5 0

Bitcoin Price Declines to $76,899 as Ownership Patterns Shift

Bitcoin is trading at $76,899, down 3.7% in the last 24 hours and 29.4% from its January all-time high over $109,000. The asset has struggled to regain momentum after falling below $80,000, reflecting ongoing selling pressure across the crypto market.

Market Dynamics

- Recent analysis by CryptoQuant shows a shift in Bitcoin ownership patterns.

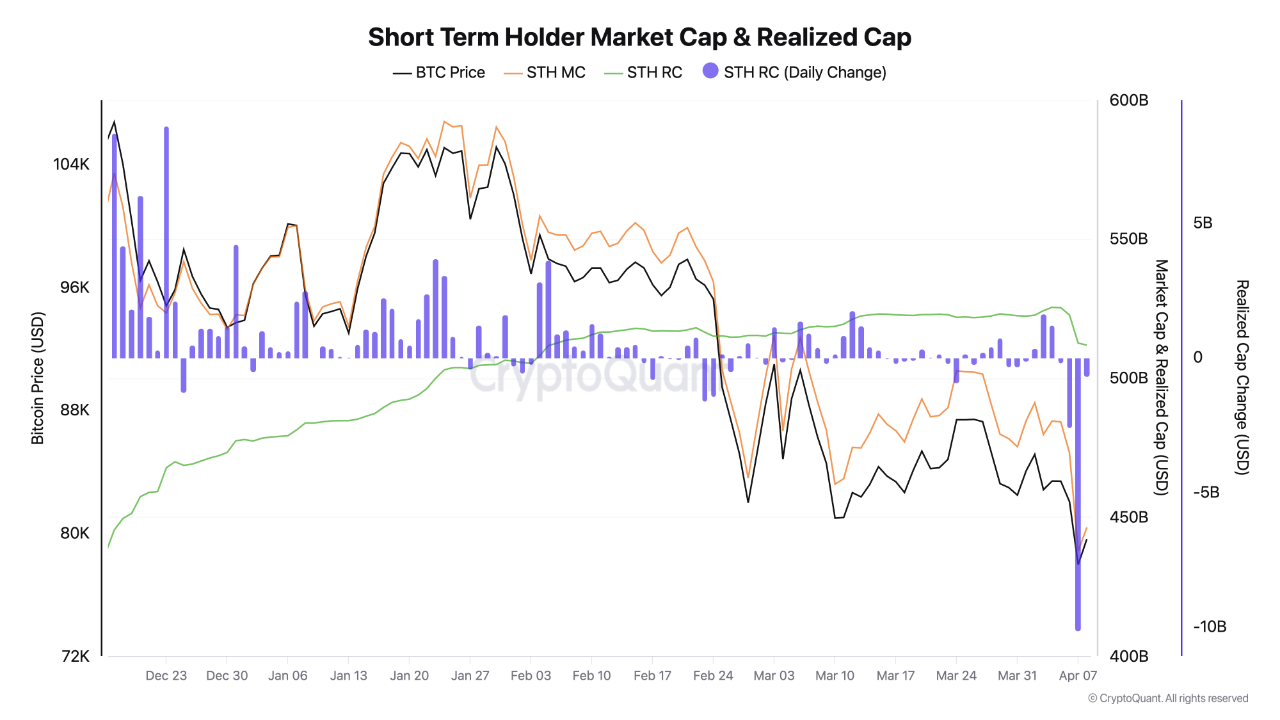

- Short-Term Holders (STH) experienced a ~15% decline from $88,000 to $74,400 over the past week.

- On April 7, STHs realized a $10 billion drop in their cap, marking their largest single-day loss of the cycle.

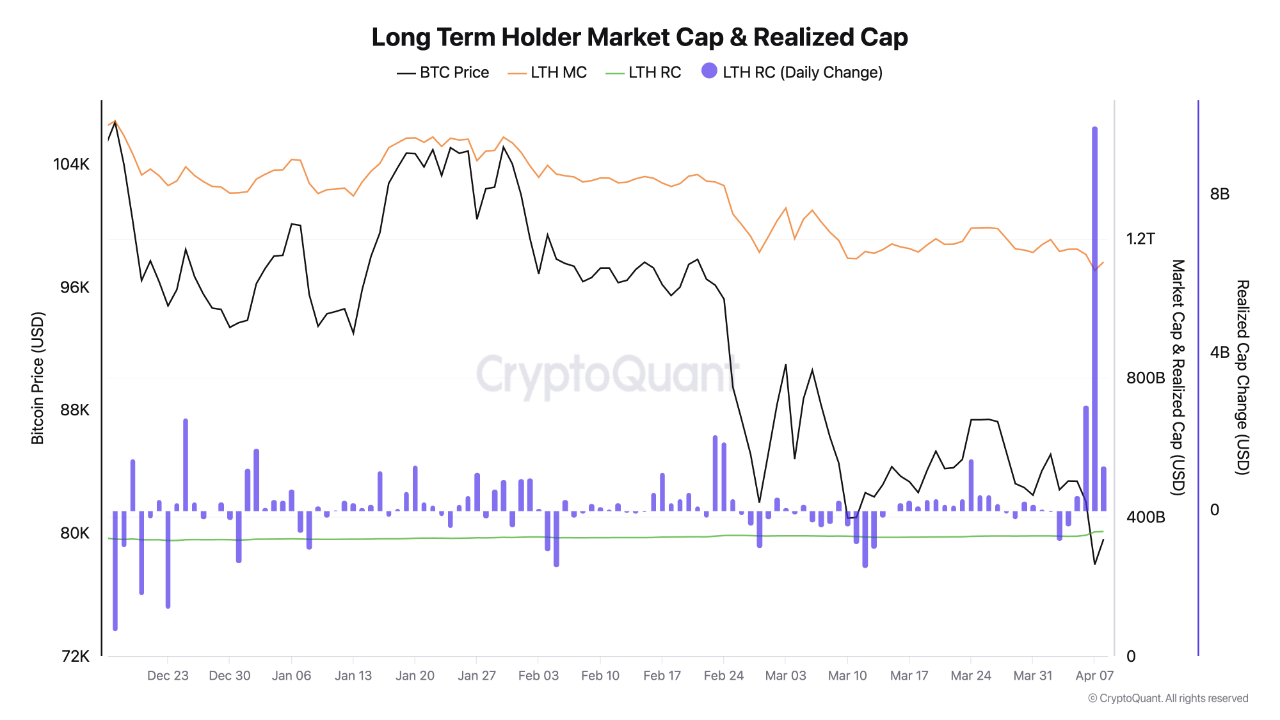

- Long-Term Holders (LTH) saw an increase of $9.7 billion in their realized cap, indicating a transfer of coins to more experienced holders.

- By April 8, realized losses from STHs were at $693 million, while LTHs increased their cost basis by $1.13 billion.

This shift shows supply moving from weaker hands to stronger ones, historically seen near market bottoms or early recovery phases. Analysts noted that long-term investors are buying during market weakness, which typically signals late-stage corrections or early recovery.

Implications for Market Structure

- The behavior divergence between STHs and LTHs could affect Bitcoin’s market structure.

- A reduction in short-term sell pressure may result as STHs decrease holdings.

- Increased accumulation by LTHs indicates confidence in Bitcoin's long-term prospects amid volatility.

- Historical patterns suggest this could lead to price stabilization or trend reversals.

Whether this shift marks the end of the current correction or the beginning of recovery remains to be seen, but on-chain trends indicate significant repositioning within the Bitcoin market.