7 0

Bitcoin Reclaims $100,000 as Exchange Deposits Decline

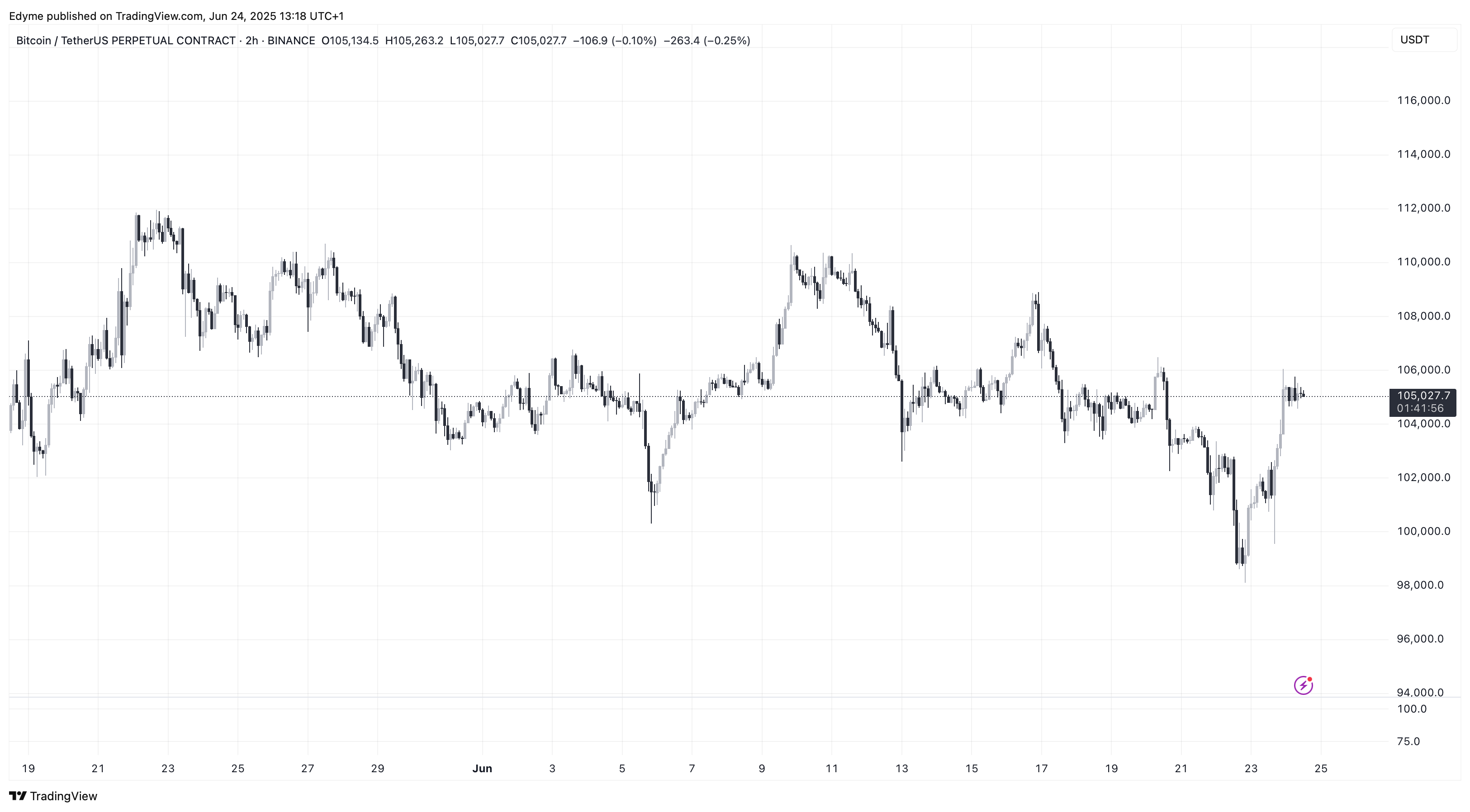

Bitcoin has regained the $100,000 price mark, currently trading at $105,323, up 4% in 24 hours. This recovery follows shifts in investor sentiment influenced by geopolitical tensions.

Key Insights on Bitcoin's Market Behavior

- Analysis from CryptoQuant indicates a decline in Bitcoin addresses depositing to exchanges, a trend since the end of the 2021 market cycle.

- Between 2015 and 2021, the annual average of depositing addresses peaked at around 180,000; it has since decreased significantly.

- The current 10-year moving average is approximately 90,000, with the 30-day average at 48,000 and recent daily figures dropping to 37,000.

- This decline may reflect a behavioral shift among investors towards long-term strategies, partly due to the introduction of ETFs.

- Low retail participation has contributed to fewer exchange deposits, with many viewing Bitcoin as a store of value rather than for speculation.

Whale Accumulation Trends

- CryptoQuant analyst Mignolet observed large holders' activity on Bybit amidst reduced market interest and trading volume.

- Historically, low sentiment and volume have preceded significant whale accumulation, suggesting potential upward price movements.

- Since April's local bottom, accumulation by large entities has been consistent, indicating underlying market confidence.