5 0

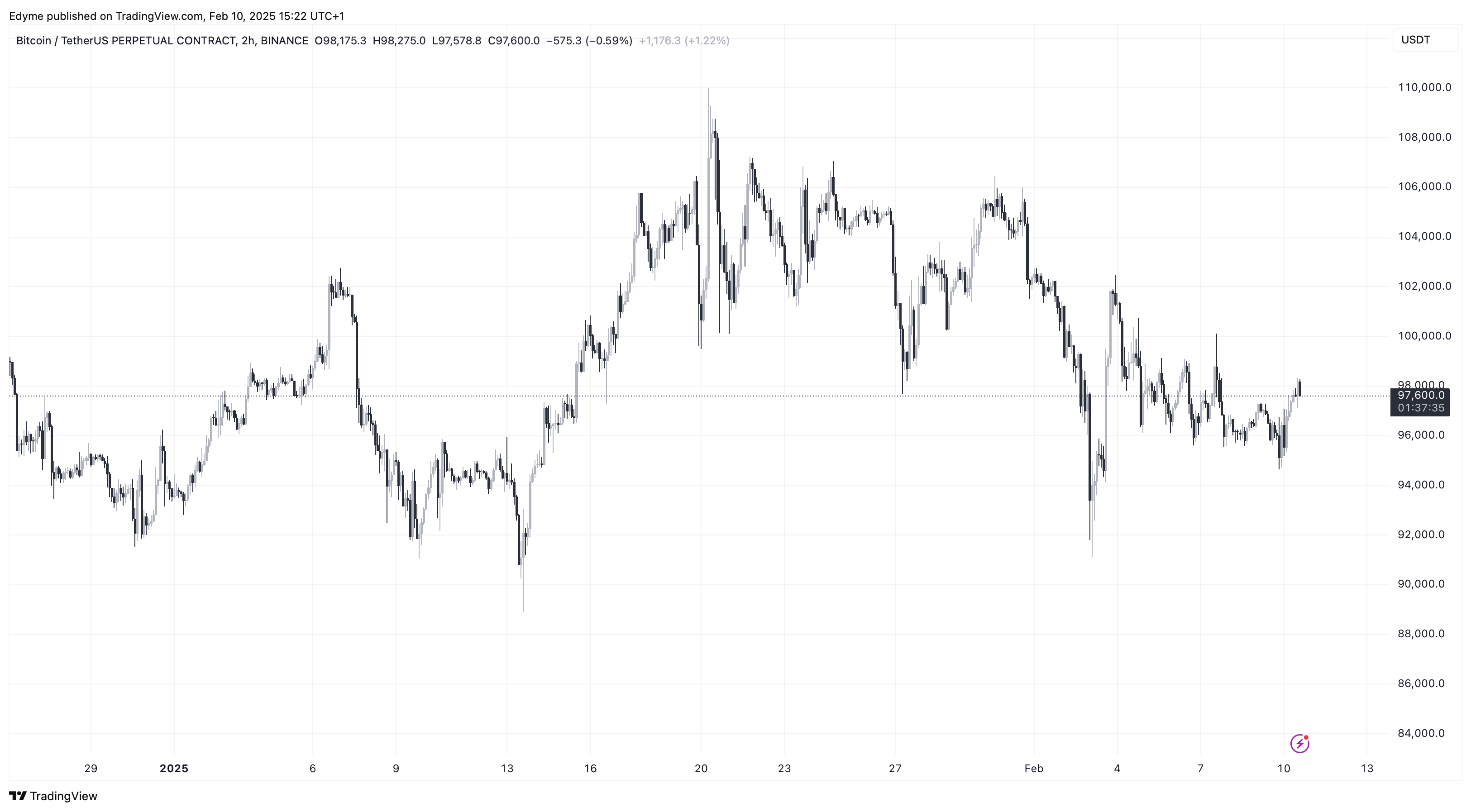

Bitcoin Price Recovers to $97,000 Amid Decrease in Leverage and Outflows

Bitcoin's price has rebounded from a low of $94,000, currently trading above $97,000 with a 1.3% gain in the last day.

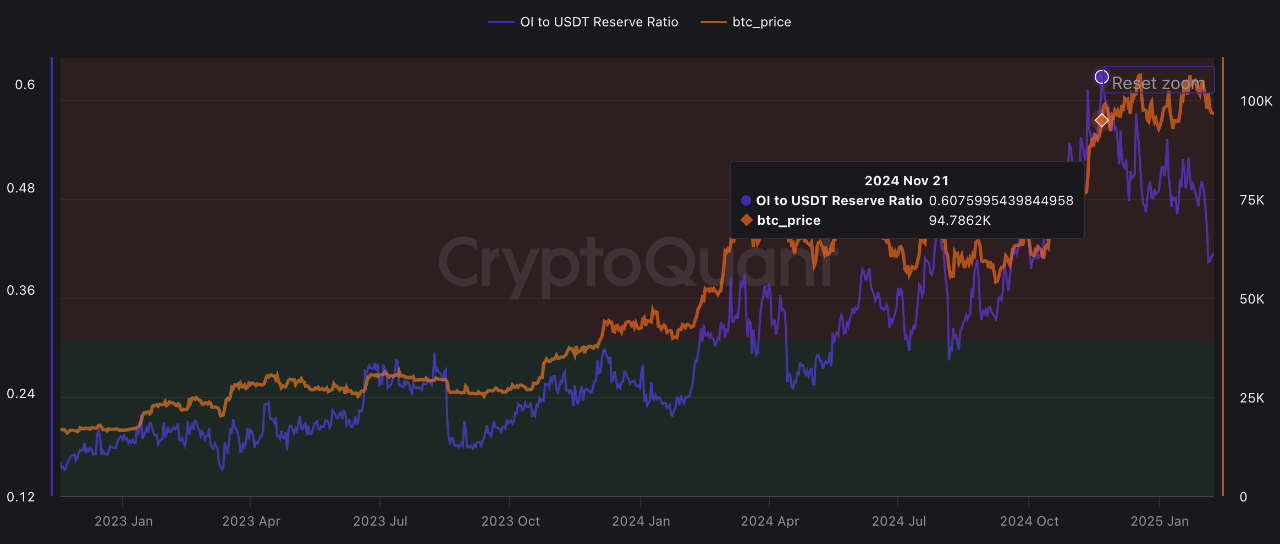

Leverage Ratio Decrease and Its Implications

- Analyst Crypto Lion noted a decline in Bitcoin's leverage and open interest (OI) ratios since November 21.

- This reflects a decrease in leverage as Bitcoin moves off centralized exchanges (CEXs).

- Much of this Bitcoin is now held on Coinbase Prime or backing ETFs, indicating long-term holding trends.

- Risk-off behavior among large investors appears to be increasing.

“The large decrease in the leverage ratio means that OI is decreasing relative to the CEX BTC reserve...”

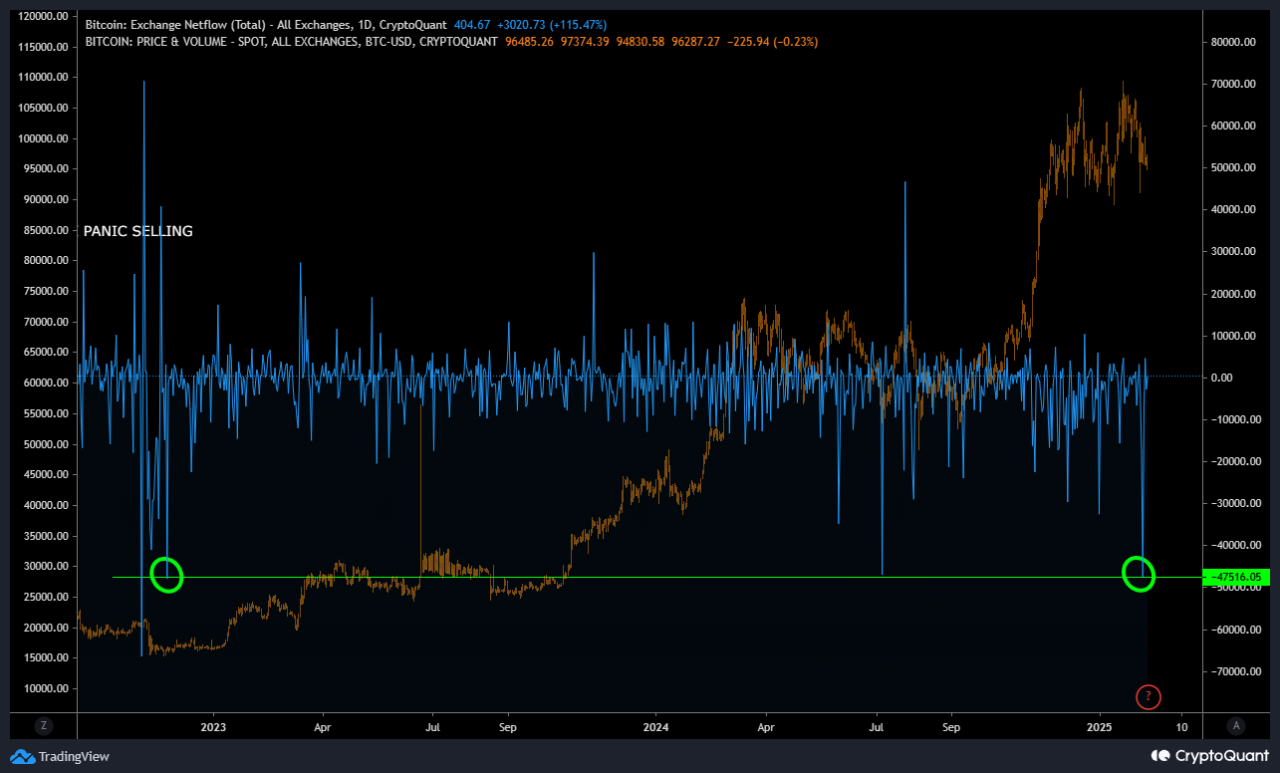

Bitcoin Exchange Outflows Reach 2022 Levels

- Analyst Papi reported the largest net outflow of Bitcoin from exchanges since 2022, dropping supply by 3%.

- This trend resembles the outflows seen post-FTX collapse, reflecting market sentiment shifts.

- Institutional players and long-term holders show growing confidence in Bitcoin.

- Large buyers are accumulating during dips, suggesting expectations of future price appreciation.

The movement of funds into private wallets points to a strategy favoring long-term holding over short-term trading, potentially supporting future market stability.

Overall, reduced leverage ratios and significant outflows from exchanges may indicate cautious optimism in the market, setting the stage for a sustained recovery in Bitcoin's price.