Bitcoin Price Volatility Continues Amid Strong ETF Demand

Bitcoin's price has fluctuated between its recent all-time high of $93,483 and a low of $85,100, indicating a potential consolidation phase. Traders are monitoring whether BTC will stabilize or continue to rise.

Data from CryptoQuant indicates possible increased selling pressure from speculative traders seeking quick profits. However, this may not impede Bitcoin's bullish momentum due to rising demand for Bitcoin ETFs among institutional investors.

The balance between short-term selling and institutional accumulation may influence Bitcoin’s next movement. Volatility is expected in the coming days, prompting market participants to look for signals indicating BTC's price direction. This phase could either lead to a deeper correction or push Bitcoin toward new highs.

Bitcoin Demand Supports Bullish Price Action

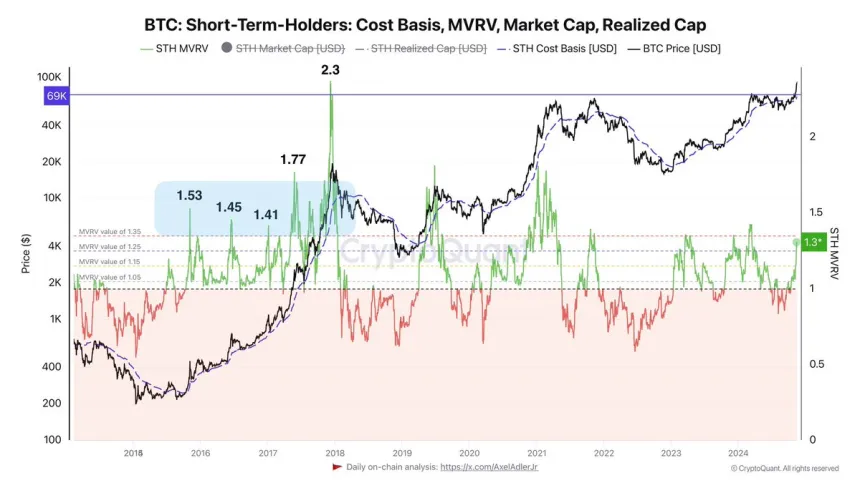

Bitcoin's price has surged by 38% over the past ten days, highlighting strong demand. According to CryptoQuant analyst Axel Adler, Bitcoin trades above its short-term holder cost basis of $69,000, which serves as a support level for recent buyers.

The MVRV (Market Value to Realized Value) ratio is currently at 1.3, indicating profitability for holders. Should this ratio exceed 1.35, it may trigger selling from short-term speculators. However, this anticipated volatility is expected to be mitigated by growing institutional demand through Bitcoin ETFs.

The recent price increase appears driven by strong spot demand rather than speculative futures trading, suggesting a more stable price move. As Bitcoin remains above key support levels, the outlook remains bullish, supported by both speculative trading and long-term institutional interest.

BTC Technical View: Prices To Watch

Bitcoin is currently trading at $89,240, down 7% from its all-time high. This consolidation allows the market to stabilize and test key support levels before determining future movements.

The $85,000 mark is a crucial support level. Holding above this could lead to another surge, potentially challenging the $90,000 resistance and retesting the all-time high. A successful reclaim of $90,000 would indicate renewed bullish momentum.

Conversely, failing to maintain the $85,000 support could result in a deeper correction, with $82,000 becoming a significant area for buyer interest. Market participants will closely observe price action for indications of either a breakout or pullback, impacting Bitcoin’s short-term trajectory.

Featured image from Dall-E, chart from TradingView