Bitcoin Price Faces Rejection at $100,000 but Bullish Forecast Remains

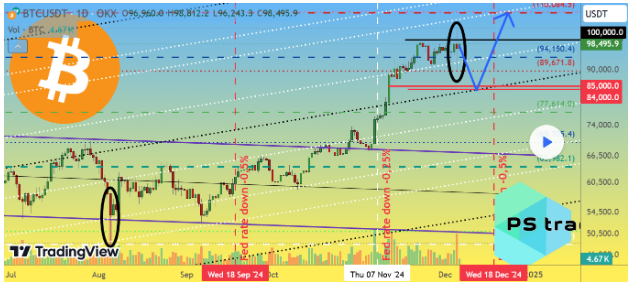

The Bitcoin price is experiencing challenges after surpassing the $100,000 threshold, correcting to around $94,000 shortly thereafter. This correction does not indicate a negative outlook, as investor sentiment remains in the extreme greed zone. Technical analysis suggests potential for Bitcoin to rise above $100,000 by December 2024.

Record Bitcoin Liquidations Shake The Market

Market dynamics suggest that Bitcoin's dip below $100,000 could be a temporary setback. A recent analysis on TradingView predicts significant future gains. December 5, 2024, marked a record day for cryptocurrency liquidations, totaling $1.1 billion, which included $820 million in long positions and $280 million in short positions. Price data indicates a low near $93,600, with some exchanges reporting dips to $89,000–$90,000.

Despite these fluctuations, analysts maintain that Bitcoin's upward trend is still viable, supported by the Fear and Greed Index remaining in the “greed” zone at 71, now at 82, indicating continued optimism among market participants.

Bold Year-End Price Prediction

The altcoin market has shown minimal reaction to Bitcoin's price movements, suggesting a potential decline before broader recovery. Analysts predict Bitcoin may drop below $90,000, possibly reaching the $84,000–$85,000 range before rebounding to $110,000. Anticipation surrounding the Federal Open Market Committee (FOMC) meeting on December 18, where a 0.25% rate cut is expected, could further boost Bitcoin’s recovery momentum.

Currently, Bitcoin trades at $99,450, nearing the $100,000 mark again. On-chain data reveals that Bitcoin whales have used the price decline to increase their holdings, with addresses holding between 100 and 1,000 BTC adding 20,000 BTC, valued at $2 billion, within 24 hours.

Featured image from Pixabay, chart from TradingView