2 0

Bitcoin Price Rises to $85,215 as Short-Term Holders Reduce Selling Pressure

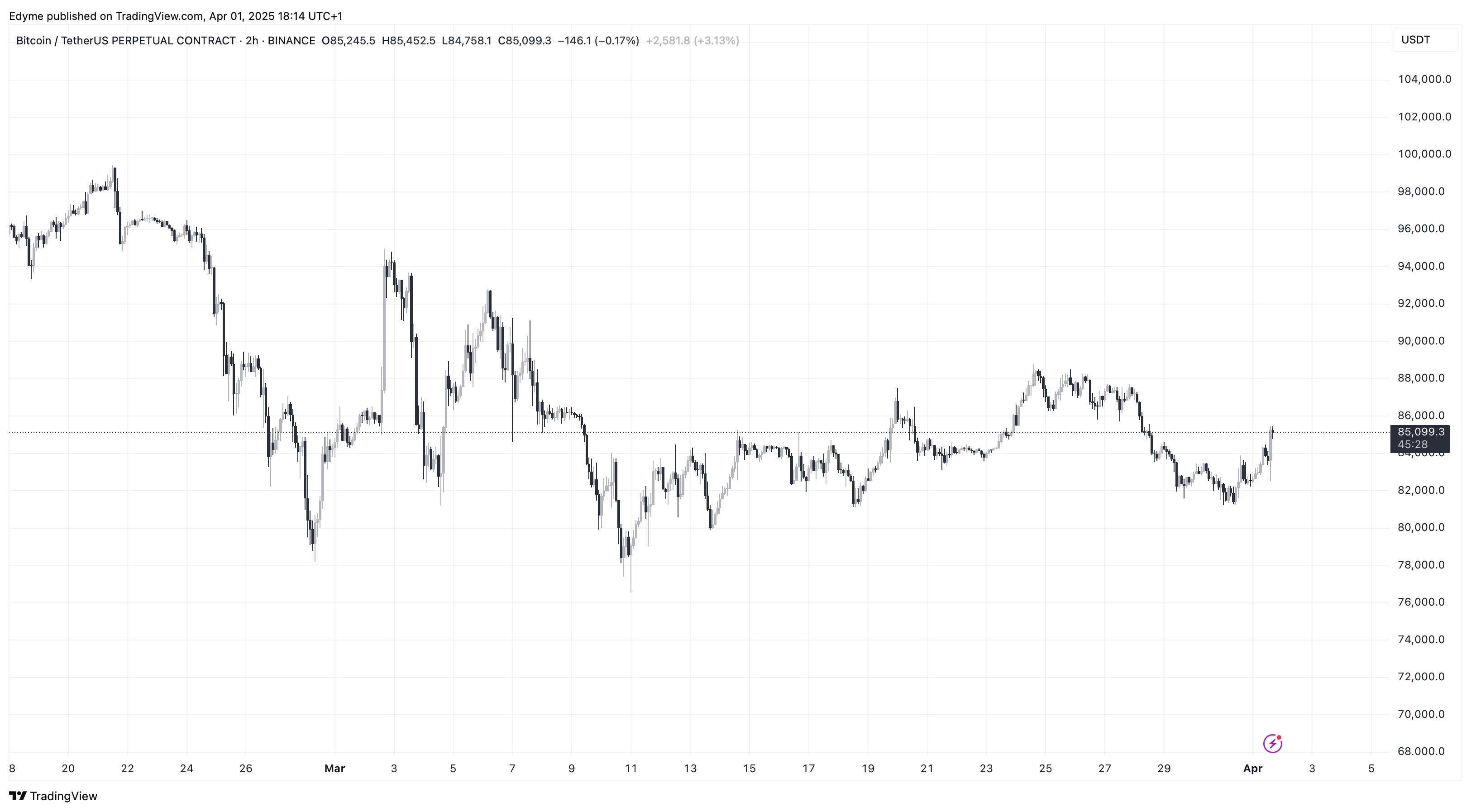

Bitcoin is currently trading at $85,215, reflecting a 2.2% increase in one day but remains down 21.2% from its all-time high of $109,000 in January. The asset continues to experience broader downward trends.

Short-Term Holders’ Behavior

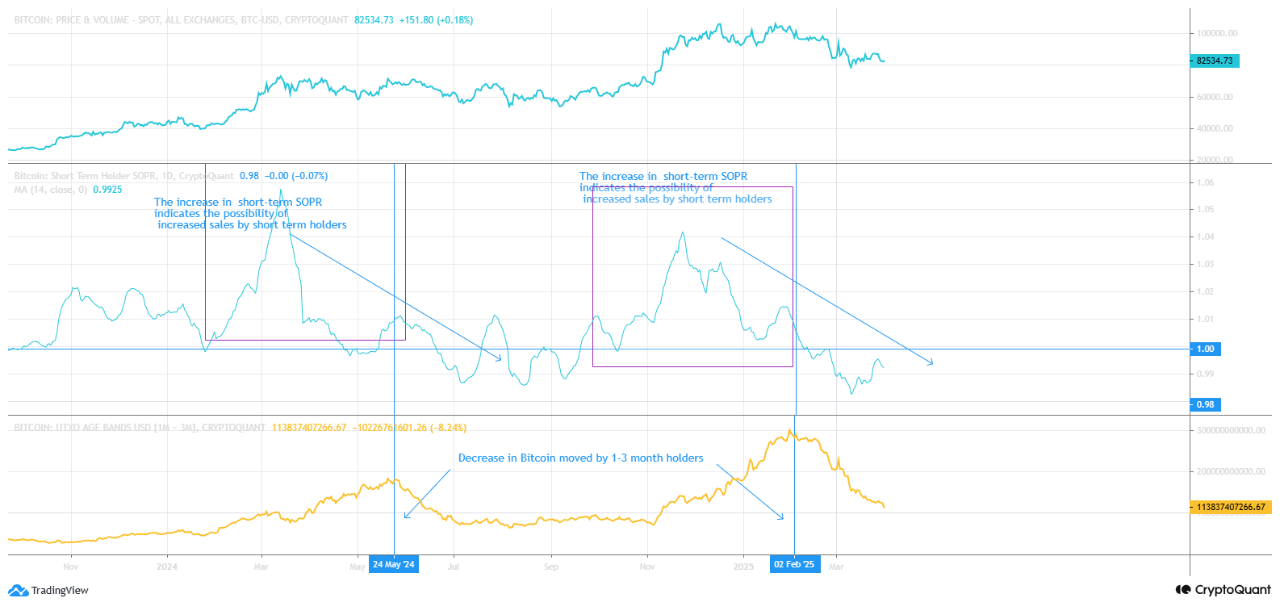

- Data from CryptoQuant indicates changes in short-term holders' behavior, which may influence market dynamics.

- Short-term holders (one to three months) are showing reduced panic selling compared to previous cycles.

- Realized losses among these holders are low relative to unrealized losses, suggesting they prefer to hold rather than sell.

- 28% of Bitcoin's circulating supply is held by short-term holders; if they shift to long-term holding, it could drive prices above $150,000.

Decreasing Selling Pressure

- Analyst CryptoOnchain reports a decrease in selling pressure from short-term holders, supported by the Short-Term SOPR chart and UTXO Age Band data.

- This trend indicates that short-term investors are less active in the market after taking profits.

- If this pattern continues, Bitcoin might achieve more stability or witness a price rebound.

The ongoing observation of short-term holders will be crucial as Bitcoin approaches a pivotal phase for potential sentiment shifts.