Bitcoin Average Profitability Index Reaches 221% Amid Price Surge

On-chain data indicates that Bitcoin investors currently hold an average profit of 121%. This analysis explores whether this level of profitability signals a market peak.

Bitcoin Profitability Index Is Currently Sitting Around 221%

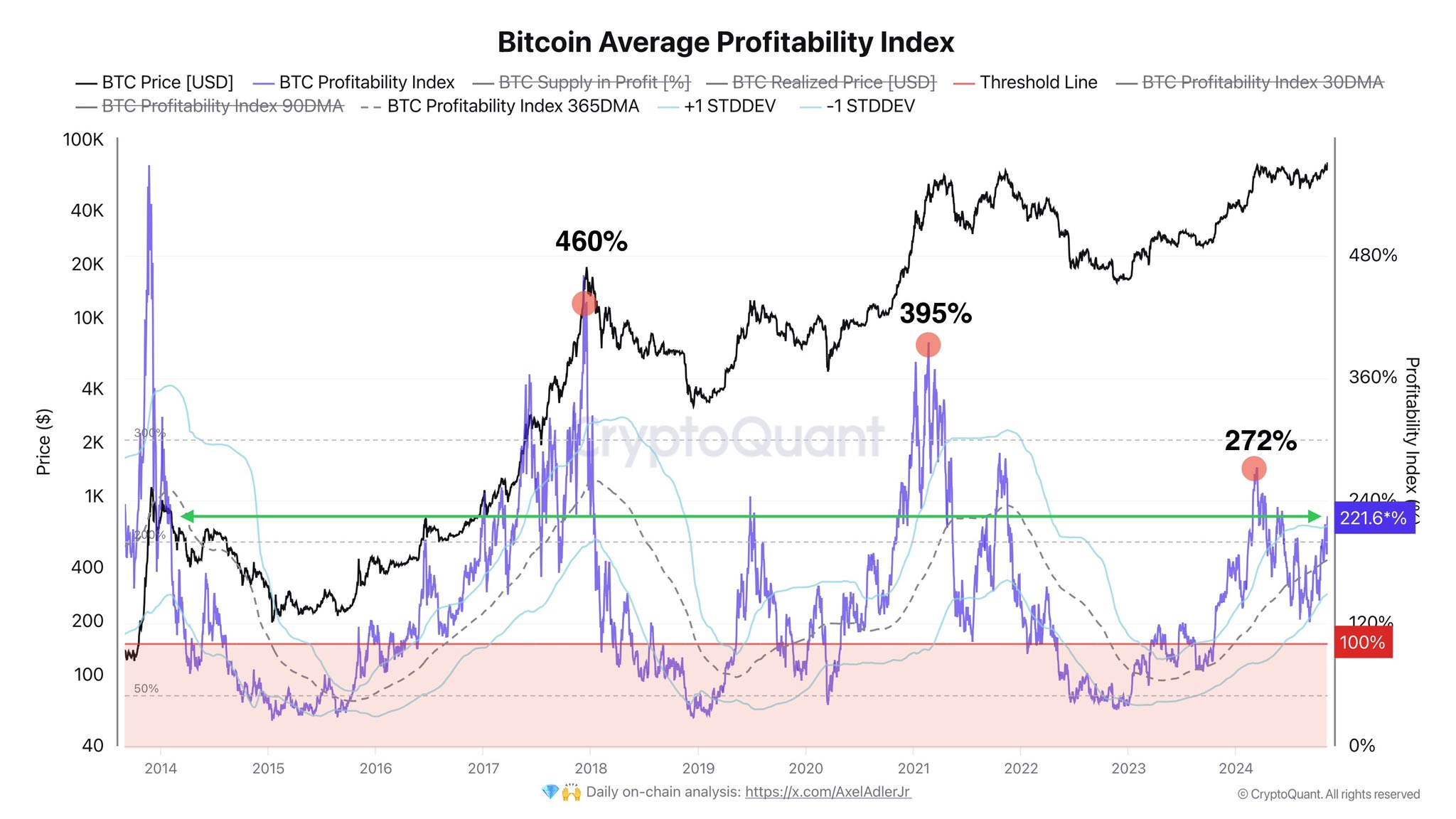

CryptoQuant author Axel Adler Jr highlighted the Bitcoin Average Profitability Index in a recent post. The "Average Profitability Index" measures the difference between Bitcoin's spot price and its realized price.

The "realized price" reflects the cost basis of the average Bitcoin investor, calculated using on-chain data based on the last transaction price of each coin. An index above 100% indicates that the cryptocurrency's spot price exceeds its realized price, meaning investors are generally profiting. Conversely, an index below 100% suggests a net unrealized loss, while a value of exactly 100% signifies breakeven for holders.

Below is a chart illustrating the Bitcoin Average Profitability Index over the past decade:

The graph shows a significant increase in the Average Profitability Index as Bitcoin approaches a new all-time high (ATH). The current index stands at approximately 221%, indicating substantial gains for investors.

As profitability rises, the likelihood of profit-taking increases; however, it remains uncertain if this level is sufficient to trigger widespread selloffs. Historical peaks show that in 2017, the index reached 460%, and in 2021, it peaked at 395%. The current cycle's highest index value was 272% in March, suggesting potential for further upward movement before a top is likely.

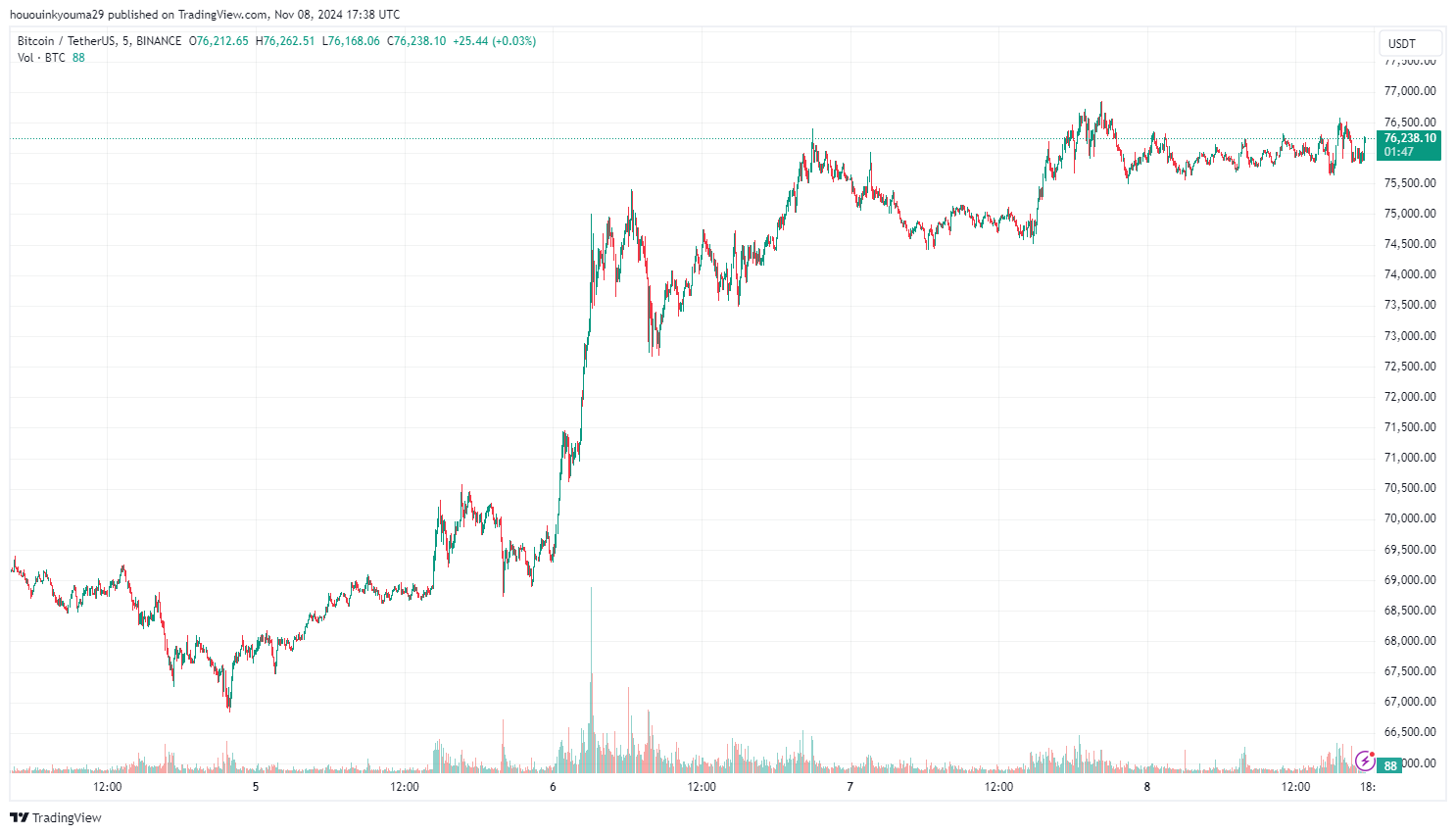

BTC Price

Currently, Bitcoin trades around $76,200, reflecting an increase of over 9% in the past week.