Bitcoin Price Surges 2.45% Ahead of FOMC Meeting on January 29

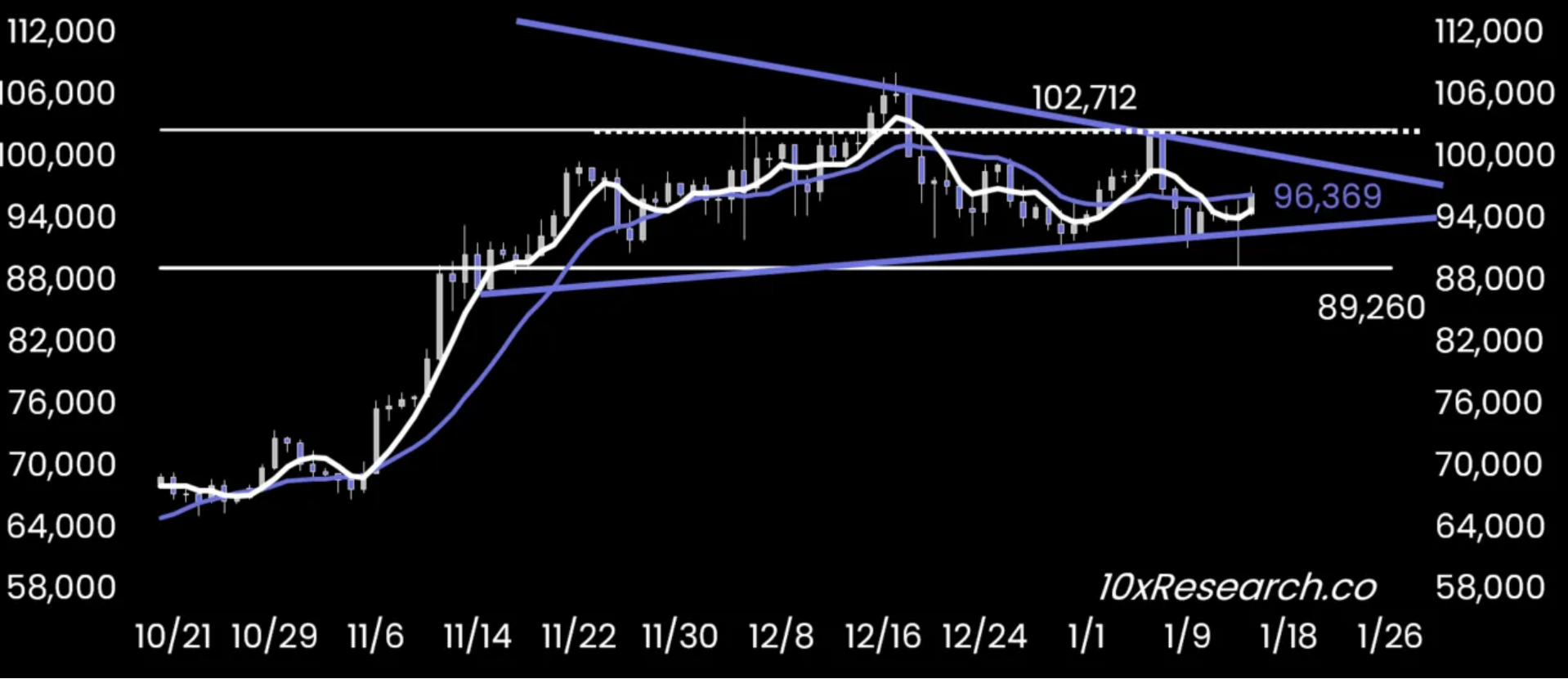

In the past 24 hours, Bitcoin has increased by 2.45%, surpassing $97,300. Markus Thielen from 10x Research indicates a potential breakout is likely before the Federal Open Market Committee (FOMC) meeting on January 29. He stated:

“Bitcoin trades within a narrowing triangle, signaling a breakout is imminent — likely no later than the January 29 FOMC meeting.”

-

Source: 10x Research

Thielen advises traders to follow the upcoming breakout direction. Key factors influencing Bitcoin's price include the Consumer Price Index (CPI) data release today and expectations of inflation rates. A lower-than-expected CPI could trigger a price rally.

The FOMC will announce its first interest rate decision for 2025 following strong jobs data that has postponed Fed rate cuts to June. According to the CME FedWatch Tool, there is a 38.3% chance the Fed will not cut rates in the first half of 2025.

Market Outlook Ahead of Trump's Inauguration

As Donald Trump's inauguration approaches on January 20, analysts express caution regarding Bitcoin's struggle at the $100K mark. Thielen predicts Bitcoin may remain range-bound until mid-March due to weak market drivers:

“Due to weak market drivers, Bitcoin will likely remain range-bound until mid-March.”

Crypto analyst Lark Davis observed that current price movements resemble those during past presidential transitions, noting a historical dip before Biden's inauguration in 2021 followed by a rally.