Bitcoin Price Movements Linked to Upcoming US Election

Harry Potter entered the Wizarding World by running into a brick wall at Platform 9¾. A similar moment is approaching for bitcoin.

Upcoming events include:

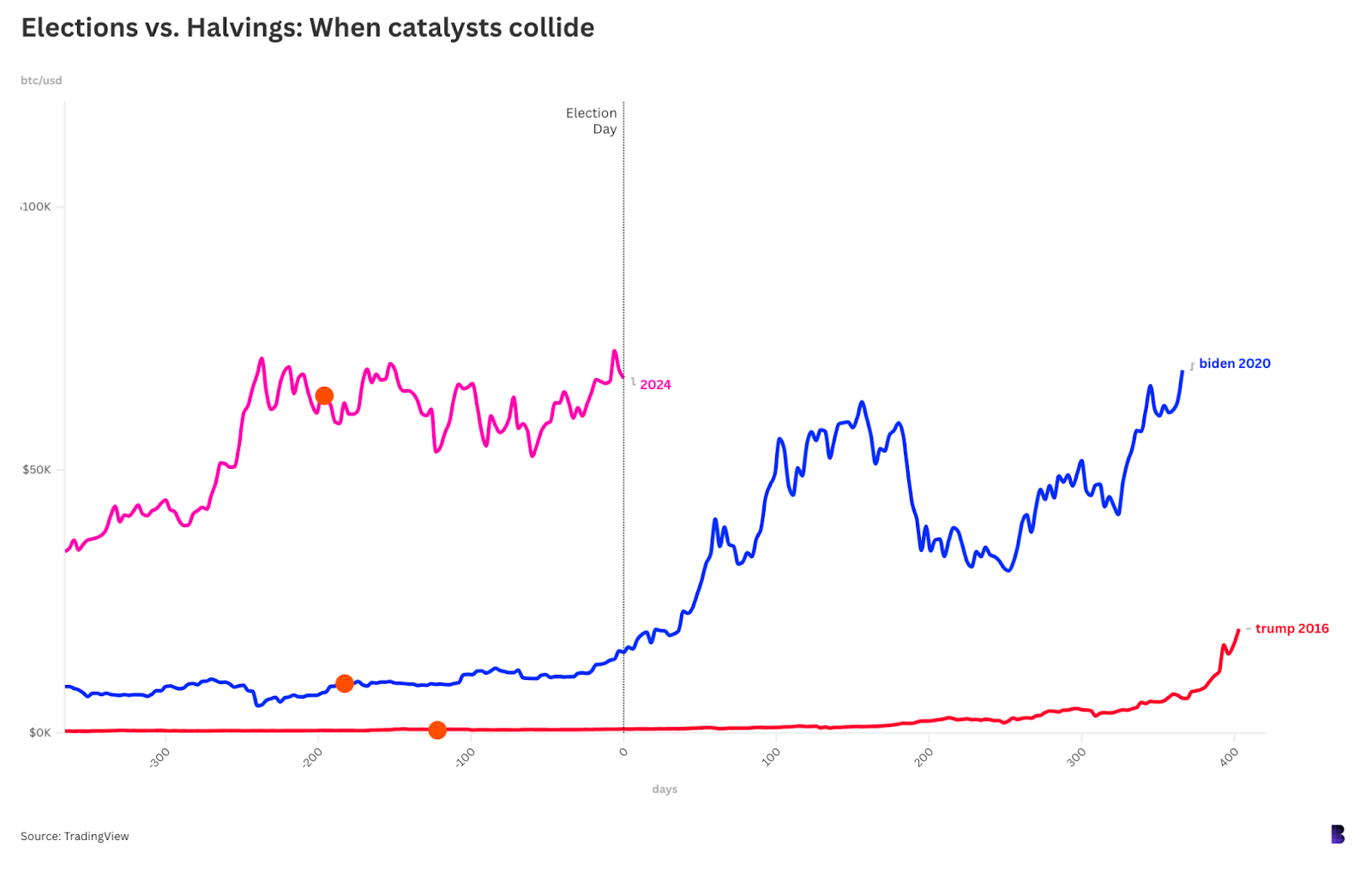

- The Bitcoin halving: The network reduced its issuance by half nearly 200 days ago, with cycle-maxis predicting a supply shock one year later.

- US election: Scheduled six to eight months after the halving; previous elections have led to significant bitcoin price increases.

Bitcoin's price rose from $720 to nearly $20,000 in about 400 days post-2016 election, a 27x increase. Following Biden’s win in 2020, it increased from $16,300 to $69,000, or 4.2x.

Critics note that only two or three halving-election cycles provide insufficient statistical significance. These price movements may reflect broader price discovery rather than specific events like elections or halvings, which could be less influential compared to global liquidity trends.

Currently, Trump’s odds on Polymarket are viewed as an immediate factor influencing bitcoin's price.

The chart correlates bitcoin's price (green area) with Trump's odds (orange line), highlighting periods of alignment, though they only coincide about half the time. Since early October, their correlation has been closer.

Bitcoin has reached an all-time high before this halving, marking an unusual deviation from established patterns.