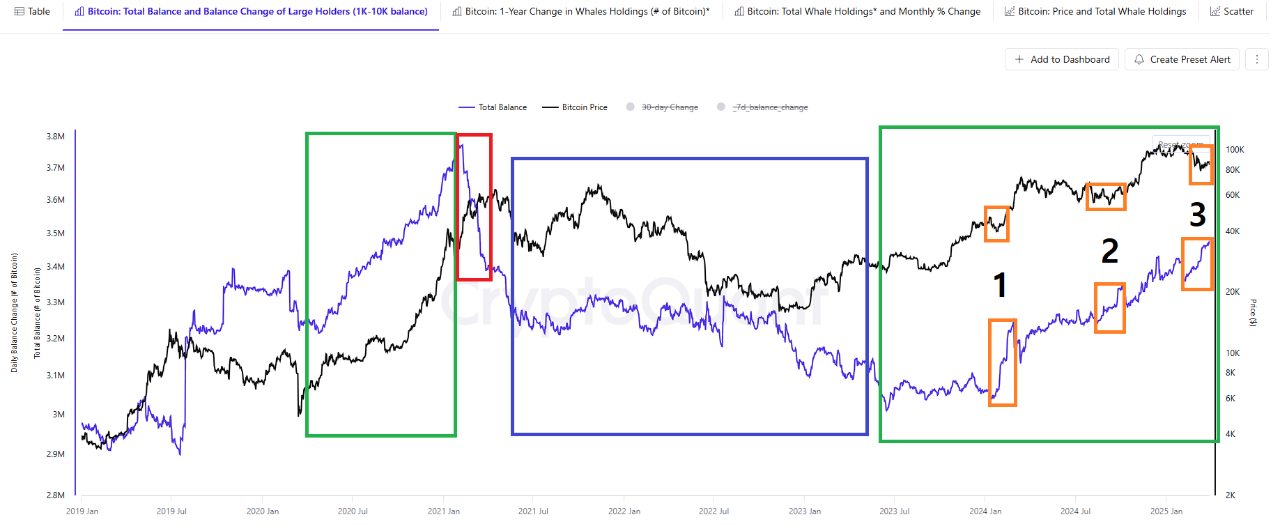

Whale Accumulation Patterns Echo Previous Bull Market Phases

Despite the downtrend, whale addresses (holding 1,000 to 10,000 BTC) are accumulating Bitcoin, similar to patterns observed in the 2020 bull cycle. Key points include:

- Whales showed accumulation during bearish phases in 2020.

- Current whale behavior suggests confidence in long-term value.

- The significance of whales lies in their historical influence on market direction.

- Accumulation may provide support and reduce rapid declines, though volatility remains possible.

Bitcoin Short-Term Holders Show Signs of Capitulation

Short-term holders (STHs) are facing distress, with the Short-Term Holder Spent Output Profit Ratio (SOPR) below 1.0 for over two months, currently at 0.98. This indicates selling at a loss, signaling capitulation. Key points include:

- Approximately 46,000 BTC have been sent to exchanges at a loss recently.

- Heavy short-term capitulation historically precedes market bottoms.

- Longer-term investors often capitalize on discounts during these periods.