5 2

– Bitcoin trading range-bound between $109,000 and $124,000 – Potential Fed leadership change eyed as bullish driver for Bitcoin – Dovish Fed chair could weaken dollar, boost crypto investments – Analysts note early signs of stabilization in Bitcoin market – Swissblock’s indicator suggests possible rebound phase for cryptos

Bitcoin is currently trading in a cautious range, with potential changes at the US Federal Reserve possibly influencing its price trajectory. Investors are attentively monitoring who will replace Jerome Powell, as a new Fed chair with a dovish stance could be a significant bullish factor for cryptocurrencies.

Key Points

- Galaxy Digital CEO Mike Novogratz suggests a dovish Fed chair might drive Bitcoin into a rapid rally, potentially altering market dynamics.

- Potential candidates for the Fed chair include Kevin Hassett, Christopher Waller, and Kevin Warsh, with Waller favoring earlier rate cuts, which might benefit Bitcoin.

- Currently, Bitcoin is trading around $109,000 after a recent decline of 5%. It has been range-bound between $109,000 and $124,000 for about ten weeks.

- Risk models indicate early signs of stabilization after a destabilization phase.

- Long-term holders' selling has slowed, with ETFs and treasuries continuing to buy, supporting the market.

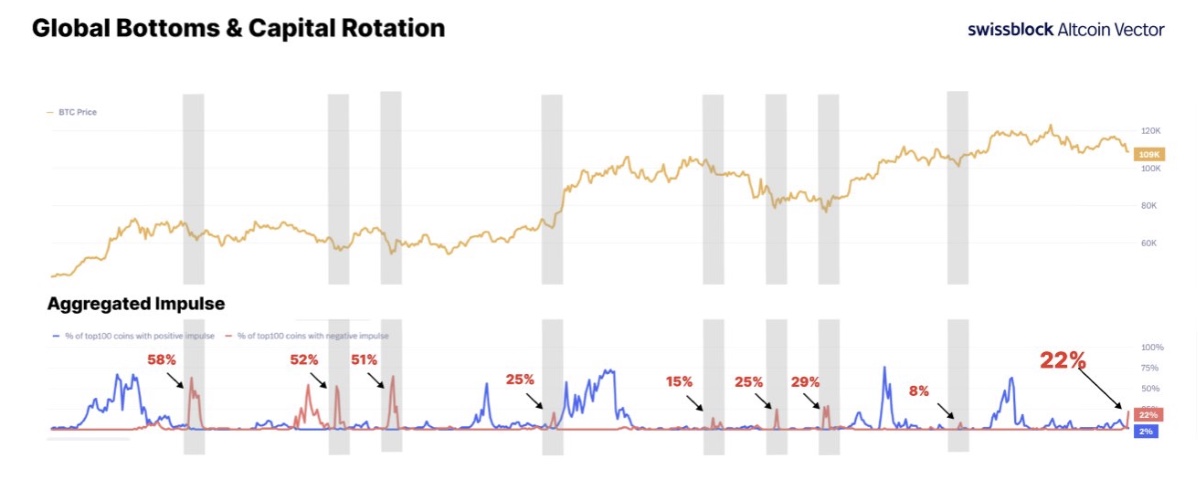

- Swissblock's “Aggregated Impulse” indicator suggests the market is entering a reset phase, historically marking major lows followed by strong rebounds.

- October and November typically provide favorable conditions for crypto, and a dovish Fed could further boost cryptocurrency investments.

The upcoming decisions regarding the Fed chair and monetary policy could significantly impact Bitcoin and the broader crypto market, especially if they result in a weaker dollar and lower yields.