8 1

Bitcoin Price Struggles at $95,000 Amid Kalshi’s Bearish Outlook

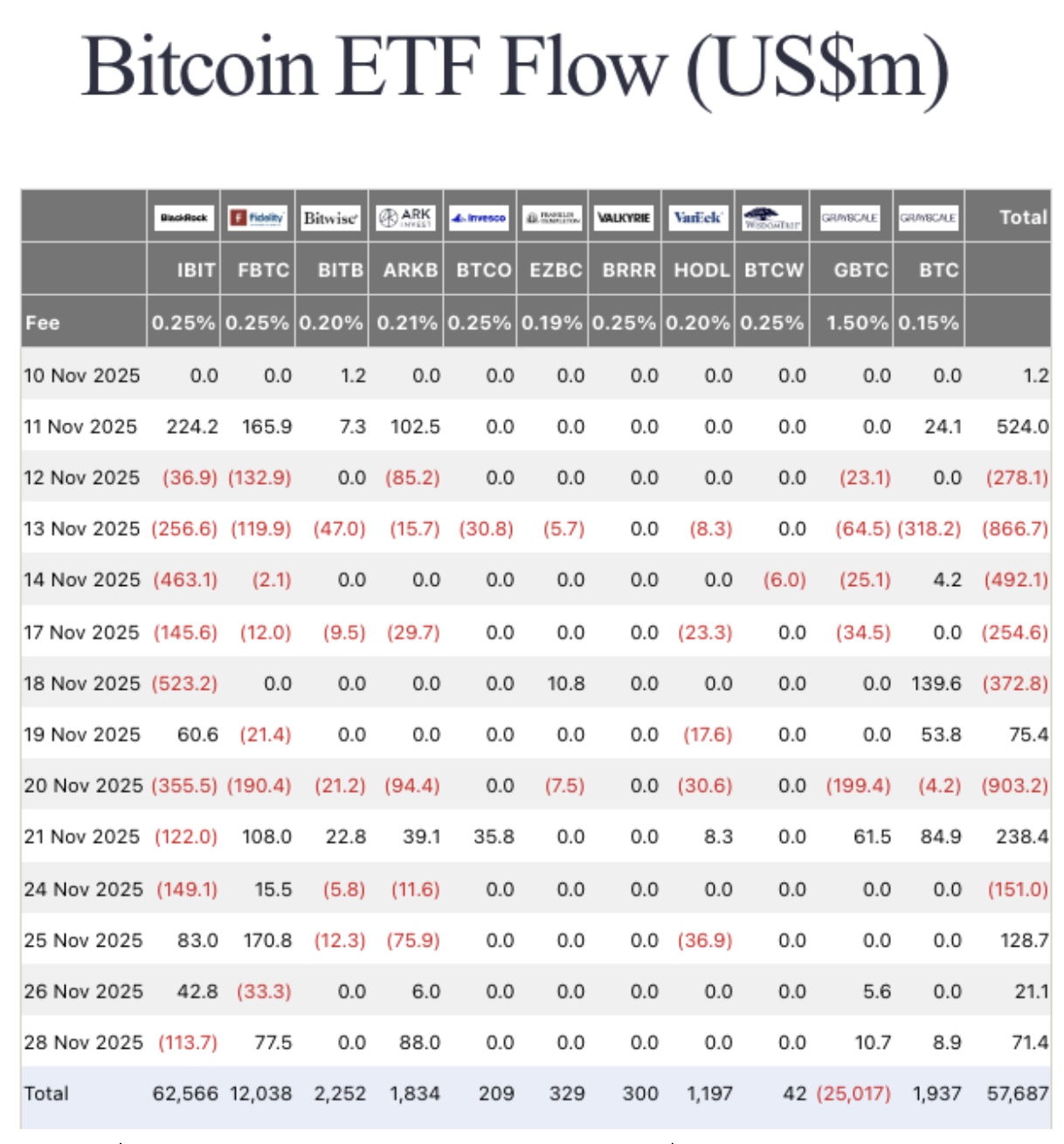

Bitcoin's price saw a 17% rise, moving from $82,000 on November 21 to nearly $93,000 on November 28. Bitcoin ETFs reported net inflows of $221 million between November 25 and November 28. However, BTC faced resistance at the $95,000 level.

- BlackRock experienced significant outflows of $117 million, influencing global institutional investor sentiment.

- Strategy Inc. halted Bitcoin purchases after a 14-week streak, last acquiring 8,178 BTC on November 17.

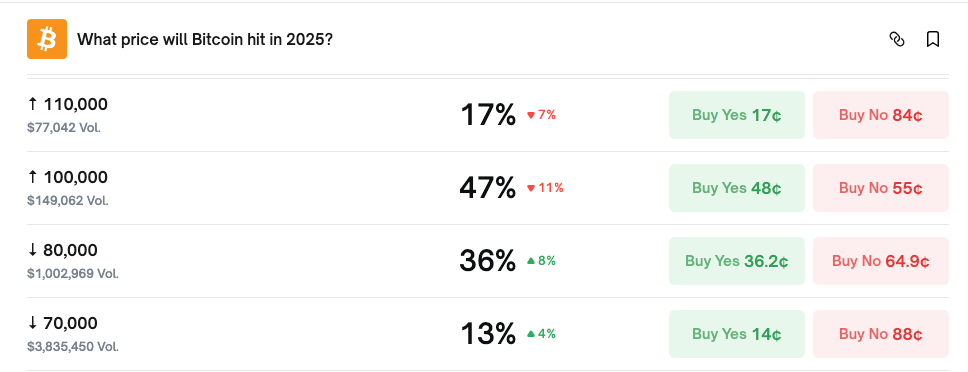

- Prediction markets show reduced confidence in Bitcoin reaching $100,000 by 2025, with odds falling by 11% on November 29.

- The likelihood of Bitcoin closing below $80,000 by the end of 2025 rose to 36%.

Analysis and Forecast

- Bitcoin's rebound from $82,705 is encountering resistance at $92,971.

- Technical indicators like MACD and Woodies CCI suggest early bullish momentum.

- A daily close above $95,000 could signal a bullish trend towards $100,000.

- If Bitcoin fails to maintain support at $90,000, it risks a decline to around $85,880.