10 2

Bitcoin Rebounds to $84,000 Amid Uncertain Market Signals

Bitcoin has stabilized after a correction earlier this month, dropping to $74,000 and rebounding nearly 10% to trade above $84,000. This recovery has renewed investor optimism, although analysts remain cautious about a trend reversal.

Market Analysis

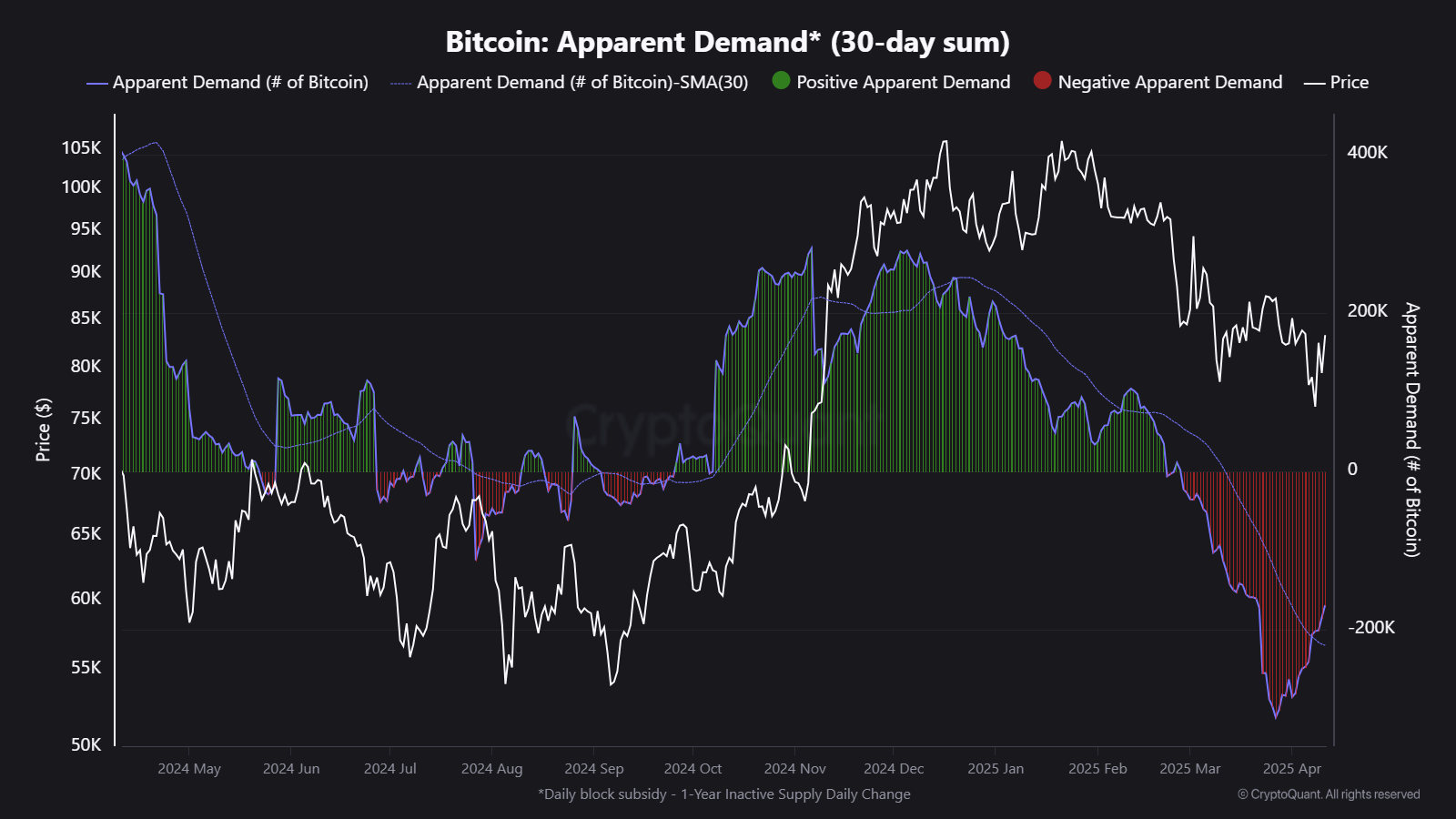

- On-chain data indicates improving demand for Bitcoin, but confirmation of a sustainable rally is needed.

- Apparent Demand metric shows a rebound from negative territory, yet caution is advised regarding potential bullish cycles.

- Historical patterns suggest demand can remain suppressed even with price recoveries.

Short-Term Holder Insights

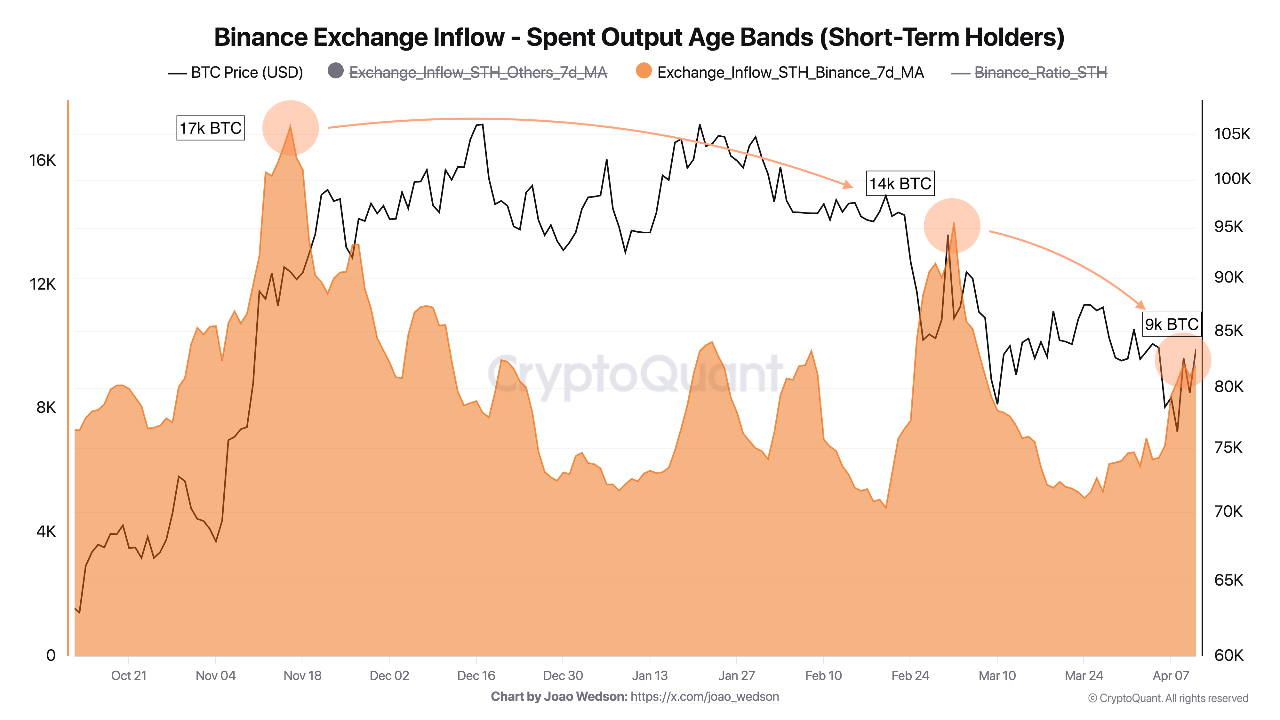

- Decrease in Bitcoin inflows from short-term holders (STHs) to Binance noted, suggesting reduced selling pressure.

- Average realized prices for STHs are around $92,800, indicating recent sellers may have exited at a loss.

- Inflow from STHs dropped from approximately 17,000 BTC in November to about 9,000 BTC recently.

The reduction in short-term holder activity could support Bitcoin’s current price levels but requires continuous monitoring for confirmation of market stability.