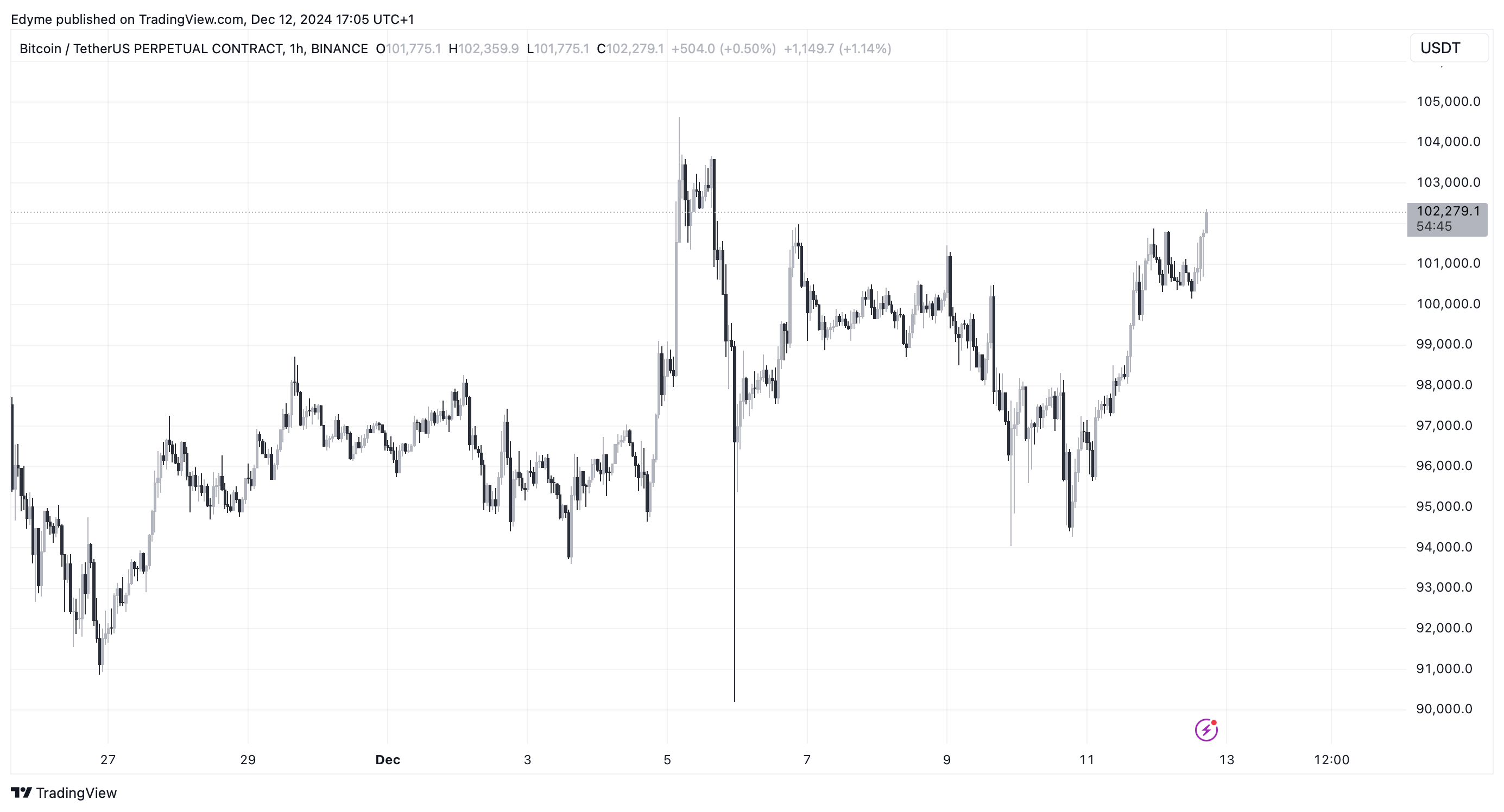

Bitcoin Reclaims $100,000 with 1.4% Increase in 24 Hours

Bitcoin has recovered significantly, reclaiming the $100,000 milestone with a trading price of $101,805, reflecting a 1.4% increase in the past 24 hours. Analysts are examining various metrics to identify potential market movements and optimal cash-out moments. Recent data reveals patterns that may inform investor strategies.

When Should You Cash Out Your Bitcoin?

CryptoQuant analyst Onchain Edge identifies critical signals for reducing Bitcoin holdings. He emphasizes the BTC supply loss percentage as a marker for peak market phases. Specifically, when this metric falls below 4%, it may indicate the end of a bull market and the onset of an overheated market phase. Currently, the supply loss percentage is at 8.14%, indicating potential for further price growth before a peak.

Onchain Edge advises investors to consider dollar-cost averaging (DCA) out of their positions once the supply loss percentage drops below 4%. This strategy aims to mitigate risks associated with transitioning into a bear market, as historical peak bull run phases often precede sharp corrections. Strategic exits can help protect gains while allowing preparation for lower entry points in future downturns.

BTC Buyer Activity Resurges

In another analysis, CryptoQuant analyst Crazzyblockk examines buyer behavior on Binance, noting a shift toward aggressive buying activity. The Taker Buy/Sell Ratio, which compares buy orders filled by takers to sell orders, had previously shown negative values, indicating a selling preference among market participants. However, it has recently turned positive, suggesting renewed buyer interest and optimism regarding Bitcoin's price potential.

Sustaining this momentum is essential for maintaining a bullish trajectory, especially as Bitcoin consolidates around the significant $100,000 level.

Featured image created with DALL-E, Chart from TradingView