8 0

Bitcoin Rebounds to $92,000 Amid Geopolitical Concerns and Market Caution

Bitcoin Market Update

- Bitcoin rebounded above $92,000 after previously staying below $90,000, temporarily easing market pressure.

- Despite this uptick, analysts warn of a potential bear market in 2026 due to weak demand and ongoing sell-side activity.

- Geopolitical concerns, including potential US military action in Venezuela, have increased market volatility.

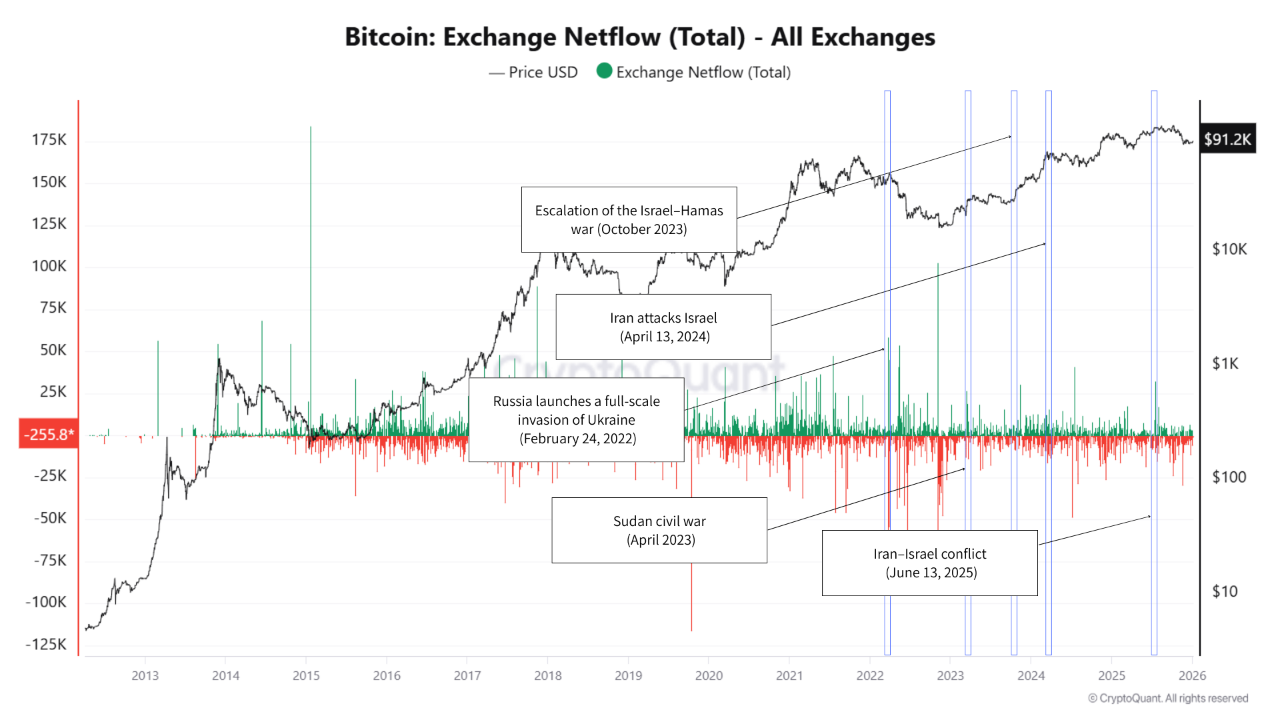

- Exchange Netflow data shows no significant increase in Bitcoin moving onto exchanges, suggesting caution rather than panic among investors.

- Historically, Bitcoin's price shows short-lived volatility during geopolitical tensions, but on-chain data often remains stable.

- The current situation mirrors past patterns where the market absorbs shocks without widespread liquidation.

Technical Analysis

- Bitcoin reclaimed $92,000, marking a relief rally after falling from the $105,000–$110,000 range.

- The price is below a declining short-term moving average, indicating resistance since the November sell-off.

- While BTC is above the 200-day moving average, it lacks strong bullish momentum.

- The market appears to be consolidating between $88,000 and $96,000, with critical resistance at $100,000.

- Price movement suggests stabilization rather than a confirmed trend reversal.

Overall, the market is in a cautious stance, monitoring geopolitical developments while maintaining existing exposure. A sustainable uptrend requires breaking through higher resistance levels.