Bitcoin Price Surges Above $71,000 Driven by ETF Inflows and Market Activity

The Bitcoin price has surpassed $71,000 today, increasing over 8.5% in the past five days from $65,600 to a peak of $71,118 on October 29. In the last 24 hours, BTC rose by 3.8%. Key factors contributing to this upward trend include:

#1 Bitcoin ETFs Attract Massive Inflows

Bitcoin's price increase correlates with significant inflows into Bitcoin Exchange-Traded Funds (ETFs), totaling $479.4 million yesterday. BlackRock led with $315.2 million, followed by Fidelity at $44.1 million, Ark with $59.8 million, and Bitwise at $38.7 million. This investment coincided with Bitcoin’s rise from $68,000 to over $71,000.

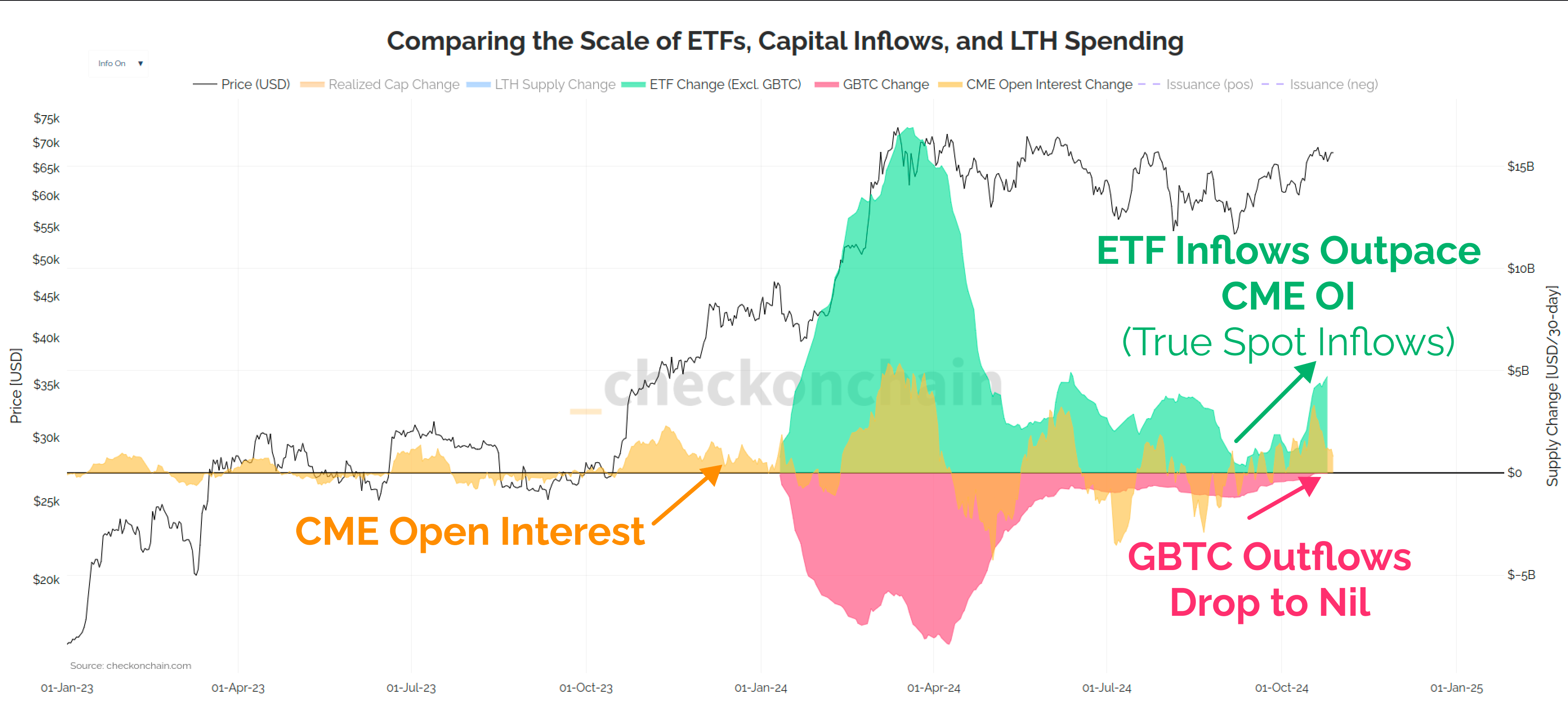

On-chain analyst James "Checkmate" Check noted a divergence between ETF inflows and CME Open Interest, indicating a preference for direct Bitcoin exposure through ETFs rather than cash and carry trades involving futures contracts.

This shift indicates bullish sentiment among investors anticipating further price increases.

#2 The “Trump Trade”

Political events are also impacting Bitcoin's rally. QCP Capital highlighted former President Donald Trump’s recent interview on the Joe Rogan Experience podcast, which has influenced Bitcoin's correlation with Trump's potential election victory. Despite an 8% increase this October, it is less than the average 21% seen in previous years, suggesting that if current levels hold, it could mark Bitcoin's fourth-worst October performance in a decade.

Total perpetual futures open interest across exchanges stands at $27 billion, and a breakout above $70,000 could lead to new all-time highs.

#3 Shorts Squeeze Amplifies Price Surge

A significant shorts squeeze has also fueled Bitcoin's price surge. In the last 24 hours, 65,622 traders were liquidated, resulting in total liquidations of $228.51 million across the crypto market, with $169.47 million from short positions. For Bitcoin specifically, $83.61 million in shorts were liquidated, with the largest order valued at $18 million on Binance.

This liquidation reflects traders' forced exits as prices increased, accelerating upward momentum as they buy back into the market.

#4 Whales Increase Buying Activity

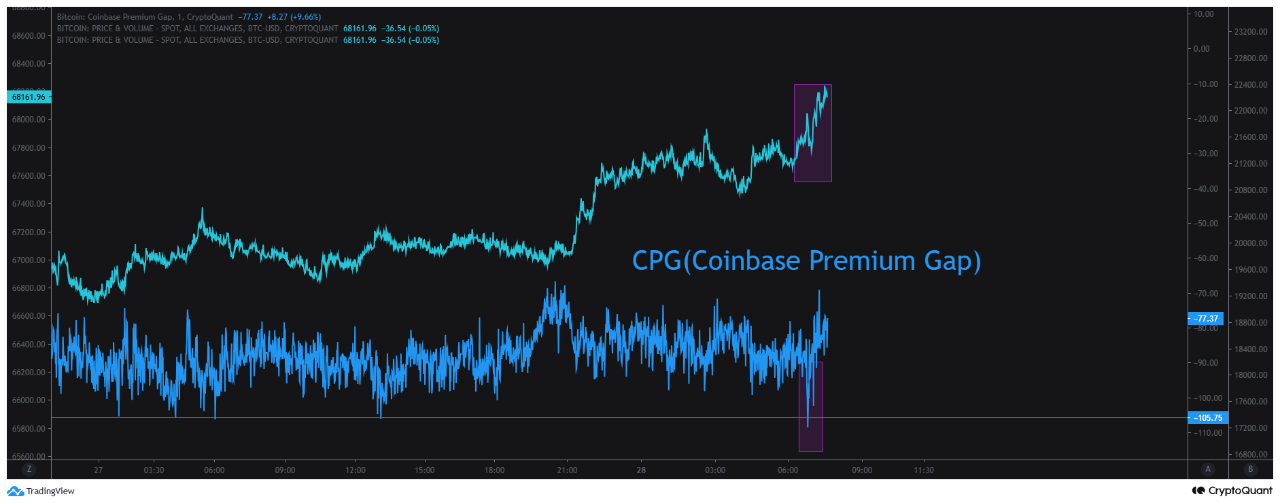

Large-scale investors, or "whales," are significantly influencing the current rally. CryptoQuant analyst Mignolet reported increased involvement from Binance whales, particularly during Asian trading hours. The decline in the Coinbase Premium Gap (CPG) alongside rising prices indicates strong buying pressure from Binance, despite no decrease in US demand.

Over two weeks, demand for US Bitcoin spot ETFs surged, with net inflows of approximately 47,000 Bitcoin. Mignolet concluded that the current Bitcoin price is driven by Binance whales with sustained US capital inflows.

At press time, BTC traded at $71,340.