Bitcoin Price Drops Below $70,000 Amid Market Concerns

The Bitcoin (BTC) price has declined significantly in the last 24 hours, dropping below $70,000 after peaking at $73,620 on Tuesday. The current low is $68,830, marking a 5.7% decrease. Key factors influencing this downturn include:

#1 Risk-Off Sentiment Ahead of US Election

Bitcoin's price drop aligns with a tightening lead for Donald Trump over Kamala Harris in prediction markets like Polymarket and Kalshi. Bitcoin is viewed as a "Trump hedge" due to Trump's support for the cryptocurrency sector.

Trump proposed a “strategic Bitcoin reserve” if re-elected, aiming to retain all Bitcoin held by the US government. This initiative is part of his campaign to position the US as the "crypto capital of the planet."

Earlier in the week, Bitcoin approached its all-time high when Trump's lead was more substantial. The narrowing lead has led to a risk-off sentiment among investors, contributing to the price decline. Analyst HornHairs noted historical patterns of derisking before elections.

#2 S&P 500 Loses 3-Month Trendline

The correlation between Bitcoin and traditional markets may have affected BTC’s price. The S&P 500 fell to its lowest level since October 9, impacting investor sentiment in crypto.

Despite strong earnings from major tech companies, their stock prices declined. Analysts from The Kobeissi Letter observed widespread selling in technology stocks, stating that markets are de-risking ahead of the upcoming election.

Trader Marco Johanning expressed concerns about the S&P 500 losing its three-month trendline, indicating potential short-term selloff risks.

#3 Leverage Flush Out

A significant unwinding of leveraged positions has contributed to Bitcoin's decline. Analyst Miles Deutscher noted the pullback was expected due to market overextension driven by leverage.

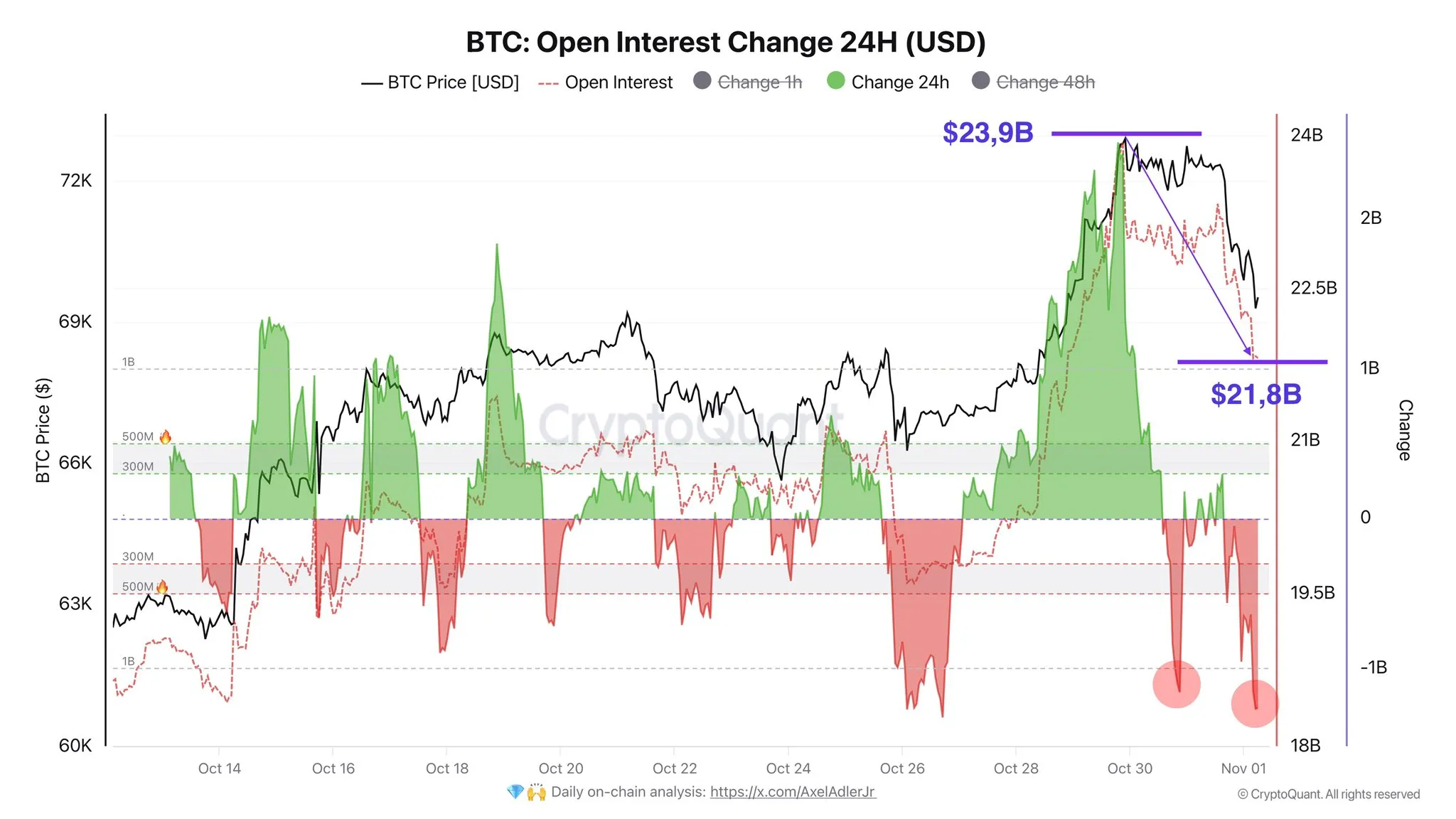

Austin Reid from FalconX reported that the crypto derivatives market saw futures open interest for BTC, ETH, and SOL exceed $50 billion for the first time. On-chain analyst Axel Adler Jr indicated a $2.1 billion reduction in open interest, signaling a leverage flush out.

According to Coinglass, 93,864 traders were liquidated in the past 24 hours, totaling $286.73 million. The largest liquidation order was valued at $11.26 million on Binance's BTCUSDT pair, with $81.38 million in long positions liquidated for Bitcoin—the highest since October 1.

At press time, BTC traded at $69,446.