2 0

Bitcoin Price Drops Amid Renewed Concerns Over U.S. Trade Policy

Cryptocurrency markets declined on Friday, influenced by renewed U.S. trade policy concerns, overshadowing otherwise positive developments in the industry.

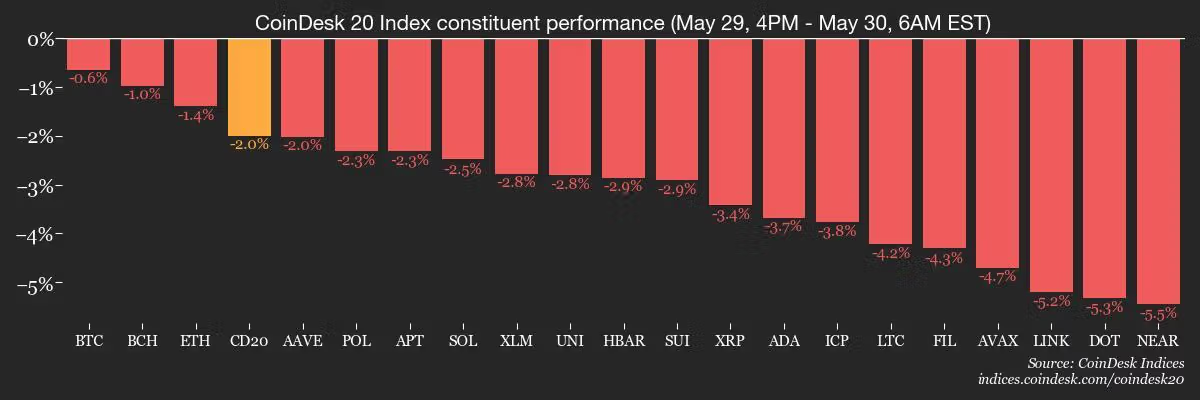

The CoinDesk 20 Index dropped 4.4% to 3,129, while Bitcoin fell 2.8% to approximately $105,300, maintaining above $100,000 for over 20 days. The decline followed a U.S. appeals court reinstating previously blocked trade tariffs, raising fears of an extended trade war.

Key points include:

- U.S. Treasury Secretary noted stalled negotiations with China, heightening uncertainty.

- BlackRock’s iShares Bitcoin Trust is experiencing record-low volatility, attracting billions from investors.

- Spot Bitcoin ETFs recorded $5.85 billion net flows this month, up from $2.97 billion in April.

- Spanish bank Santander is exploring cryptocurrency access for retail clients.

- Panama proposed allowing ships to pay transit fees in Bitcoin.

- Upcoming core PCE inflation data could impact Fed rate cut expectations.

Current crypto market movements:

Additional insights:

- Stablecoin usage in B2B payments has surged to nearly $3 billion, reflecting growing adoption.

- The Central African Republic plans to tokenize land for resource extraction using its official token.

- SEC clarified that certain staking activities do not violate U.S. securities law.

- Thailand plans to block several unlicensed crypto platforms starting June 28.