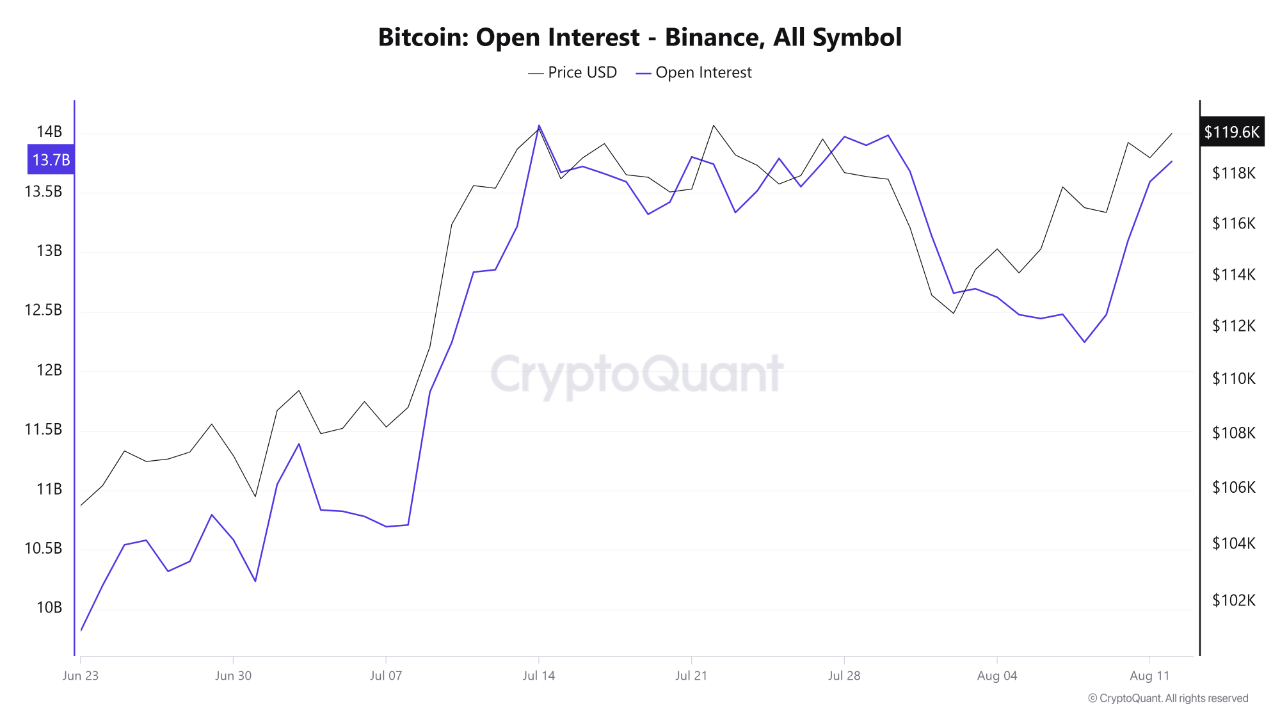

Bitcoin Price Rises Nearly 6% with Open Interest Approaching $14 Billion

Bitcoin has risen nearly 6% over the past week and 1.8% in the last 24 hours, currently trading at $120,499. This price is near a significant resistance zone between $119,000 and $120,000.

Key points include:

- Traders are closely monitoring the $119,000-$120,000 range due to its importance in previous price movements.

- Open interest on Binance has increased to approximately $13.7 billion, nearing mid-to-late July highs.

- A rise in both price and open interest indicates new speculative liquidity, often from long positions.

- This situation can lead to short-term price increases but may also create vulnerability to corrections if open interest grows faster than price.

A breakout above $120,000 with stable or declining open interest may suggest a move driven by spot buying, potentially targeting the $122,000-$124,000 range. Conversely, a rejection with high open interest could lead to declines toward support levels.

Current open interest is just below an all-time high of about $14 billion, indicating limited capacity for additional leveraged positions. A simultaneous decline in price and open interest from late July to early August suggests capital exit, but recent recoveries indicate renewed confidence among traders.

Monitoring open interest trends is crucial; stability or gains above $120,000 with steady or declining open interest would signal healthier market conditions. The sustainability of Bitcoin's current bullish trend will depend on whether leverage levels stabilize as it tests resistance.

Traders will focus on BTC's performance around the $120,000 mark, with open interest dynamics providing key signals for future price movements.