Bitcoin Price Retests $67,000 Amid Predictions of $100,000 Target

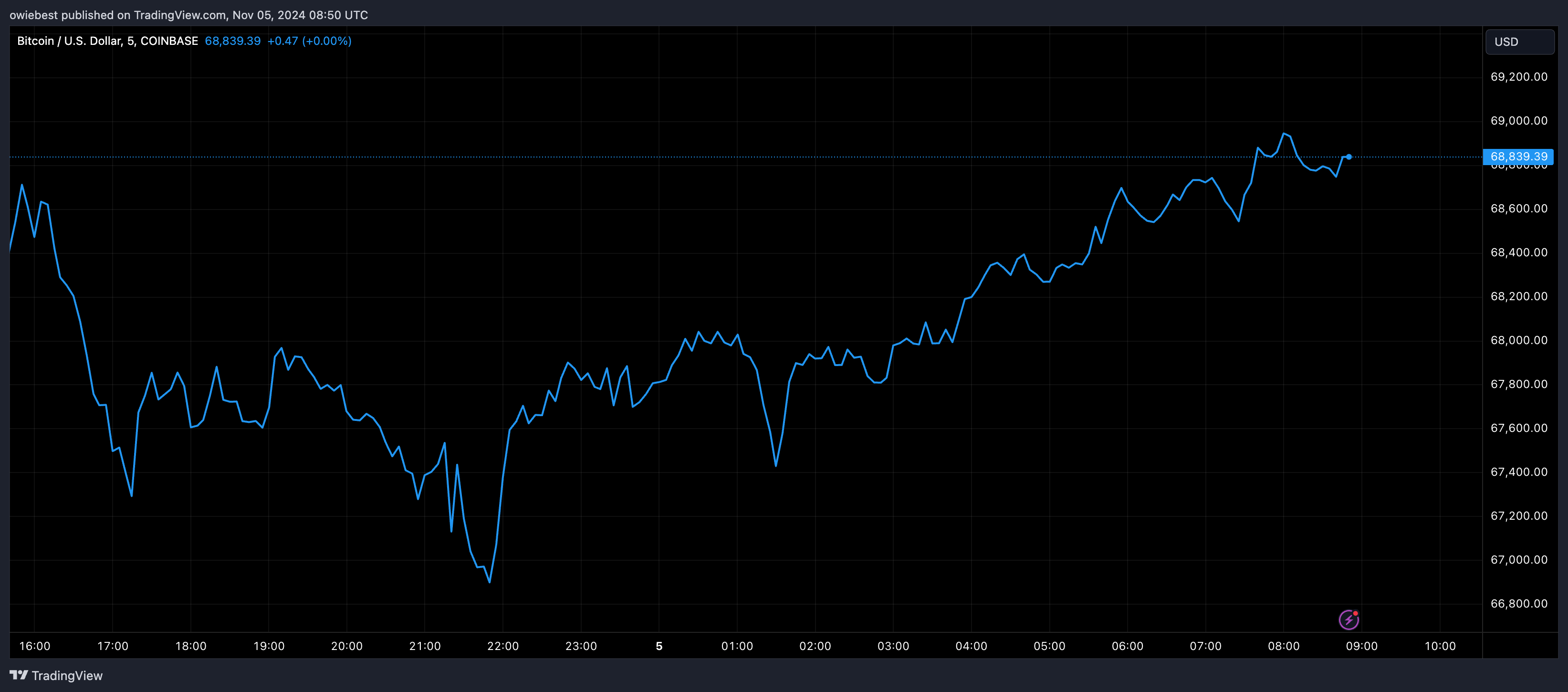

Bitcoin recently retested the $67,000 level, experiencing an 8.9% decline from $73,464 on October 29 to $66,895 on November 4, as short-term traders exited positions. Some long-term holders also sold Bitcoin to secure profits.

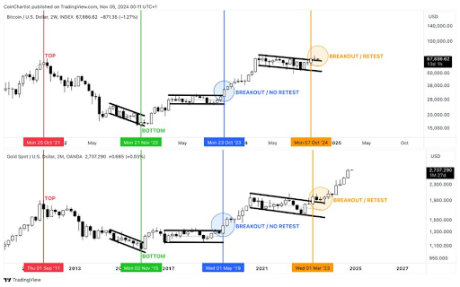

Technical analysis indicates that this correction is normal for Bitcoin, with a continued price target of $100,000 remaining plausible. This outlook draws parallels between Bitcoin's price movement and historical patterns observed in gold.

Analyst Insights on Gold's Influence on Bitcoin

Bitcoin is often referred to as digital gold due to its inflation-hedging properties. Analyst Tony Severino shared on social media that Bitcoin's price movements show similarities to gold's historical trends, including price tops, bottoms, breakouts, and retests.

Severino compared Bitcoin's two-week candlestick chart with gold's two-month candlestick chart, noting that Bitcoin has mirrored gold's price action in several instances. He specifically referenced a breakout/retest pattern in gold during March 2023 that preceded a significant rally, suggesting Bitcoin may follow a similar path.

Future Projections for Bitcoin Price

Severino predicts that Bitcoin's current correction will conclude soon, anticipating a notable increase for the remainder of the year. He forecasts a new all-time high by the end of 2024 and a potential price of $100,000 in the first quarter of 2025.

This projection aligns with other analyses, such as one from CryptoQuant analyst CoinLupin, who based his predictions on the Bitcoin MVRV (Market Value to Realized Value) ratio, estimating a price range of $95,000 to $120,000.

Currently, Bitcoin trades at $68,714, reflecting a 3% decrease in the past 24 hours.