Bitcoin Price Could Surge to $138,000 Before 30% Correction

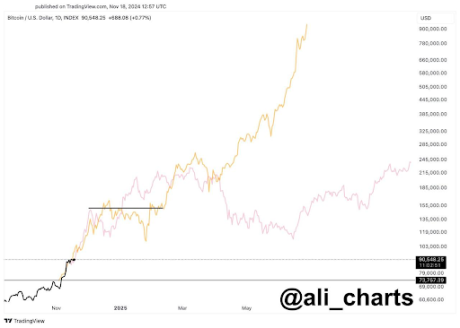

Crypto analyst Ali Martinez has projected that Bitcoin's price could reach $138,000 followed by a 30% decline in the coming weeks.

Potential Price Movement to $138,000 and Subsequent Crash

Martinez referenced historical trends, noting that during the 2017 bull market, Bitcoin rose 156% above its previous all-time high (ATH) before a major correction of 39%. Similarly, in the 2020 bull run, Bitcoin increased by 124% before a 32% correction.

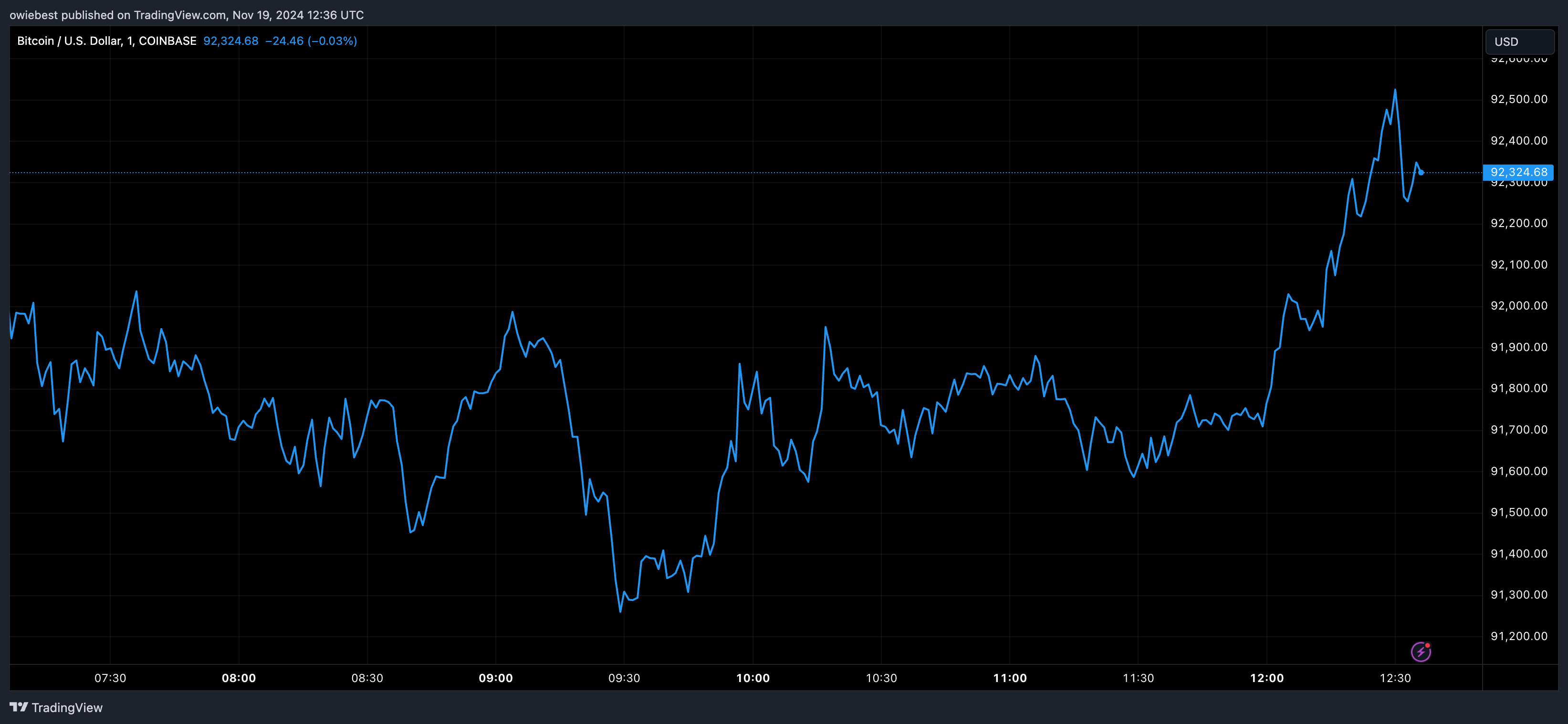

If past patterns hold, Bitcoin may reach at least $138,000 before experiencing a significant pullback. Following recent gains after Donald Trump's presidential election win, Martinez identified conditions necessary for Bitcoin to exceed $100,000, specifically a sustained daily close above $91,900 to eliminate current bearish sentiment and target $100,680. He cautioned that a peak greed index might indicate overleveraging among investors, increasing the likelihood of a sharp price drop.

Martinez updated his forecast, suggesting that Bitcoin could surpass $100,000 before a notable correction, raising his target to $150,000 for an imminent breakout within days.

Doubling Potential Within Three Weeks

Analyst Kevin Capital predicted that Bitcoin could double in value within three weeks. Historically, following a break above its previous ATH, Bitcoin typically enters a price discovery phase, doubling its price within four to six weeks. Currently, Bitcoin is approximately 45% to 50% away from doubling its previous ATH of $73,000 and is in week three of this price discovery phase.

Capital emphasized that if Bitcoin does not achieve this rally within the specified timeframe, it would be underperforming compared to previous bull markets. Notably, this cycle marks the first instance where Bitcoin reached a new ATH prior to the halving event earlier this year.

As of now, Bitcoin trades around $91,900, reflecting an increase over the last 24 hours based on CoinMarketCap data.