Bitcoin Price Surges Above $100,000 Amid Early 2025 Market Recovery

Bitcoin's (BTC) price has returned to six-digit territory, surpassing $100,000 during Monday's trading session. It rose 2.5% in one hour as U.S. markets opened, reaching approximately $102,000, marking a 4.3% increase over the past 24 hours and its highest level since December 19.

The CoinDesk 20 index increased by 3.5%, with all twenty major cryptocurrencies showing positive returns. Ethereum's ether (ETH) rose 2.8% to $3,700, while Solana's SOL advanced 4.5% above $220.

Market Dynamics

Bitcoin and the broader crypto market ended 2024 with a correction after significant gains following Donald Trump's election victory. BTC reached a local bottom of approximately $91,000 on December 30, a nearly 15% decline from record highs, influenced by profit-taking and reduced trading volumes during the holiday period.

Demand Returns Amid Low Leverage

As traders returned post-holidays, corporate BTC purchases resumed. MicroStrategy announced it bought another 1,020 BTC, and KULR Technology Group added $21 million worth of BTC to its holdings, doubling their treasury position.

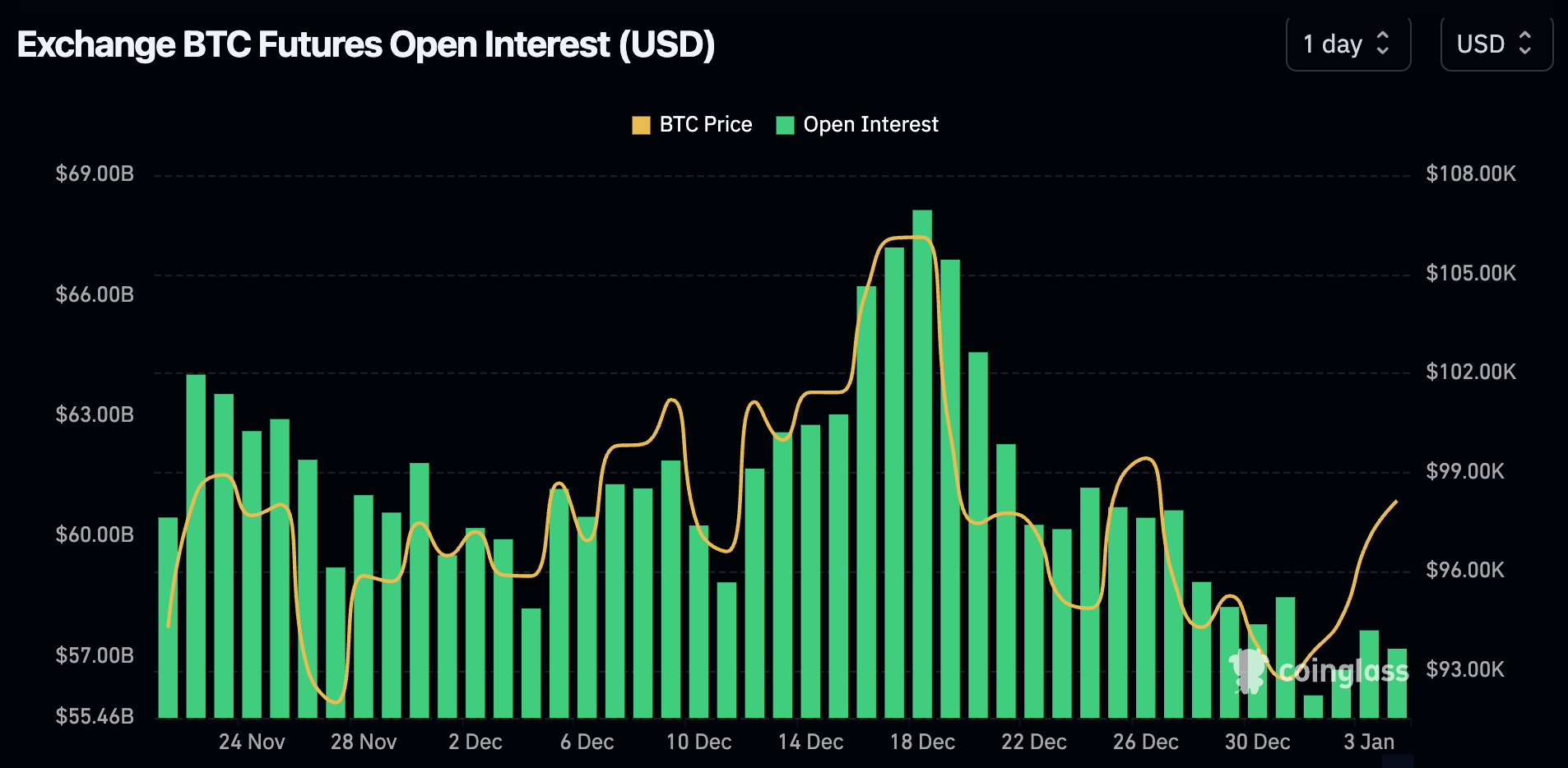

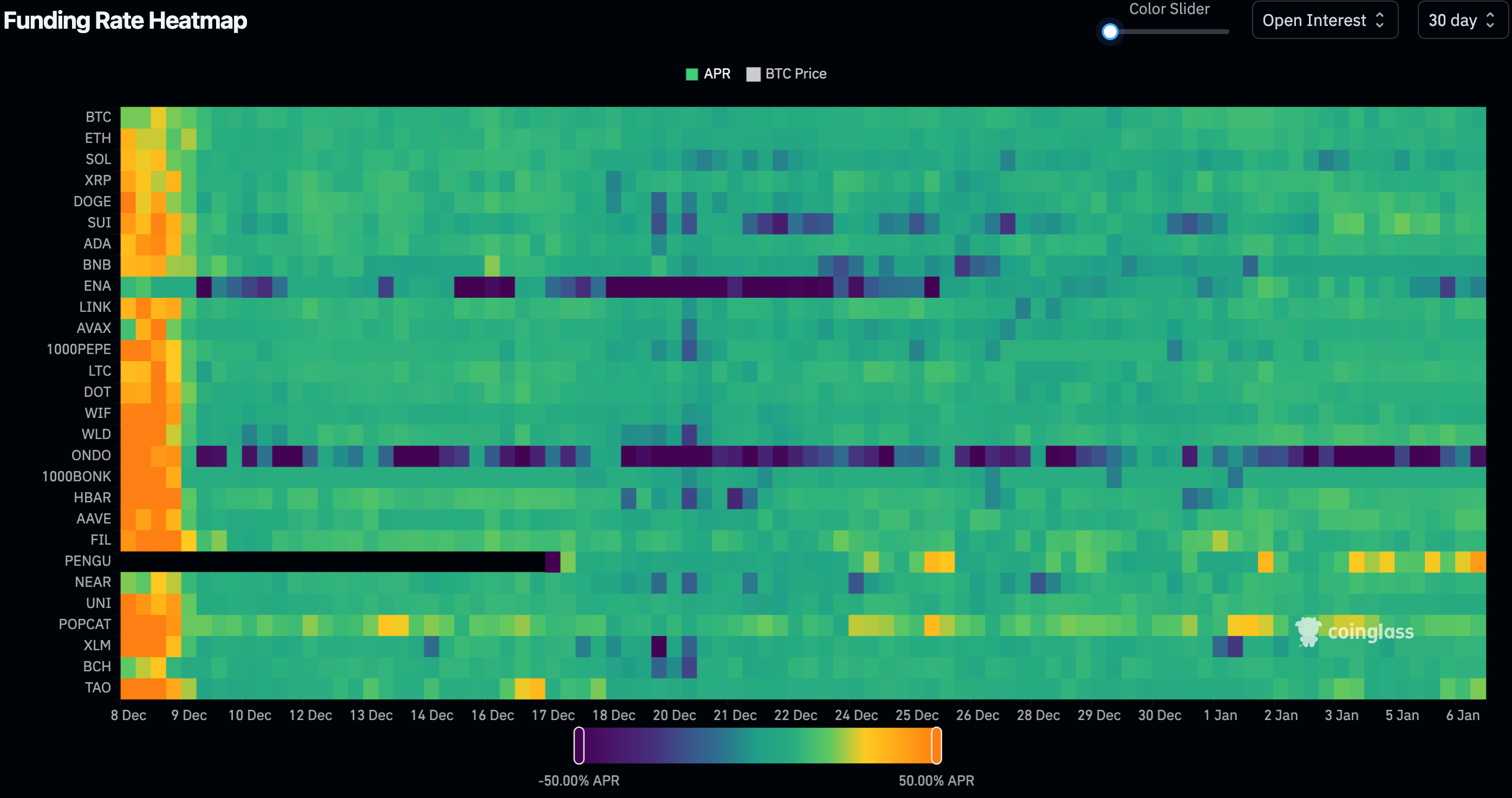

Spot BTC ETFs experienced $908 million in inflows on Friday, reflecting renewed demand. Open interest in BTC futures remains significantly lower than mid-December levels, indicating that the recent price increases were mainly due to spot buying rather than leverage, according to analyst James Van Straten from CoinDesk. Funding rates are neutral, suggesting stability during the rally.

Federal Reserve Risks

Paul Howard from crypto trading firm Wincent noted that institutional behavior around year-end and holidays influences price action and demand. He cautioned against reading too much into Bitcoin exceeding $100,000, anticipating increased volatility in the coming weeks.

10x Research projected a rebound in crypto prices in January leading up to President-elect Trump's inauguration but warned of potential sell-offs ahead of the Federal Reserve's meeting. Hawkish remarks from Fed Chair Jerome Powell in December initiated a pullback for risk assets. Markus Thielen from 10x Research stated that while lower inflation is anticipated this year, it may take time for the Fed to adjust its stance.

Thielen emphasized that although some enthusiasm is expected at the year's start, it does not equate to the bullishness seen in previous months.