Bitcoin Price Falls Below $93,000 Amid Coinbase Premium Gap Decline

Bitcoin has dropped below $93,000 recently. This decline is linked to changes in the Coinbase Premium Gap indicator.

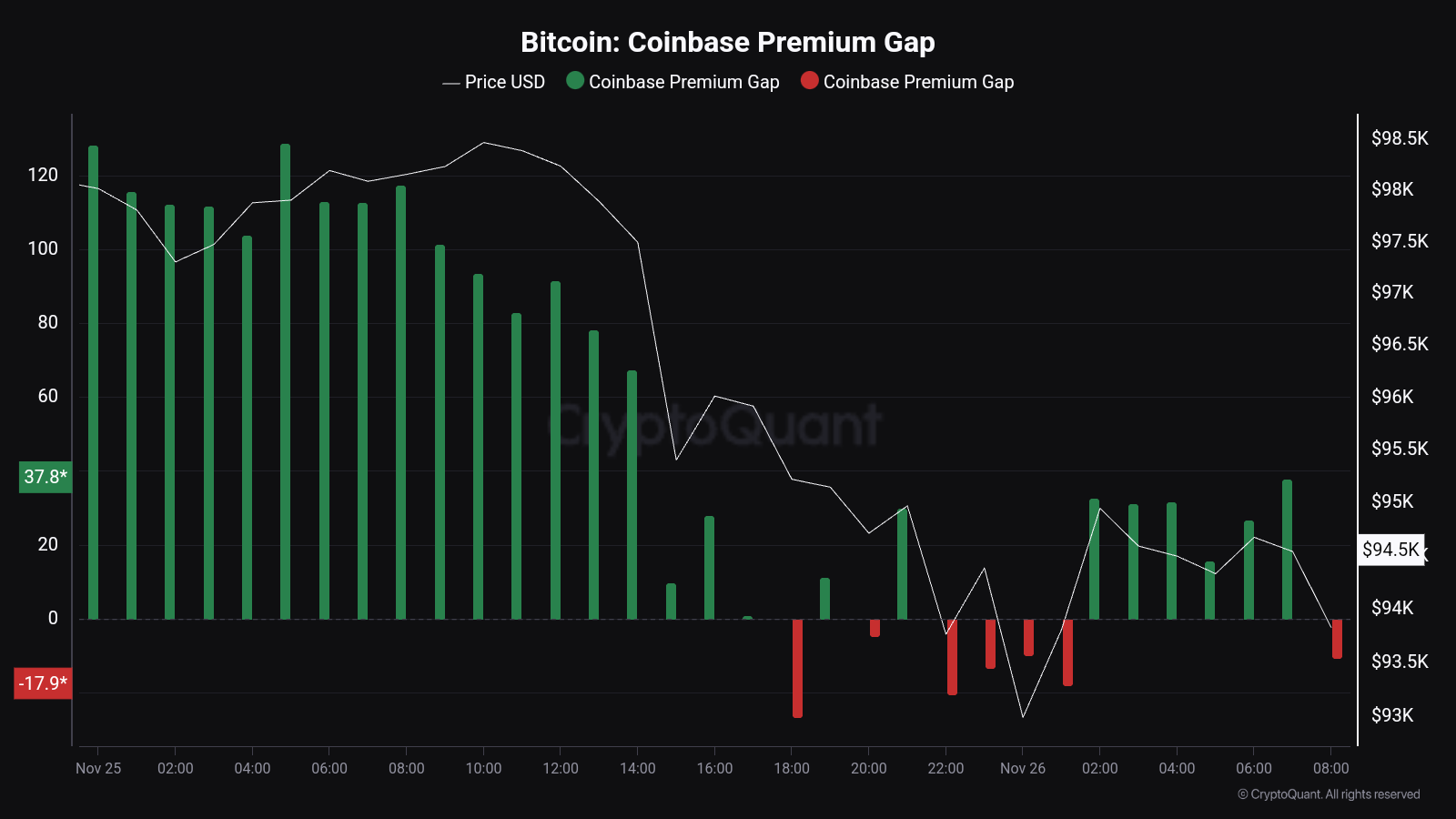

Bitcoin Coinbase Premium Gap Analysis

According to CryptoQuant analyst Maartunn, the Coinbase Premium Gap has returned to neutral levels. This gap measures the price difference of Bitcoin on Coinbase (USD pair) compared to Binance (USDT pair). A positive gap indicates higher buying from US-based investors, while a negative gap suggests increased buying pressure on Binance.

The recent chart shows that the Bitcoin Coinbase Premium Gap, which had been notably positive, has declined to zero:

Maartunn attributes the previous positive premium to Microstrategy's substantial purchase of Bitcoin worth $5.4 billion. The depletion of this buying pressure correlates with Bitcoin's recent price drop below $93,000. The relationship between BTC and the Coinbase Premium Gap throughout 2024 suggests that future movements in this metric may indicate Bitcoin's price direction. A shift into negative territory could lead to further declines.

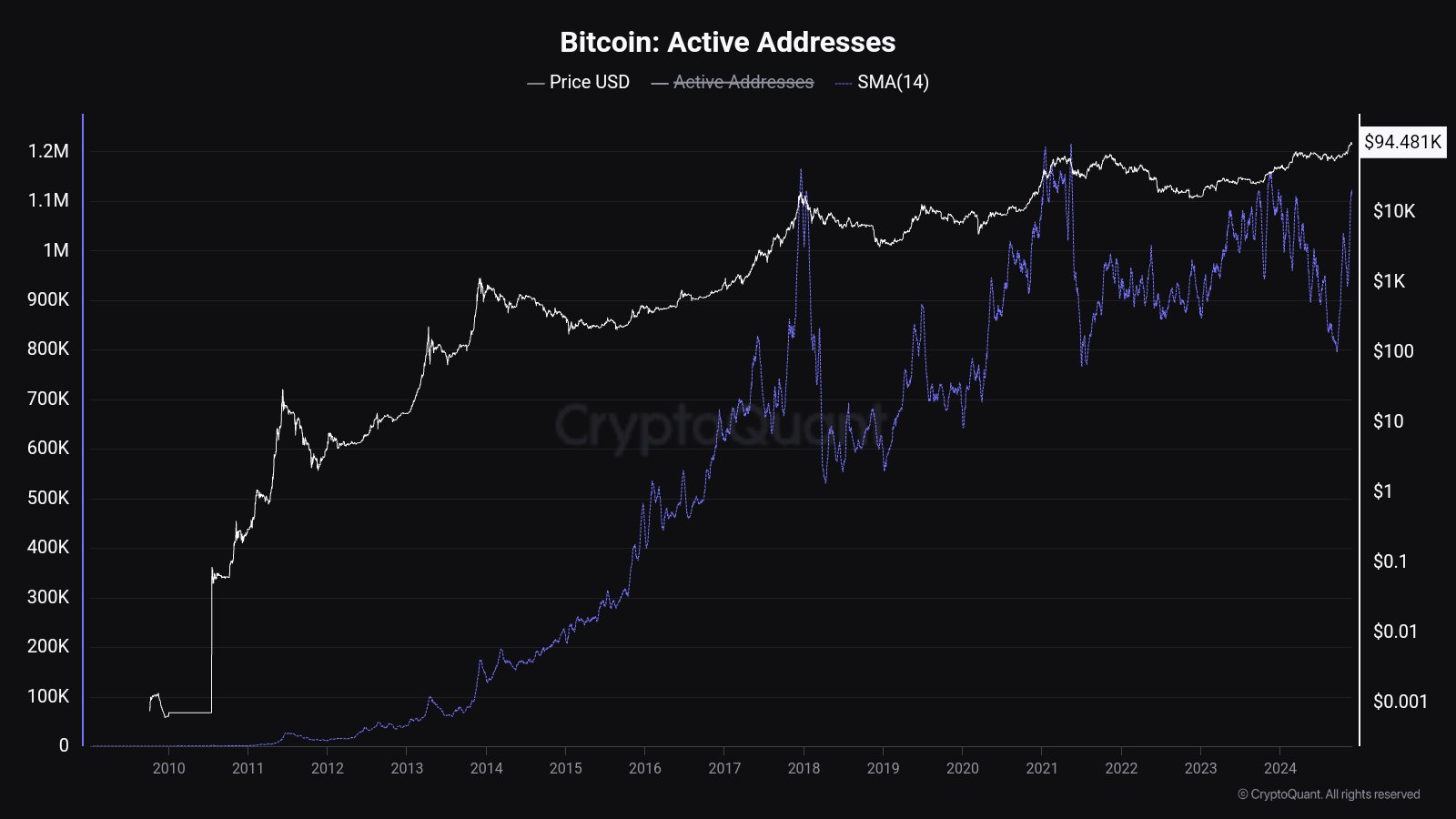

Additionally, the Bitcoin Active Addresses indicator has recently surged, indicating increased transaction activity on the network:

The 14-day simple moving average of active addresses has reached its highest level in eleven months. However, despite the increased activity, it does not appear to reflect buying interest, as Bitcoin's price has decreased.

Current BTC Price

Currently, Bitcoin is priced at approximately $92,400, reflecting a nearly 6% decrease over the last 24 hours.