5 4

Bitcoin Price Fluctuates as Dollar Weakens and Risk Assets Rise

The crypto market experienced significant volatility recently, with Bitcoin fluctuating between 2% to 3% in short intervals but maintaining a value above $100,000, currently around $105,000. Key factors influencing this include:

- A decline in the U.S. dollar index (DXY) to its lowest since December 17, boosting risk assets like cryptocurrencies.

- U.S. bond yields and WTI crude oil prices are also decreasing, with oil below $75 per barrel.

- The Bank of Japan raised interest rates to 0.50%, the highest in over 16 years, against a backdrop of rising inflation at 3.6%.

Key Upcoming Dates

Important dates for investors to monitor include:

- Jan. 25: Deadline for SEC decisions on four spot Solana ETFs.

- Jan. 29: Launch of Ice Open Network mainnet.

- Feb. 4: MicroStrategy Q4 earnings report.

- Feb. 4: Pepecoin halving at block 400,000.

- Feb. 5: Boba Network upgrade.

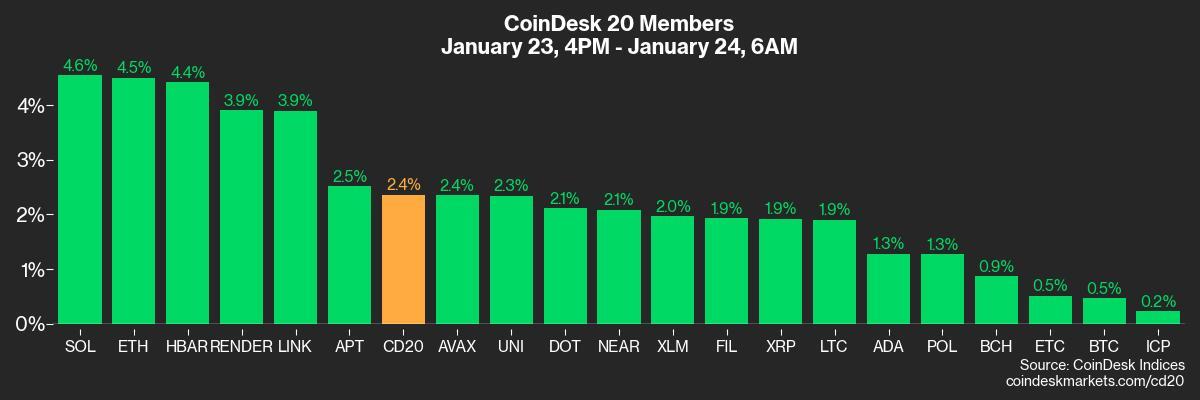

Market Movements

Current market performance shows:

- Bitcoin: +2% to $105,450.57 (24hrs: +3.43%)

- Ethereum: +4.96% at $3,409.62 (24hrs: +6.18%)

- CoinDesk 20 Index: +2.4% to 3,988.16 (24hrs: +4.79%)

Token Developments

Notable activities include:

- Frax DAO considering a $5 million investment in World Liberty Financial.

- Arbitrum BoLD's activation vote deadline approaching.

- Hedera hosting a community call.

ETF Flows

Recent ETF flows indicate:

- Spot BTC ETFs: Daily net flow of $188.7 million; cumulative net flows of $39.42 billion.

- Spot ETH ETFs: Daily net flow of -$14.9 million; cumulative net flows of $2.79 billion.

Market capitalization of Tether’s USDT remains near $138 billion, while USDC supply has increased to nearly $52 billion, the highest since September 2022.